Unsold Sites for Over Two Years

High Vacancy in Large Offices

Strict Height and Development Restrictions

Support facility sites within the Magok industrial and business complex in Gangseo-gu, Seoul, where major companies are located, have been struggling to find buyers for nearly two years. Amid a cold wave in the real estate market and high vacancy rates in nearby large offices, sales are hampered by building height restrictions and other factors.

According to SH Corporation (Seoul Housing and Communities Corporation) on the 12th, five support facility sites and one convenience facility site in the Magok district have been offered on a first-come, first-served basis since the 10th of last month, but no buyers have appeared for over a month. Most of the support facility sites for sale began accepting bids in September 2023, but after several failed auctions, they switched to first-come, first-served sales.

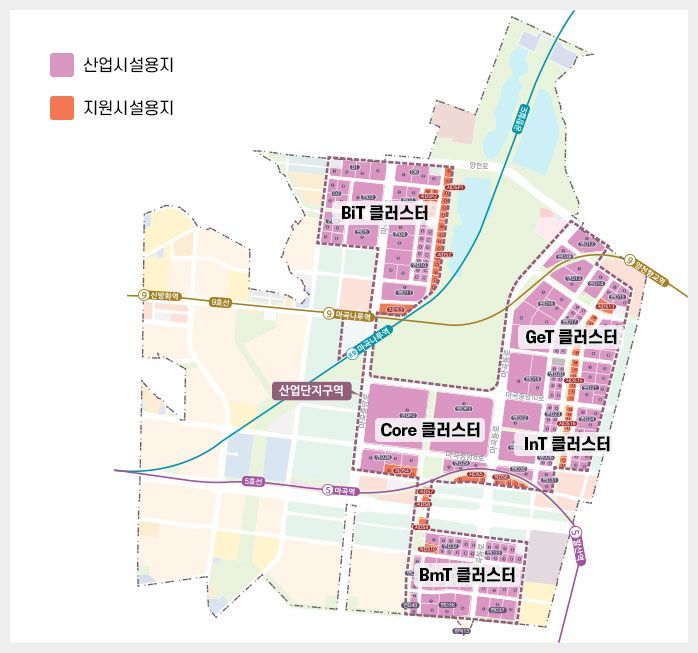

The support facility sites currently for sale are five plots: Ds14-3, Ds15-2, Ds15-3, Ds15-4, Ds16-2, and one convenience facility site (S3). Most of these sites are located on the eastern side of the Magok district, situated between lands acquired by E-Land, S-Oil, Kolon, a consortium led by Hyundai Development Company, and a consortium led by Gyeryong Construction. The S-Oil R&D Center was completed at the end of 2023, while E-Land and Kolon completed their R&D centers in early last year.

Among these, the support facility sites have been auctioned unsuccessfully more than three times due to the real estate market downturn, building height restrictions, and land price burdens. Support facility sites can be used to provide necessary services in industrial complexes and similar areas. They can be used for neighborhood living facilities, cultural and assembly facilities, sports facilities, etc., but apartments or officetels cannot be built. The floor area ratio is limited to 300% or less, allowing buildings up to five stories. The supply price for support facility sites ranges from 7.8 billion to 8.9 billion KRW, with areas between 858 and 984 square meters. Buyers must start construction within three years and complete it within five years after signing the occupancy contract. The price per pyeong (3.3㎡) is in the 30 million KRW range.

The convenience facility site can be used to build neighborhood living facilities, sales facilities, hospitals, educational and research facilities, sports facilities, and office facilities (excluding officetels). This land has a floor area ratio of 250% or less and building height limited to seven stories. The area is 6,473 square meters, priced at 61.2 billion KRW. The price per pyeong (3.3㎡) is in the 31 million KRW range.

Industry insiders predict it will be difficult to find buyers even in this first-come, first-served sale. Although Magok district has self-sufficient functions, it is far from downtown Seoul. Since last year, large offices such as Le West City Tower, K-Square Magok, and One Grove have been completed one after another, resulting in an oversupply. According to R-Square, as of November last year, vacancy rates were 97.3% for One Grove and 84.3% for K-Square.

The cold wave in the market shows no signs of abating. According to the Construction Industry Research Institute, the Construction Business Survey Index (CBSI) in January recorded 70.4, down 1.2 points from the previous month. Housing dropped by 15.3 points to 59.8, and non-residential construction fell by 4.6 points to 60.6, marking the second-largest decline.

SH Corporation explained, "Magok is a popular area, but because it is near the airport, there are height restrictions. Buildings can only be constructed up to about five to seven stories, and the land parcels are small, making it difficult to develop by combining them." They added, "We plan to continue announcing first-come, first-served sales until March or April."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.