Expansion of K2 Tank Exports to Poland... Defense Sector Margin Reaches 31%

Continuous Expansion of Parts Suppliers... Confidence in Achieving Order Targets

Hyundai Rotem is attracting market attention with news of significant performance growth and high profit margins in the fourth quarter of last year. Securities firms are unanimously raising their target prices, anticipating a large volume of additional orders.

According to the financial investment industry on the 10th, Hyundai Rotem's sales in the fourth quarter of last year amounted to KRW 1.4408 trillion, a 45.7% increase compared to the same period last year, and operating profit rose by 131.7% to KRW 161.7 billion. The operating profit margin was recorded at 11.2%.

However, considering the one-time cost of KRW 140 billion in the railway sector and KRW 12 billion in overhaul (large-scale maintenance) revenue in the defense sector, the actual company-wide profit margin exceeded 20%, leading to an earnings surprise, according to analysis.

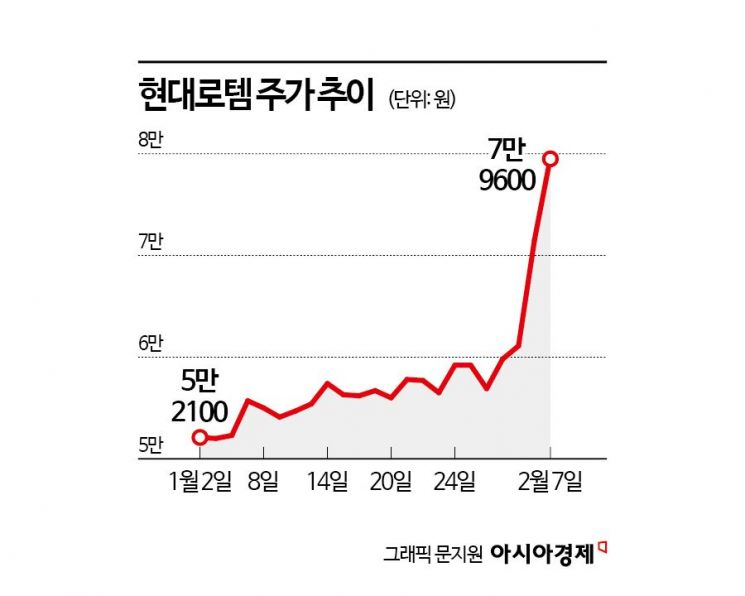

As a result, Hyundai Rotem's stock price also showed a sharp rise. On the 6th, it closed at KRW 71,500, up 17.02% from the previous day, and on the 7th, it recorded an increase of over 11%. In two days, it rose about 30%, increasing the market capitalization by KRW 2 trillion.

The cause of the strong performance is attributed to the defense (Defense Solutions) sector. The profit contribution of the defense sector is estimated to be over 90%. The expansion of sales of K2 tanks exported to Poland and favorable exchange rate effects worked positively. An Yu-dong, a researcher at Kyobo Securities, analyzed, "The operating profit margin of the defense sector in the fourth quarter is estimated at 31%, and the export sector is expected to have recorded 41%."

Hyundai Rotem's fourth-quarter Defense Solutions sector export ratio is estimated to be around 67%, and profitability improvement continues due to the expansion of export share. The profitability of domestic business is also analyzed to be improving due to cost reduction and other factors.

Baek Seong-jo, a researcher at Hanwha Investment & Securities, said, "Defense sales in the fourth quarter increased by 114.1% year-on-year to KRW 898.1 billion, and 56 K2 tanks related to the first contract with Poland have already been delivered," adding, "In particular, the Poland 2-1 phase contract (180 units + 81 support vehicles) for the K2 tank, expected to be worth more than KRW 7 trillion, and additional orders such as Romania (expecting about 100 units in the first phase within this year) are highly likely, so positive momentum will continue in the short term."

In addition to Poland, the export pipeline is expanding in various regions. Following the armored vehicle project in Peru last year, negotiations are underway for the next-generation tank project in Romania. Interest in the K2 tank is also increasing in the Middle East, and performance improvements suitable for high-temperature and tropical climates are being prepared. Export marketing to the Middle East is expected to be in full swing ahead of testing scheduled for next summer.

Accordingly, securities firms have unanimously raised their target prices for Hyundai Rotem. Lee Han-gyeol, a researcher at Kiwoom Securities, said, "This year, Hyundai Rotem's sales are expected to reach KRW 5.3458 trillion, operating profit KRW 854.7 billion, increasing by 22.1% and 87.2% respectively compared to the previous year, with an operating profit margin of 16%," adding, "Considering the expansion of production capacity in the Defense Solutions sector last year and the ongoing expansion of parts suppliers, confidence in achieving Hyundai Rotem's mid- to long-term order targets can be confirmed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.