Caustic Soda, Once the 'Savior' of Petrochemicals,

Faces Uncertain Business Prospects Amid Battery Industry Slump

"Waiting for the Battery Industry to Recover"

Hanwha Solutions, the leading company in the caustic soda market share, is about to start operating its expanded caustic soda (sodium hydroxide) plant, riding on the expectations of the 'electric vehicle boom.' However, contrary to initial forecasts, the prolonged downturn in the battery industry has cast a shadow over the business outlook.

According to the industry on the 7th, Hanwha Solutions' expanded plant at its Yeosu factory in Jeollanam-do has been completed and is currently undergoing testing. This year, an additional 270,000 tons of caustic soda production capacity is expected to be secured.

Caustic soda, commonly known as 'lye water,' can be obtained by electrolyzing saltwater. It has strong alkalinity and was mainly used in the past for textile dyeing or soap manufacturing. Recently, it is used as a kind of 'detergent' to remove impurities in the production processes of cathode materials, which are key components of secondary batteries, and semiconductor manufacturing processes.

Petrochemical companies, anticipating a surge in demand for electric vehicle batteries, actively invested, viewing caustic soda as a savior in the severely depressed petrochemical industry.

However, as the sluggish demand for electric vehicles continues, the outlook has darkened. A company official said, "It is true that the situation has worsened compared to when the initial decision was made," adding, "The upstream industry needs to do well for us to follow in a good direction together, so we are currently waiting for the industry to improve." However, the official further explained, "Caustic soda is needed in various fields beyond batteries, so the investment was not made solely based on the electric vehicle battery market or short-term prospects."

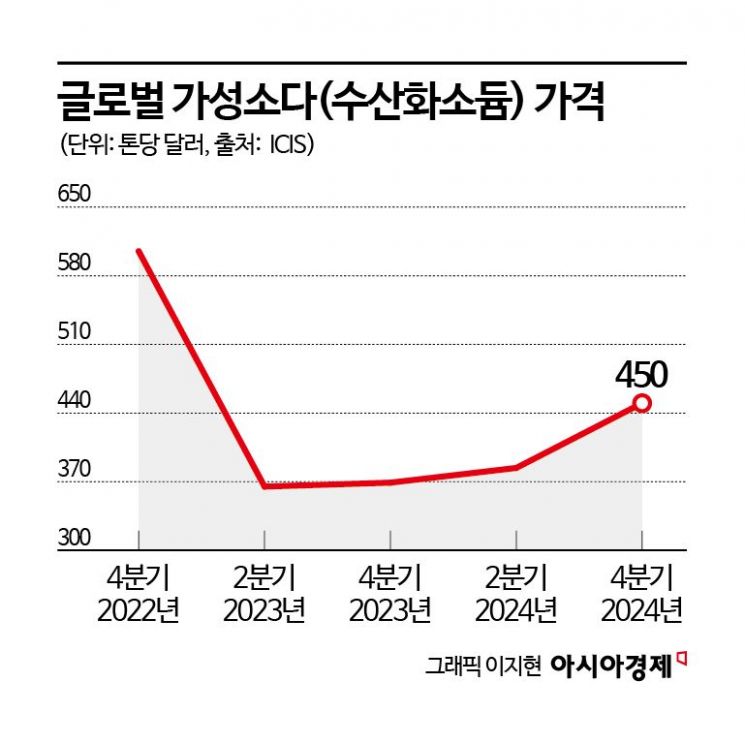

At the end of last year, there were also expectations that the rebound in global caustic soda prices would boost chemical companies' performance in the fourth quarter. According to market research firm ICIS, the global price of caustic soda per ton rose from $361 (approximately 522,367 KRW) in the first quarter of last year to $450 (approximately 651,150 KRW) in the fourth quarter. However, this was also evaluated as having little effect. An industry insider pointed out, "It was only a slight improvement in a bad situation. There are expectations that prices will be maintained this year, but the volatility is so severe that the future is uncertain."

Hanwha Solutions' Chemical Division performance announced on the 6th showed a sluggish trend. Last year, sales were 4.8172 trillion KRW, with an operating loss of 121.3 billion KRW. The company forecasted that the first quarter of this year would also continue to show losses due to decreased sales volume caused by regular maintenance.

Moon Hak-hoon, a professor in the Department of Future Electric Vehicles at Osan University, diagnosed, "Production capacity (capacity) was created anticipating an increase in electric vehicle demand, but sales have been sluggish, so the entire downstream industry, including the three major battery companies, is facing difficulties." He added, "With this production volume, the industry must somehow maintain it for about 4 to 5 years to prevent the battery market, which accounts for 20% of the total, from being taken over by China," advising, "The government should support companies to ease their burdens, and each company should seek other breakthroughs such as energy storage systems (ESS) and lithium iron phosphate (LFP) batteries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.