Gradual Signs of Recovery Amid Economic Downturn

DL E&C and GS Construction Show Clear Signs of Performance Rebound

Is the Construction Industry Reaching a Turning Point?... Rising Expectations for a 'Turnaround'

Last year, major large construction companies struggled to secure performance, and this year’s first quarter is expected to show widely varying results among the companies. Although the construction market remains sluggish, signs of a performance rebound, such as overseas construction orders, are being detected.

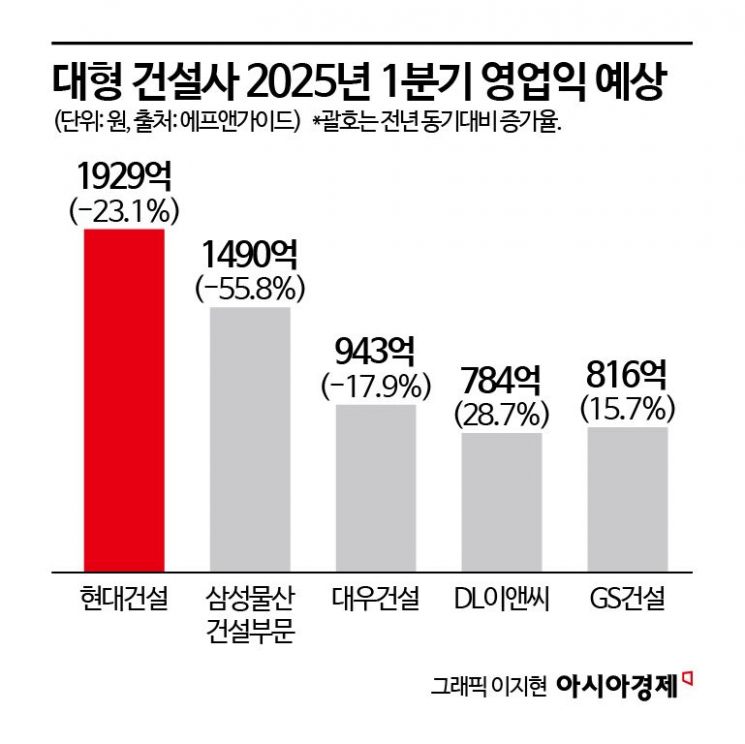

According to financial information provider FnGuide on the 6th, among the top five construction companies by construction capability evaluation (Samsung C&T Construction Division, Hyundai Construction, Daewoo Construction, DL E&C, and GS Construction), three are expected to see a decline in profitability in the first quarter of this year. About two of them are expected to see an increase. DL E&C and GS Construction are anticipated to record double-digit growth rates in operating profit compared to the same period last year. On the other hand, Samsung C&T, Hyundai Construction, and Daewoo Construction are expected to experience a decline in profitability.

'Big 3' First Quarter 'Cloudy'... Future 'Turnaround' Expected

Looking at the consensus (average estimate by securities firms), Samsung C&T Construction Division’s first-quarter sales are projected to be 3.668 trillion KRW, with an operating profit of 149 billion KRW. This represents a decrease of 34.3% and 55.8%, respectively, compared to the same period last year. Kim Dongyang, a researcher at NH Investment & Securities, said, “Despite steady construction orders of around 18 trillion KRW annually, the poor performance is due to differences in the timing of revenue recognition, and improvement is expected from the second half of this year.”

Hyundai Construction’s first-quarter sales are expected to be 7.5214 trillion KRW, down 12% from the previous year. Operating profit for the same period is estimated to decrease by 23.1% to 192.9 billion KRW. Although this is a decline compared to the same period last year, considering the large-scale loss of 1.7334 trillion KRW recorded in the fourth quarter of last year, the outlook is generally that the company will “hold its ground.” Song Yurim, a researcher at Hanwha Investment & Securities, said, “With the reflection of large loss costs in the fourth quarter of this year, this is the point where a true performance turnaround is expected.”

Daewoo Construction, expected to post an operating profit of 94.3 billion KRW (sales of 2.4 trillion KRW), down 17.9% for the same period, is also actively pursuing cost reduction and selective orders, anticipating future performance improvement. Daewoo Construction recorded the largest reduction in new orders among the top five construction companies. The new order amount for 2024 was 9.9128 trillion KRW, a 25% decrease compared to 13.2096 trillion KRW in 2023.

DL E&C and GS Construction, Signs of Performance Rebound

DL E&C and GS Construction are expected to show a clear performance turnaround in the first quarter of this year. DL E&C is projected to achieve sales of 1.9543 trillion KRW and an operating profit of 78.4 billion KRW, representing increases of 3.4% and 28.8%, respectively, compared to the same period last year. The improvement in performance is attributed to better cost ratios. DL E&C’s cost ratio, as recently disclosed for the fourth quarter of 2024, was 88.2%, an improvement of 0.9 percentage points compared to the third quarter. The cost ratio is one of the most important profitability indicators as it is directly linked to operating profit, cash flow, and debt ratios.

GS Construction, which recorded its largest-ever new orders since its founding last year (19.91 trillion KRW), is also expected to increase its first-quarter operating profit by 15.7% to 81.6 billion KRW from 70.5 billion KRW in the same period last year. Sales for the same period are expected to slightly increase to 3.0774 trillion KRW from 3.0709 trillion KRW a year earlier. The combined effects of margin improvement in the housing sector, sales growth in new business sectors, and cash flow improvement from move-in payments are expected to raise the return on equity (ROE) from 6% last year to 6.9% this year. KB Securities also noted that GS Construction’s first-quarter “earnings surprise” in 2018, when the construction industry showed strong growth, had a positive impact across the industry.

Park Sera, a researcher at Shin Young Securities, said, “From the second half of 2022, concerns about additional cost reflections due to high interest rates and inflation have continuously spread in the market since 2023,” adding, “In particular, Hyundai Construction symbolically showed that the issue of cost increases due to raw material price surges has been resolved, signaling the awaited turning point and inflection point for the construction industry.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.