Annual Prepayment Deduction Rate Set at 5%, Not 3%

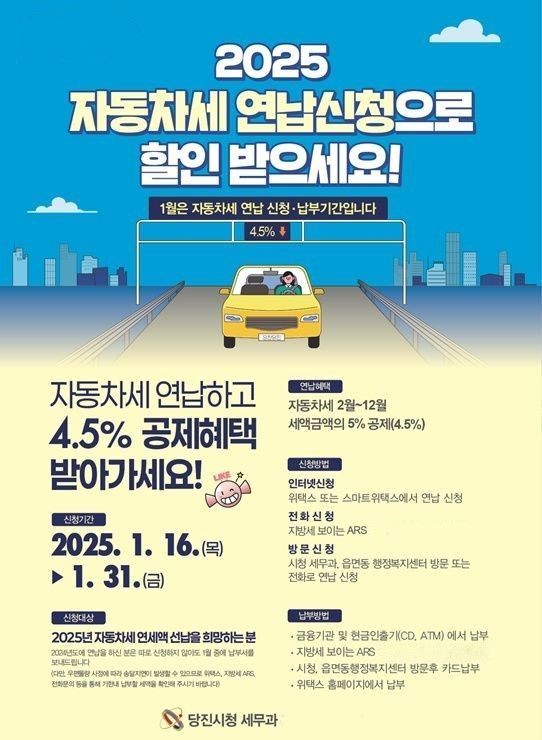

Dangjin City, Chungnam Province, announced on the 14th that it will be accepting applications for the 2025 annual automobile tax prepayment until the 31st of this month.

The annual automobile tax prepayment system allows taxpayers to pay their automobile tax, which is usually billed in June and December each year, in advance and receive a certain amount of deduction from the annual tax amount.

If the annual automobile tax is paid in advance in January, a 5% deduction will be applied to the automobile tax for February through December, excluding January.

The city stated that it has decided to maintain the discount rate at 5%, the same as last year, instead of lowering it to 3% as originally planned for 2025.

Applications for prepayment can be made by visiting or calling the Tax Division at Dangjin City Hall or the local administrative welfare centers in towns and districts, or through the internet or by phone via Wetax.

If you applied for the annual automobile tax prepayment last year and there are no changes to the vehicle, a payment notice will be sent to your registered address or business location this month without the need for a separate application.

In addition, if the ownership of the vehicle is transferred or the vehicle is scrapped after the annual prepayment, the tax will be calculated on a pro-rata basis up to the relevant date and the excess amount will be refunded.

The payment deadline is the 31st of this month, and various payment methods are available, including payment at financial institutions, online (Wetax), Giro payment, virtual account payment by phone, and ARS credit card payment.

Kim Insik, head of the Tax Division, said, "The annual prepayment deduction rate has been confirmed at 5%, the same as last year, so you can receive the same tax deduction as last year. We hope you take advantage of the prepayment application and payment to receive the deduction benefit and reduce your tax burden."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.