Triple Hardships: High Exchange Rates, Domestic Demand Slump, and Political Instability

Quick Response to Changing Consumer Trends

High exchange rates, domestic demand stagnation, political instability.

The business environment faced by the distribution industry last year was an unprecedented domestic demand slump. As prices soared and the economy worsened, consumers tightly closed their wallets. Due to rising costs such as raw material prices and labor expenses, both manufacturers and sales channels experienced double hardships. The uncertainty continues beyond the year.

Distribution companies quickly responded to changing consumer trends and sought new opportunities. Offline channels such as department stores, large marts, convenience stores, and fashion & beauty focused on diversifying consumers' shopping experiences and increasing their dwell time to lead to purchases by strengthening touchpoints. They targeted consumers by promoting specialized products that maximize the advantages of offline stores, such as fresh food and ultra-low-price promotional events, and introduced 'convergence' spaces combining department stores and shopping malls, or shopping malls and marts. Additionally, by utilizing their own applications (apps) or pop-up stores, they strengthened the 'O4O (Online for Offline)' strategy to secure loyal customers.

At a cosmetics shopping mall in Myeongdong, Seoul, customers, mostly foreigners, are selecting cosmetics. Photo by Younghan Heo younghan@

At a cosmetics shopping mall in Myeongdong, Seoul, customers, mostly foreigners, are selecting cosmetics. Photo by Younghan Heo younghan@

In line with the value consumption culture spreading mainly among young people domestically and internationally, cases of strengthened collaboration with small and medium manufacturers have also greatly increased. A representative example is CJ Olive Young, which has emerged as a distribution powerhouse with annual sales around 4 trillion won, filling over 80% of its brands with domestic small and medium enterprises.

A child carrying a gift is walking through the Christmas-themed village 'H Village' at The Hyundai Seoul in Yeouido, Seoul. Photo by Jo Yong-jun

A child carrying a gift is walking through the Christmas-themed village 'H Village' at The Hyundai Seoul in Yeouido, Seoul. Photo by Jo Yong-jun

Online platforms are expanding their reach with competitive pricing, delivery convenience, and dramatic discount benefits. After innovating distribution networks to enable product orders to arrive within a day or even the same day, they are strengthening 'quick commerce' services that allow customers to receive goods within an hour near their residence or activity radius.

Food and beverage manufacturers have also embarked on overseas expansion to compensate for the limitations of the domestic market. Various items including ready meals, snacks, desserts, and alcoholic beverages have gained popularity as key products in overseas markets such as North America, Europe, and Southeast Asia. Some companies have long seen their overseas sales proportion approach twice that of the domestic market. There have also been cases of establishing complex shopping malls in local markets centered on Southeast Asia, such as Lotte Mall West Lake Hanoi, which has become a landmark in Hanoi, Vietnam.

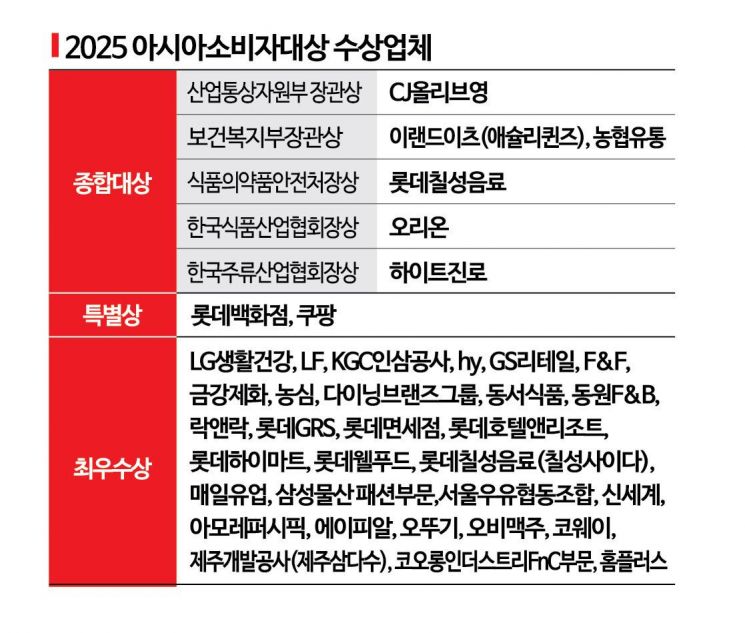

At the 19th '2025 Asia Consumer Awards' held this year, the achievements of distribution companies that turned crises into opportunities were comprehensively reviewed. The focus was not limited to sales performance or transaction results. Attention was paid to continuous research and development (R&D), investment, and the dedication poured into customer satisfaction. As the marketing adage goes, "To induce purchase, you must move the consumer's heart," the spotlight was on companies that respected diverse consumer tastes and gained empathy by realizing their desires through products and services.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.