"Loan Interest Rates Fall but Seoul Housing Market Remains Cautious"

Gangnam 3 Districts' House Prices Already Up by 120M to 230M KRW

Mayongsung House Prices Rise by 80M to 120M KRW

Financial Authorities: "Loan Interest Rate Cuts Will Be Felt in Q1 Next Year"

"Domestic Demand Slump and Political Turmoil Delay Purchase Decisions"

Contrary to the financial authorities' expectation that the effect of lower loan interest rates would be felt by the first quarter of next year, real estate market experts predict that the cold wave will not subside. They observe that it will be difficult for buying sentiment to revive amid increased uncertainty due to economic recession and political turmoil following the president's impeachment. As doubts about high housing prices grow, demand that has turned cautious is unlikely to return to the market just because interest rates fall.

"Seoul housing prices are high, so transactions won't increase"

On the 25th, Park Won-gap, Senior Real Estate Specialist at KB Kookmin Bank, commented on the financial authorities' recent view that loan interest rates, which did not fall despite two base rate cuts this year, could decrease in the first quarter of next year. He said, "Even if loan interest rates are lowered, the fatigue caused by the rapid short-term rise in Seoul apartment prices this year will suppress buying sentiment."

Ko Jong-wan, President of the Korea Asset Management Research Institute, pointed out, "Housing prices have already risen significantly, making transactions difficult for the time being." He added, "The stock market moves much faster than the housing market. Who would want to buy a house when even the stock market is in a bad situation?"

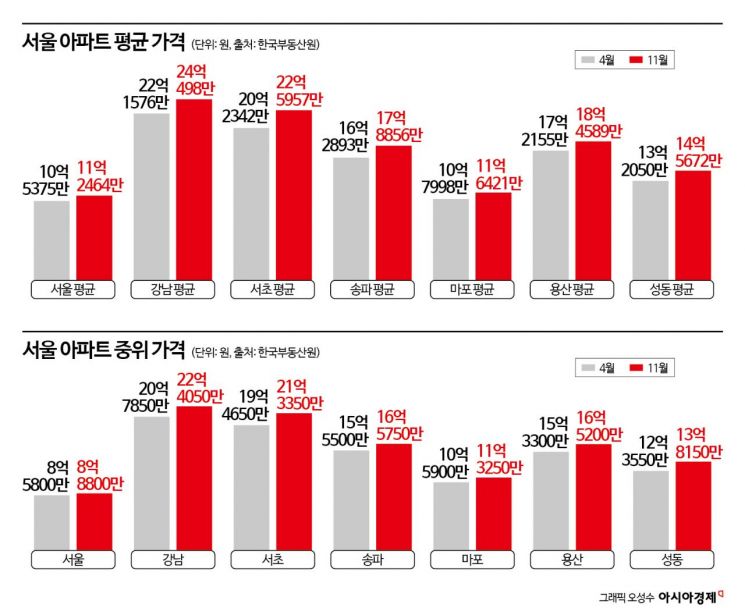

According to the Korea Real Estate Board, the average price of apartments in Seoul recorded 1.12464 billion KRW last month. This is over 70 million KRW higher compared to April (1.05375 billion KRW), when the price increase trend began. During the same period, the Gangnam 3 districts (Gangnam, Seocho, Songpa) saw prices rise from 1.62893 billion KRW to 2.21576 billion KRW to 1.78856 billion KRW to 2.40498 billion KRW, and Mayongseong (Mapo, Yongsan, Seongdong districts) jumped from 1.07998 billion KRW to 1.72155 billion KRW to 1.16421 billion KRW to 1.84589 billion KRW.

The median price in Seoul also steadily increased from 858 million KRW to 888 million KRW. In the Gangnam 3 districts, it rose from 1.555 billion KRW to 2.0785 billion KRW to 1.6575 billion KRW to 2.2405 billion KRW, and in Mayongseong, it went from 1.059 billion KRW to 1.533 billion KRW to 1.1325 billion KRW to 1.652 billion KRW.

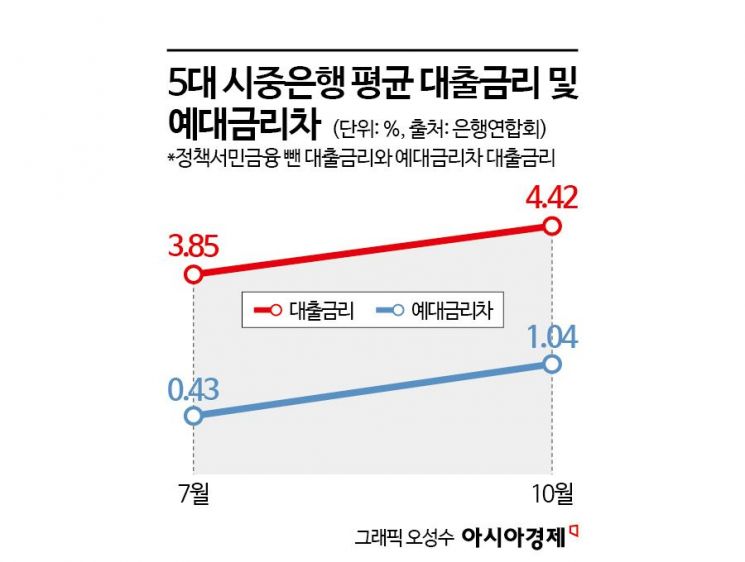

On the 18th, during a National Assembly Political Affairs Committee inquiry, Kim Byung-hwan, Chairman of the Financial Services Commission, and Lee Bok-hyun, Governor of the Financial Supervisory Service, responded to criticism that the effect of the base rate cuts was not felt in the market by saying, "There will be a noticeable effect (of loan interest rate cuts) in the first quarter of next year."

Shin Yong-sang, Senior Research Fellow at the Korea Institute of Finance, stated, "The financial authorities play the most important role in the current direction of loan interest rates." He explained, "Although the base rate was cut twice, banks did not lower the additional interest rates due to the authorities' household debt management policy. Now that the authorities have indicated they will make the loan interest rate cuts more tangible, additional interest rates will decrease in the first quarter of next year, leading to a drop in loan interest rates."

"Variables such as domestic demand recession from self-employed loans and political turmoil due to impeachment must also be considered"

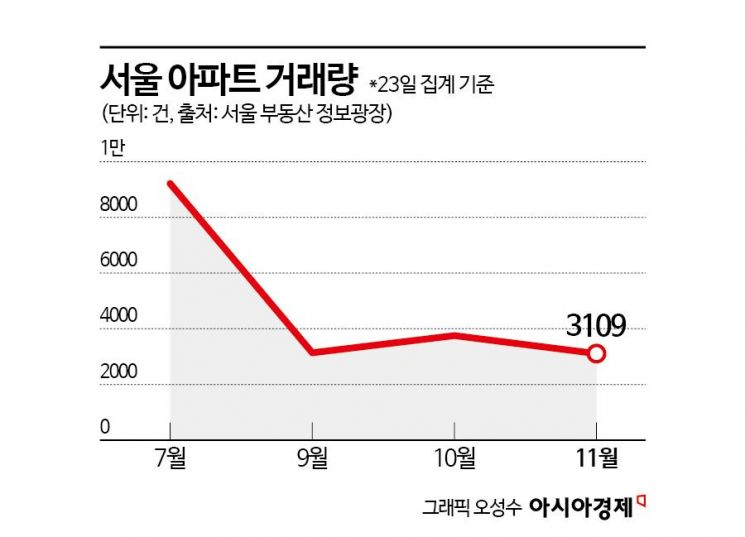

It is difficult for transactions to suddenly increase when buyers have turned cautious. According to the Seoul Real Estate Information Plaza, as of the 23rd, the number of apartment transactions in Seoul has remained in the 3,000 range since September, after peaking at 9,212 in July.

Domestic economic recession and political turmoil following the president's impeachment also act as uncertainties for buying sentiment. Researcher Shin said, "Although the financial authorities have indicated a direction to lower loan interest rates, it will be difficult for Seoul apartment transactions to increase in the first quarter of next year due to economic growth slowdown and domestic demand recession caused by issues such as self-employed loans," adding, "It will take a considerable amount of time for buying sentiment to spread."

Park also explained, "Until political uncertainty is resolved, buying demand is unlikely to appear regardless of interest rates. In this situation, concerns about supply shortages will prevent apartment prices from falling significantly, and the cautious stance may deepen."

There is also an analysis that transaction volume trends could diverge depending on the extent of loan interest rate cuts in the first quarter of next year. Kim Hyo-sun, Senior Real Estate Specialist at NH Nonghyup Bank, said, "During the current political turmoil, apartment transaction volume will increase only if loan interest rates drop dramatically. Otherwise, transaction volume will not rise significantly."

Currently, loan interest rates are rising. According to the Korea Federation of Banks, the average loan interest rate excluding policy loans for low-income borrowers at the five major commercial banks was 4.42% in October. It steadily increased from 3.85% in July. Although the Bank of Korea cut the base rate in October, loan interest rates rose.

Park said, "The timing of the loan interest rate cut in the first quarter of next year is also important. For example, if political instability decreases due to a quick presidential election following the acceptance of the impeachment motion, and loan interest rates fall, buyers may move to purchase homes. Otherwise, the effect of loan interest rate cuts will be limited."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.