Low-Power DDR6 Roadmap Under Development

"Prototype Launch as Early as End of Next Year"

SK Hynix Also Joins Development

Accelerating High-Value Product Development Amid Falling General-Purpose DRAM Prices

Samsung Electronics is reportedly set to showcase a prototype of its next-generation memory, 'Low Power Double Data Rate 6 (LPDDR6),' as early as the end of next year. LPDDR6 is emerging as a key memory for on-device artificial intelligence (AI), intensifying commercialization competition among manufacturers, and a concrete launch roadmap has been revealed. This move is seen as accelerating the shift to high value-added products amid growing downward pressure on general-purpose DRAM prices.

An industry insider said on the 11th, "Samsung Electronics is currently testing the LPDDR6 under development this month and plans to unveil a prototype as early as the end of next year," adding, "They aim to resolve all issues by mid-next year." According to the industry, Samsung Electronics is reducing the proportion of LPDDR4 products based on older processes and transitioning to high-performance products such as DDR5 and LPDDR5x. In particular, preparations for next-generation memory products like LPDDR6 are being expedited.

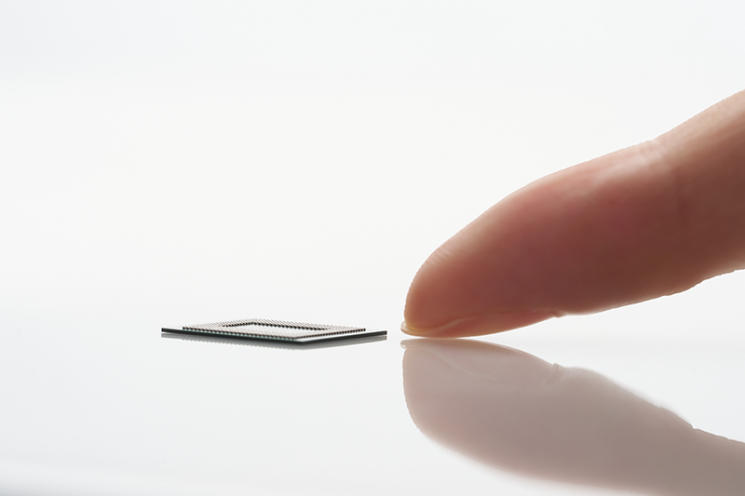

Samsung Electronics LPDDR5X 0.65㎜ Product Size Comparison Image. Samsung Electronics developed the industry's thinnest 12-nanometer class LPDDR5X DRAM with the industry's highest operating speed of 10.7Gbps (gigabits per second) in the first half of this year, and started mass production of LPDDR5X 12GB and 16GB packages in August. Provided by Samsung Electronics

Samsung Electronics LPDDR5X 0.65㎜ Product Size Comparison Image. Samsung Electronics developed the industry's thinnest 12-nanometer class LPDDR5X DRAM with the industry's highest operating speed of 10.7Gbps (gigabits per second) in the first half of this year, and started mass production of LPDDR5X 12GB and 16GB packages in August. Provided by Samsung Electronics

LPDDR6 is considered a next-generation memory suitable for on-device AI. Compared to the previous generation LPDDR5, it expands the 'channels' through which data is transmitted to process more data faster. Previously, data was transmitted through 8 lanes (8DQ), but LPDDR6 increases this to 12 lanes (12DQ). At the same time, these 12 lanes are divided into two groups of 6 lanes each, adopting a '2-sub channel' structure that processes data independently in each group. This reduces bottlenecks and enables more efficient simultaneous processing of multiple tasks.

This is optimized for tasks requiring rapid transmission of large volumes of data, such as real-time AI computations and autonomous vehicle sensor analysis. Additionally, it is designed with ultra-low voltage technology to extend usage time in products where battery efficiency is critical, such as smartphones and wearable devices. Not only Samsung Electronics but also SK Hynix is accelerating the development of LPDDR6.

The acceleration of next-generation memory development by Samsung Electronics and SK Hynix is due to structural changes in the DRAM market. An industry insider explained, "Recently, the DRAM market has polarized into a clear division between high value-added markets like AI servers and general-purpose markets." While general-purpose DRAM is clearly declining due to aggressive competition from Chinese companies, memories like DDR5 are classified as high value-added segments.

According to market research firm DRAMeXchange, the average fixed transaction price (enterprise contract price) for PC DRAM DDR4 8Gb, classified as general-purpose, was $1.35 in November, down 35.7% from July. Chinese companies ChangXin Memory Technologies (CXMT) and Fujian Jinhua Integrated Circuit Co. (JHICC) are selling DDR4 8Gb DRAM at prices between $0.75 and $1, about half the market price. Morgan Stanley forecasts that China's DRAM production share will reach 16% by the end of next year.

However, some experts suggest the possibility of a market rebound after the second half of next year. Park Yoo-ak, a researcher at Kiwoom Securities, said, "Increased demand for Blackwell and HBM3E, along with recovery in server, PC, and automotive demand, will normalize inventory and lead to a rebound in DRAM prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)