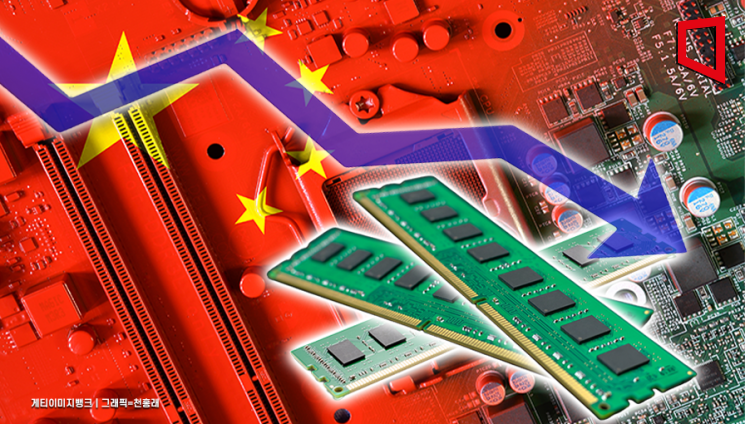

Impact of Weak Demand and Oversupply

Chinese CXMT and JHICC Flood Market with Low-Priced DRAM

Concerns Over Increased DDR5 Supply

High Possibility of Sharp DRAM Price Drop Early Next Year

As the global economic recession prolongs and the sluggish demand for information and communication technology (IT) continues, the price of memory semiconductors, specifically 'DRAM,' keeps falling. In particular, the low-price offensive by Chinese companies is significantly impacting the oversupply of legacy (general-purpose) DRAM.

According to market research firm 'DRAMeXchange' on the 8th, the average fixed transaction price of general-purpose PC DRAM products (DDR4 8Gb 1Gx8) dropped 35.7% over four months, from $2.10 in July to $1.35 in November. Especially last month, the price plunged 20.59% compared to the previous month, marking the largest decline this year. It recorded the lowest price since $1.30 in September last year, just before DRAM prices began to rise due to production cuts by memory suppliers.

DRAM prices fell for about a year and a half after February 2022 but rebounded from October last year as the industry recovered due to production cuts and inventory depletion. However, as the economic recession prolonged and weak front-end IT demand for smartphones and PCs remained unresolved, the upward trend could not be sustained from August, ten months later. Moreover, the aggressive production investment and low-price sales offensive by Chinese companies intensified the oversupply, accelerating the price decline.

Chinese memory companies Changxin Memory Technologies (CXMT) and Fujian Jinhua Integrated Circuit Co. (JHICC) are flooding the market by selling DDR4 8Gb DRAM at $0.75 to $1, about half the market price. Due to the low-price offensive from China, not only legacy products like DDR4 but also leading-edge products like DDR5, which have relatively strong demand and price resilience, are under downward price pressure.

In November, the average fixed transaction price of PC DDR5 16Gb products was $3.90, down 3.7% from $4.05 in the previous month. Compared to $4.65 in July, it fell 16.1%. This is due to concerns over increased DDR5 supply as the three major memory companies?Samsung Electronics, SK Hynix, and Micron?accelerate the transition to leading-edge processes in response to the volume offensive by CXMT and others.

Market research firm TrendForce stated, "As CXMT aggressively expands DDR4 production capacity, the three major memory companies are accelerating process upgrades to DDR5. This is expanding supply pressure from DDR4 to DDR5."

Meanwhile, there is growing consensus that legacy DRAM prices will continue to decline at least until the first quarter of next year. This is because there are no clear signs of demand improvement for smartphones and PCs, and customers are continuing to adjust memory inventories due to weak demand.

The spot price of DRAM, considered a leading indicator of the semiconductor market, is also continuing its downward trend. The spot price of general-purpose DRAM 'DDR4 8Gb 2666,' compiled by DRAMeXchange, was $1.764 as of the 6th, down 11.8% from the peak of $2.00 on July 24. DRAM spot prices are transaction prices temporarily conducted through distributors and typically converge to fixed transaction prices, which are B2B (business-to-business) prices, after 4 to 6 months.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)