From Brand Companies to ODMs 'Indiscriminate Decline'

Concerns Over Trump-Induced Tariff Bombardment

"Global Exports Will Continue, Stock Prices Will Recover"

Although the cosmetics industry continues to struggle, the securities sector has diagnosed that the sustained stock price decline in the second half of the year is excessive. In particular, as K-Beauty's penetration into the global market is still ongoing, it is analyzed that there is a high possibility of valuation normalization once the oversold phase passes.

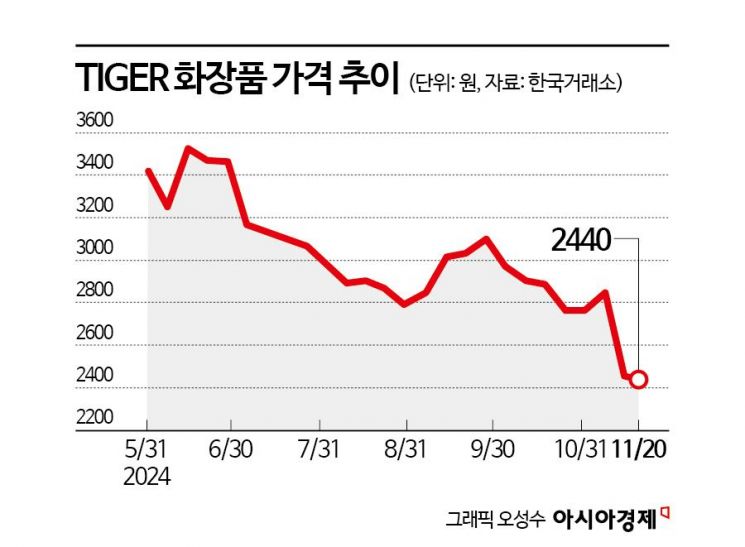

According to the Korea Exchange on the 21st, the 'TIGER Cosmetics' index, which includes cosmetics brand companies, original design manufacturers (ODM), distributors, and beauty device manufacturers, recorded 2,440 KRW (-0.41%) as of the previous day's closing price, down 33.43% from the peak in June. Until the first half of the year, cosmetics-related stocks showed a strong rally driven by overseas growth centered on the United States, but in the second half, concerns about a peak out in the industry led to most of the gains being given back regardless of the business type. In particular, amid the sluggish performance of large companies such as Amorepacific and LG Household & Health Care, intensified competition among indie brands and growth slowdown issues had a negative impact. Additionally, with Donald Trump elected as U.S. president, who pledged to introduce a universal basic tariff imposing additional duties on all imports, concerns have arisen over margin declines for K-Beauty, which has been competitive on cost-effectiveness.

Lee Seung-eun, a researcher at Yuanta Securities, said, "Recently, K-Beauty's stock price has faced an unusual situation of declining despite strong global export performance and domestic recovery. Although cosmetics companies' earnings in the third quarter slightly missed market expectations, the stock price excessively reflected this." He added, "This is the result of a combination of disappointment from failing to meet the market's high expectations and concerns over tariff increases. In particular, Trump's 10% tariff pledge could lead to margin reductions for Korean cosmetics."

In the securities industry, there is an analysis that such concerns about K-Beauty are excessive. Researcher Baesong from Mirae Asset Securities said, "Concerns about a peak out in earnings are exaggerated. The cosmetics industry is still in an expansion phase, and every quarter new global hit indie brands are being discovered." He added, "Some of the concerns are one-time or individual company issues. The current stock price appears to be in an oversold zone, and there is a high possibility of valuation recovery following confirmation of global export momentum."

Researcher Bae emphasized that global consumer interest in Korean cosmetics is rising, centered on the Jalpa generation (Generation Z + Alpha generation). He said, "Growth in overseas regions other than the U.S. and Japan has just begun to become visible." He pointed out, "Recently, exports to Europe and Southeast Asia have been growing rapidly. These regions have market potential in terms of economic scale and purchasing power."

Park Eun-jung, a researcher at Hana Securities, also forecasted, "K-Beauty is now in the process of establishing itself as mainstream in the U.S. Moreover, it is expanding beyond the U.S. to Europe, the Middle East, and Oceania, so growth is expected to continue next year."

Whether K-Beauty will sustain solid growth in the future seems to depend on the performance of Silicon2, a cosmetics distribution company. Kim Myung-joo, a researcher at Korea Investment & Securities, said, "Silicon2, which acts as a 'barometer' of the global popularity of Korean cosmetics, posted third-quarter results that fell short of market expectations due to intensified competition and consumption slowdown concerns in the U.S." However, he evaluated, "It is very unfortunate that strong sales growth in Europe and the highest-ever operating profit margin were overshadowed by the stock price plunge." He added, "Although macro uncertainties remain a concern, the strong growth in European sales is expected to highlight and lead to a recovery."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.