"Branch Expansion and Efficiency"

Including Areas with Continuous Population Decline

Concerns Over Decreased Local Financial Accessibility

NH Nonghyup Bank, which operates the largest number of branches among commercial banks, is set to undertake a large-scale consolidation of its nationwide branches. With the Seoul metropolitan area seeing the most closures, Nonghyup Bank explained that it aims to scale up and improve the efficiency of its branches. However, there are concerns that consumer accessibility may decline as some branches in depopulated areas are also included.

According to the financial sector on the 20th, Nonghyup Bank will close 38 branches (including 4 sub-branches) on the 13th and 31st of next month and merge them with nearby branches. This number exceeds that of Woori Bank, which closed 36 branches this year, the highest so far. Since the beginning of this year, Nonghyup Bank opened 3 sub-branches and 1 branch while closing 2 branches, increasing the total number of branches from 1,100 at the end of last year to 1,102, but this will be the first time the number decreases.

In particular, the bank will reduce the most branches in the Seoul metropolitan area. In Seoul, 8 branches (Cheonggye, Sadang-dong, Wirye Jungang, Hannam-dong, Nowon Station, Gaerong Station branch, and Bukahyeon sub-branch) will be closed, and in Gyeonggi Province, 6 branches (Bucheon Sinheung, Jukjeon Bojeong, Ganeung Station, Namcheon, Seongnam High-Tech Valley branch, and Gwanggyo Financial Center) will be shut down. Following that, Busan will close 3 branches (Busan, Dangam-dong, Myeongnyun Station branch). Nonghyup Bank explained that the consolidation in the metropolitan area aims to generate profits through branch enlargement. A Nonghyup Bank official said, “We intend to provide higher quality customer financial services by scaling and streamlining branches located close to each other,” adding, “We also plan to establish organizational and personnel structures that can enhance competitiveness in future core businesses such as corporate finance and wealth management (WM).”

Commercial banks such as Shinhan Bank are also promoting branch enlargement this year. On the 9th of next month, Shinhan Bank will reorganize 5 branches, including the Yangjae-dong Financial Center, into integrated branches covering both corporate and personal finance. This year, Shinhan Bank has created 17 such large branches. The purpose is to enhance customer convenience by integrating branches that were previously operated separately but located in the same building. Woori Bank has closed 19 branches in Seoul alone, including Central City, Hongik University, and Dong Yeoksam-dong branches.

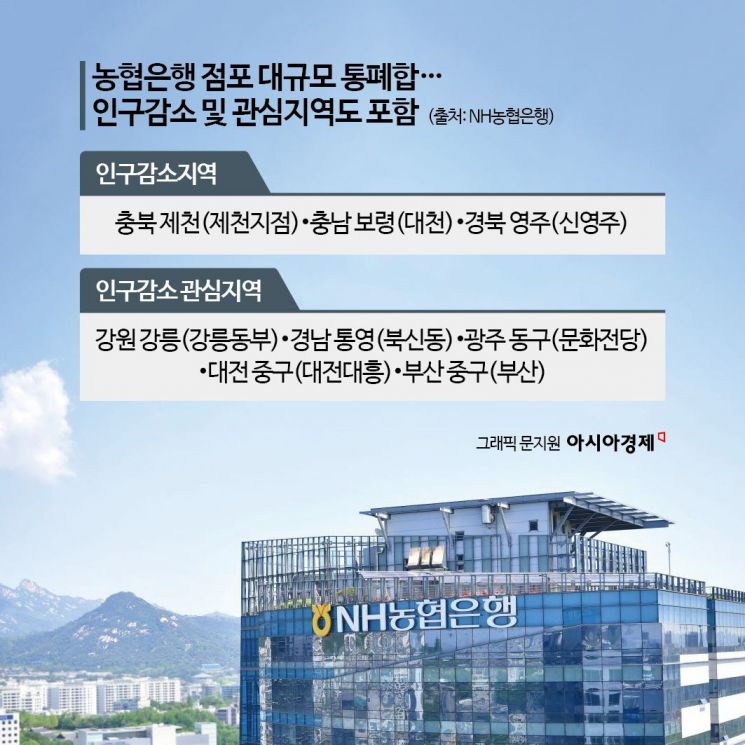

However, the consolidation targets also include 8 branches located in depopulated or designated interest areas. Specifically, branches in depopulated areas (one each in Jecheon, Chungbuk; Boryeong, Chungnam; and Yeongju, Gyeongbuk) are included. Depopulated areas refer to cities, counties, or districts at risk of regional extinction, as defined by presidential decree. In Jecheon and Boryeong, except for city hall sub-branches, only one Nonghyup Bank branch will remain in the city. Branches in depopulation interest areas (one each in Dong-gu, Gwangju; Jung-gu, Busan; Tongyeong, Gyeongnam; Gangneung, Gangwon; and Jung-gu, Daejeon) will also be reduced. Although banks are reducing the number of branches as digital finance spreads, in rural areas where there are many financially vulnerable groups such as the elderly, financial accessibility may decline. In fact, some consolidated branches in these areas (Tongyeong, Gyeongnam; Gangneung, Gangwon) are located 3.2 km and 2 km on foot, respectively, from the original branches. Nonghyup Bank stated, “Many depopulated areas have two or more branches, so accessibility will not be significantly affected.”

The reason Nonghyup Bank, which had maintained local branches as much as possible by having branches in 88 out of 89 depopulated areas, is undertaking consolidation is to reduce costs. The labor and rental costs incurred in operating rural branches exceed the profits generated by those branches.

Financial authorities, sensing this trend among commercial banks, are also preparing countermeasures. At a regular press briefing on the 30th of last month, Kim Byung-hwan, Chairman of the Financial Services Commission, said, “There are concerns and criticisms that bank branches in depopulated and rural areas are disappearing, lowering financial accessibility,” and added that they will proactively consider using post offices as bank agencies. On the 14th, the Financial Supervisory Service held a closed-door meeting with bank CEOs to address financial accessibility issues caused by branch consolidation and decided to operate a ‘Bank Branch Task Force’ centered on the Korea Federation of Banks. Various measures such as jointly operated branches by multiple banks and artificial intelligence (AI) branches are expected to be discussed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.