FTSE Russell to Announce Korea's WGBI Inclusion on 9th

'Market Accessibility' Condition Not Met

"Even if WGBI Inclusion Fails, Supply-Demand Volatility Likely Limited"

Ahead of next week's announcement of the bond country classification results by the Financial Times Stock Exchange (FTSE) Russell, many in the securities industry expect that South Korea's inclusion in the World Government Bond Index (WGBI) will have to wait until next year. This is based on the assessment that the 'market accessibility' criterion for WGBI inclusion has not yet been met.

According to the financial investment industry on the 4th, FTSE Russell will announce on the 9th, Korea time, whether Korean government bonds will be included in the WGBI. South Korea was listed as a watchlist country, a pre-inclusion stage, in September 2022 but failed to be included in the first half of this year as well as last year. This marks the fourth attempt at inclusion.

In the market, there is optimism that Korean government bonds could be included in the WGBI this time, as related systems have been improved, such as the launch of integrated government bond accounts from June to facilitate foreign investors' trading convenience and the extension of trading hours in the foreign exchange market. On the 30th of last month, Choi Sang-mok, Deputy Prime Minister and Minister of Economy and Finance, also stated ahead of a town hall meeting that "all conditions are considered to be met. I hope the inclusion decision will be made quickly" regarding WGBI inclusion.

If included in the WGBI, it is expected that tens of trillions of won will flow in due to improved accessibility to Korean government bonds in the global financial market, and there will be an effect of exchange rate stabilization. In fact, looking at the cases of Mexico and South Africa, both countries experienced a strengthening of their foreign exchange and bond markets after being included in the WGBI.

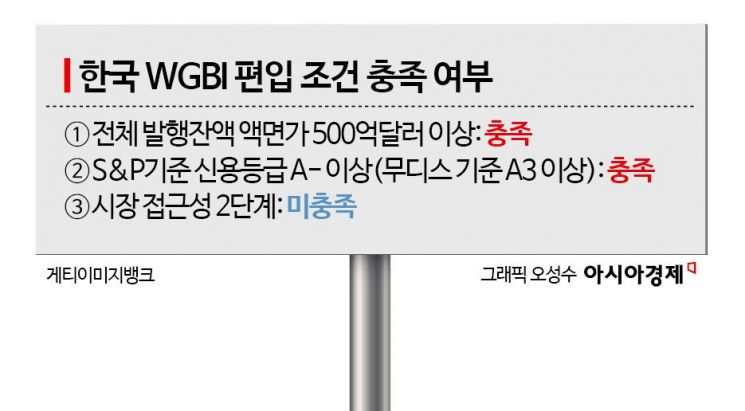

However, many in the securities industry believe that the possibility of inclusion in the WGBI this time is low. Yoo Sang-young, a researcher at Korea Investment & Securities, said, "Authorities have made institutional improvements such as opening integrated government bond accounts and extending foreign exchange market trading hours, but FTSE Russell acknowledged these efforts while stating that continuous and substantive confirmation of institutional implementation is necessary." He added, "South Korea currently meets all the quantitative requirements demanded by FTSE Russell, but it has not met the qualitative requirement of 'market accessibility.' The possibility of inclusion in the WGBI this time is limited." He also analyzed, "The disappearance of WGBI-related factors could act as an unfavorable condition for supply and demand in the government bond market at the end of the year."

There are also concerns that even upgrading the market accessibility level could be difficult. To be included in the WGBI, market accessibility must be at level 2, but South Korea currently remains at level 1. Lim Jae-kyun, a researcher at KB Securities, said, "It is necessary to first confirm whether market accessibility will be upgraded, rather than the inclusion itself." He explained, "The most important factor for market accessibility to be upgraded is the actual experience of investors, but in the case of Korean government bonds, settlement through the Euroclear system is not active, so market accessibility may not be upgraded." He added, "Even if market accessibility is upgraded immediately, FTSE rules state that inclusion in the WGBI occurs at least six months after the upgrade, so the inclusion timing may be further delayed."

However, there is a view that capital outflows due to failure to be included in the WGBI will not be significant. Kim Ji-man, a researcher at Samsung Securities, said, "I believe that market accessibility will be upgraded to level 2 in this announcement and inclusion in the WGBI will occur in March next year." He pointed out, "Since there is still time until actual inclusion in the WGBI, there are not many foreign funds currently inflowing that track the WGBI, so concerns about foreign capital outflows are not large."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.