Normalization of US Treasury Yield Curve After 26 Months

Stock Market Often Declines When Inversion Ends

"In High Inflation Era, It Is Rather a Buy Signal"

As the inversion of the U.S. Treasury yield curve between short-term and long-term rates has been resolved, conflicting opinions have emerged regarding the future direction of the market. Historically, the resolution of the yield curve inversion has often been a warning sign that led to recessions and bear markets. On the other hand, considering the unprecedented tightening and high inflation environment following the COVID-19 pandemic, some analysts interpret the resolution of the yield curve inversion as a signal for a bullish market.

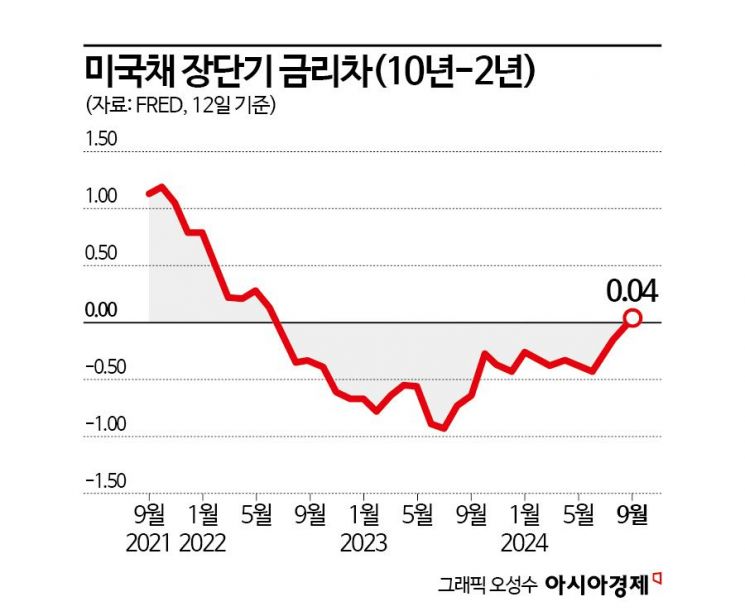

According to the financial investment industry on the 17th, the recent sharp decline in the U.S. 2-year Treasury yield has caused the spread with the 10-year yield to turn positive (+) for the first time in 26 months. The U.S. Treasury yield curve inversion had persisted since turning negative in July 2022, but as expectations for a Federal Reserve (Fed) interest rate cut increased, the inversion narrowed rapidly and returned to normal.

In the securities industry, concerns have been raised that the resolution of the U.S. Treasury yield curve inversion could lead to a bear market. Hyunki Kang, a researcher at DB Financial Investment, noted, "Recently, as the U.S. Treasury yield curve between short-term and long-term rates rebounded, the U.S. Conference Board Leading Economic Index also declined significantly. Past cases where this relationship was observed frequently led to stock market declines."

Heungjong Jang, a researcher at iM Securities, also stated, "The inversion and resolution of the yield curve have been used as key indicators for recession forecasts. Historically, recessions have invariably occurred 2 to 6 months after the inversion was resolved. While it may not happen immediately, the possibility of a future recession should be kept in mind." He added, "The recent slowdown in the upward revision rate of corporate earnings forecasts and the relative strength of defensive stocks may indicate a weakening economy. Attention should be paid to the volatility that can occur between recession and economic slowdown."

Conversely, there is also analysis that the resolution of the yield curve inversion does not necessarily lead to recession and bear markets. Euntak Lee, a researcher at KB Securities, said, "Cases where the resolution of the yield curve inversion led to bear markets occurred during low inflation periods. However, we are currently in a high inflation era." He continued, "Among the eight instances of inversion resolution during past high inflation periods, six were followed by bull markets. The other two also signaled that the market was near the bottom. The resolution of the yield curve inversion was a buy signal."

Youngwon Lee, a researcher at Heungkuk Securities, also pointed out that the normalization process following the resolution of the yield curve inversion does not necessarily have to be linked to a recession. He explained, "We must consider that the inversion persisted for a long time due to the extreme monetary policies following the pandemic."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.