Savings Banks' Losses Reach 380.4 Billion KRW in H1... Losses Widen

Savings Banks' Corporate Loan Delinquency Rate at 11.92%... Up 3.90%p from Year-End

Mutual Finance Cooperatives' Net Profit 1.0639 Trillion KRW... Down 47.3% YoY

FSS: "Ongoing Management Evaluations for Financial Firms with Inadequate Delinquency Resolution"

It has been revealed that the profitability and asset soundness of savings banks are deteriorating increasingly. Amid expanded losses due to increased loan loss provisions in the first half of this year, the non-performing loan ratio (NPL ratio) exceeded 11%, reaching double digits. The Financial Supervisory Service (FSS) plans to strengthen soundness management by encouraging the clearance of overdue loans and conducting management evaluations on financial institutions with insufficient overdue loan resolution.

According to the FSS on the 30th, losses of savings banks amounted to 380.4 billion won in the first half of this year, an increase of 96.5 billion won compared to the same period last year. This was due to a 396.2 billion won (20.5%) increase in loan loss provisions caused by rising delinquency rates and stricter evaluation standards for real estate project financing (PF) feasibility.

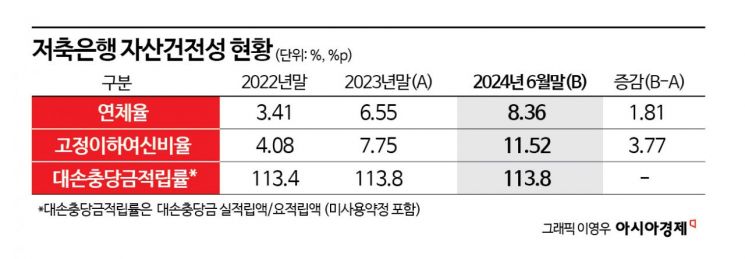

The asset soundness of savings banks also worsened overall. The delinquency rate rose by 1.81 percentage points from the end of last year to 8.36%. While the household loan delinquency rate decreased by 0.21 percentage points to 4.80% compared to 5.01% at the end of last year, the corporate loan delinquency rate increased by 3.90 percentage points to 11.92%. The non-performing loan ratio rose by 3.77 percentage points to 11.52% from 7.75% at the end of last year.

Total assets stood at 120.1 trillion won, down 5.1% from the end of last year. This was the result of a conservative business strategy due to deteriorating operating performance, leading to a decrease in loan assets mainly in corporate loans. The corporate loan volume decreased by 7.1 trillion won from 58.9 trillion won to 51.8 trillion won. Meanwhile, deposits fell by nearly 6% to 100.9 trillion won, and equity capital decreased by 2.0% due to continued deficits.

However, the BIS (Bank for International Settlements) capital adequacy ratio was 15.04%, up 0.69 percentage points from the end of last year, maintaining a level above the regulatory requirement. Despite realizing losses, equity capital slightly decreased by 1.3% due to capital increases, and risk-weighted assets significantly decreased by 5.8%, resulting in this outcome.

Additionally, the net profit of mutual financial cooperatives such as credit unions, Nonghyup, and Suhyup in the first half of the year was 1.0639 trillion won, a sharp decline of 47.3% compared to the same period last year. Net profit in the credit business division decreased by 1.0126 trillion won (26.9%) due to increased loan loss provisions, while the economic business division saw a slight reduction in deficit from 1.7472 trillion won in the first half of last year to 1.6892 trillion won this year, thanks to increased sales revenue from agricultural and fishery products.

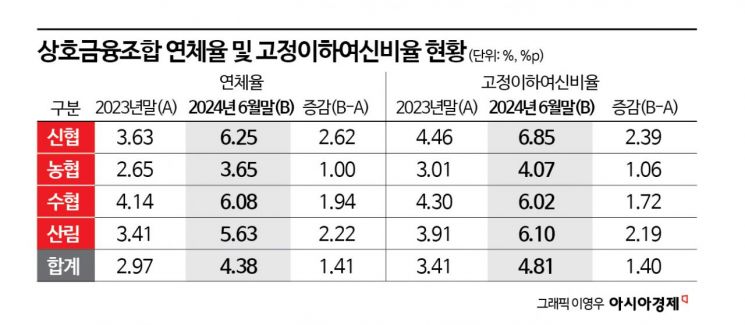

Delinquency rates and non-performing loan ratios also rose. As of the end of June, the delinquency rate was 4.38%, up 1.41 percentage points from 2.97% at the end of last year. The household loan delinquency rate increased by 0.46 percentage points to 1.99% from 1.53% at the end of last year, and the corporate loan delinquency rate rose by 2.15 percentage points to 6.46% from 4.31%. The non-performing loan ratio increased by 1.40 percentage points to 4.81% this year.

As of the end of June, total assets recorded 744 trillion won, with corporate loans increasing by 11.2 trillion won (2.4%) compared to the end of last year. Total credit rose by 0.7% to 513.7 trillion won, and total deposits increased by 2.9% to 637.2 trillion won. Meanwhile, the net capital ratio was 8.01%, down 0.12 percentage points from the end of last year but still maintained a level above the minimum regulatory requirement.

Lee Hee-seong, head of the Sound Management Team at the FSS, stated, "Although both savings banks and mutual financial sectors have experienced deteriorating performance, capital adequacy ratios significantly exceed regulatory requirements due to capital increases, maintaining a sound loss absorption capacity. However, given the persistent domestic and international economic uncertainties, we will continue to strengthen soundness management by encouraging practical clearance of overdue loans through measures such as auctioning off PF default projects and conducting management evaluations on financial institutions with insufficient overdue loan resolution."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.