US Interest Rate Cut Pressure, Yen Strengthens

Increase in Yen Carry Trade Liquidation

Supply-Demand Volatility Stimulates "Market Anxiety May Continue"

Amid the recent sharp market downturn, analysts in the securities industry suggest that for this correction to stabilize and form a bottom, the supply-demand instability caused by the unwinding of the Yen carry trade must be resolved.

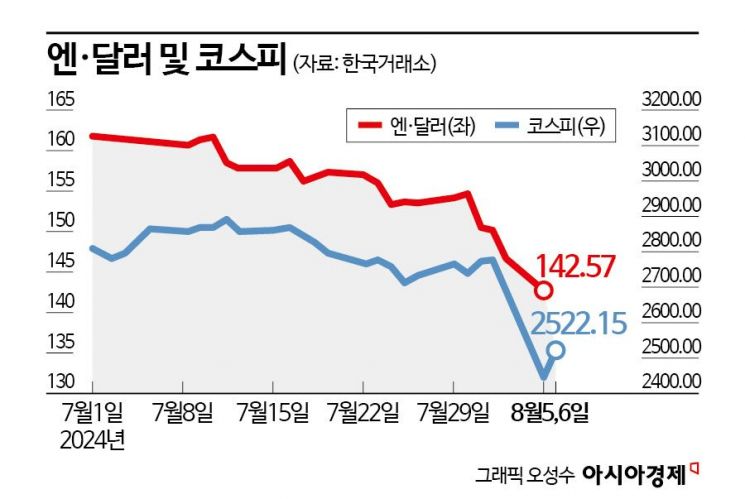

According to the Korea Exchange on the 7th, the KOSPI closed at 2522.15 the previous day. It has plunged 10.51% over the past month.

During the same period, the Japanese yen strengthened, reaching 142 yen on the 5th (local time). This marks the yen's strongest level in about seven and a half months since mid-January this year. The rise in the yen's value is attributed to the Bank of Japan (BOJ) raising its benchmark interest rate. On the 31st of last month, the BOJ increased the benchmark rate from 0.1% to 0.25% through its Monetary Policy Meeting. This is the highest interest rate level since 2008.

The yen's appreciation, coupled with growing fears of a recession and the possibility of a U.S. interest rate cut, is pressuring the unwinding of the Yen carry trade. Hyunjong Jung, a researcher at Korea Investment & Securities, explained, "The rapid changes in the financial markets over the past few days are due to the liquidation of global carry funds," adding, "The increasing possibility of a U.S. rate cut and the BOJ's rate hike have made the unwinding of the Yen carry trade a burden." He further noted, "The unwinding of carry trades accumulated since the COVID-19 crisis can lead to a strong market retracement, and it is important to note that this process will take place over a long period."

Currently, the securities industry cites recession fears, overvaluation of U.S. Big Tech companies, controversies over artificial intelligence (AI) profitability, and the unwinding of the Yen carry trade as reasons for the stock market's sharp decline. Among these, the unwinding of the Yen carry trade is particularly analyzed as increasing supply-demand volatility. Soyeon Park, a researcher at Shin Young Securities, pointed out, "While it is important to analyze factors such as interest rate cuts due to recession concerns and the easing of valuation pressures on tech stocks in confirming the market bottom, it is also necessary to verify supply-demand stabilization caused by the unwinding of the Yen carry trade."

Uncertainty surrounding the U.S. presidential election is also fueling concerns about the unwinding of the Yen carry trade. Hongchul Moon, a researcher at DB Financial Investment, said, "When Trump mentioned adjustments to the yen's value related to tariffs and trade deficits, it appears that Yen carry trading was being unwound." He added, "This financial market instability seems to have been triggered by the unwinding of the Yen carry trade amid a critical state where economic deterioration and overvaluation of some assets are intertwined," and warned, "Market instability may continue until the yen-dollar exchange rate reaches around 130 yen, which is estimated to be an appropriate level."

Youngil Kim, head of the Research Center at Daishin Securities, also commented, "Under the pressure of unwinding the Yen carry trade, fears of a U.S. recession are further stimulating yen appreciation, amplifying liquidity contraction," and predicted, "If the yen-dollar exchange rate falls further, accelerating the unwinding of the Yen carry trade, stock market volatility may continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.