Doosan Enerbility to Spin Off Doosan Bobcat... Merge with Doosan Robotics

Maximizing Business Synergy by Division and Enhancing Shareholder Value

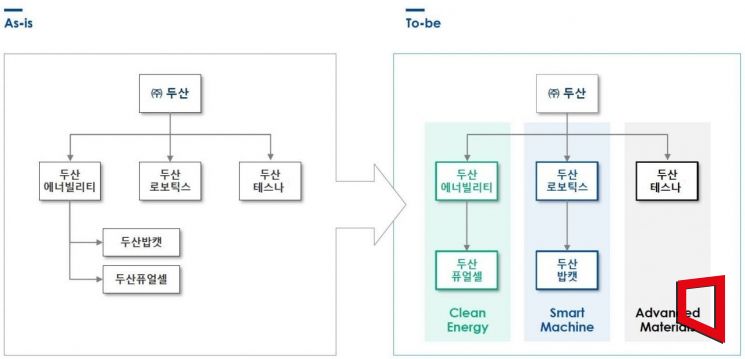

Doosan Group is restructuring its governance around three major business sectors: 'Clean Energy,' 'Smart Machines,' and 'Semiconductors & Advanced Materials.'

On the 11th, Doosan announced that it will adjust its affiliates to be positioned under divisions that correspond to the characteristics of these three major business sectors. Doosan Enerbility, Doosan Bobcat, and Doosan Robotics held board meetings on the same day and approved a governance restructuring plan that includes subsidiary spin-offs, mergers, and comprehensive stock exchanges.

The Clean Energy division, centered on Doosan Enerbility and Doosan Fuel Cell, will establish a portfolio covering the entire eco-friendly energy business, including nuclear power plants and SMRs (Small Modular Reactors), gas and hydrogen turbines, offshore wind power, hydrogen and ammonia, and recycling as part of renewable energy.

In the Smart Machines division, Doosan Bobcat and Doosan Robotics, which have established themselves as global top-tier players in the small construction equipment market and collaborative robot market, will be combined operationally. Doosan Bobcat, a subsidiary of Doosan Enerbility, will undergo a spin-off, merge with Doosan Robotics, and through a comprehensive stock exchange, become a wholly owned subsidiary of Doosan Robotics.

Doosan Robotics is expected to accelerate growth in advanced markets by utilizing Doosan Bobcat’s networks, financing capabilities, and management infrastructure in North America, Europe, and other regions. Additionally, with the expansion of automation in Doosan Bobcat’s production facilities, the supply of collaborative robot products to these facilities is expected to increase, which is anticipated to have a positive effect on captive sales growth.

Doosan Bobcat, which is focusing on unmanned and automated operations, will be able to diversify applications by integrating Doosan Robotics’ robot technology, and it is expected to promote the development of new concept products combining the technologies of both companies.

The core of the Semiconductors and Advanced Materials division is Doosan Testnada, which holds the number one domestic market share in the system semiconductor wafer testing field. The group’s advanced materials business, which produces electronic materials used in semiconductors, mobile phones, and electric vehicle batteries, will be positioned within this division.

A Doosan Group official explained, "The purpose of this business restructuring is to cluster businesses that are currently mixed without industry distinction into groups that can create synergy. We have adjusted the three companies?Doosan Enerbility, Doosan Bobcat, and Doosan Robotics?that are subject to this restructuring so that all three can achieve a ‘win-win-win’ outcome."

Doosan Enerbility, which has served as the group’s intermediate holding company in the existing governance structure, will be able to focus more on its core energy business and high value-added business portfolio including nuclear power, SMRs, gas and hydrogen turbines, and GT services, which are future growth engines. During this business restructuring process, a debt reduction effect of approximately 1.2 trillion KRW will occur, improving the financial structure.

A Doosan official stated, "This business restructuring will not only create an efficient management environment and generate synergy effects by business division but also serve as a stepping stone to discover and expand new business opportunities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.