Recovery of Tourism Demand After COVID-19 Endemic

Major Hotel Companies Show Clear Improvement in Performance

GS Retail's decision to pursue a spin-off of Parnas Hotel is analyzed to have been significantly influenced by the booming current hotel market environment. Recently, the hotel industry has regained vitality as demand, which was suppressed during the COVID-19 pandemic, has increased, leading to improved performance.

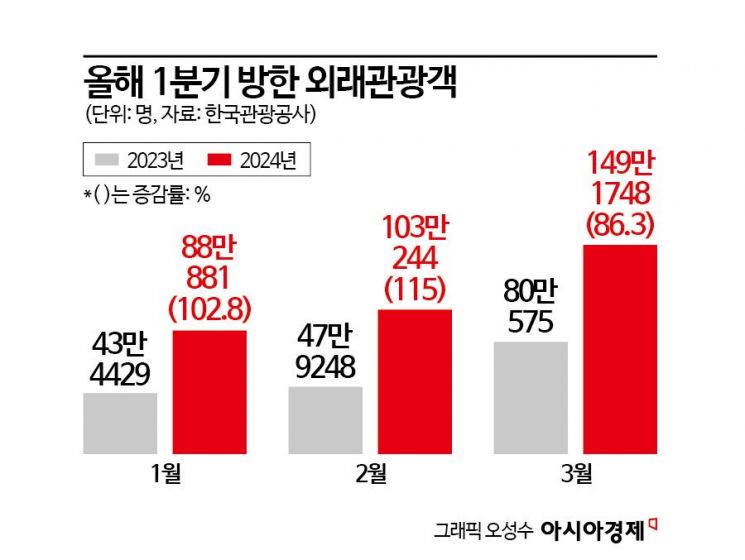

According to related industry sources on the 4th, the hotel industry has seen a substantial recovery in tourism demand due to the COVID-19 endemic. Data from the Korea Tourism Organization's Data Lab shows that the number of foreign tourists visiting Korea in the first quarter (January to March) of this year was 3,402,873, a 98.5% increase compared to the same period last year. In particular, March recorded 1,491,748 visitors, marking the highest monthly visitor count since December 2019 (1,456,888), just before the COVID-19 outbreak.

As travel demand recovered, the average room occupancy rates of major hotel operators also rose significantly. The average room occupancy rate of major hotels, which had fallen to the 30% range during the pandemic in 2020, has reportedly maintained around 80% since April last year. Prices also surged, with the average daily rate (ADR) dropping to 110,000 KRW in 2020 but soaring to around 200,000 KRW this year.

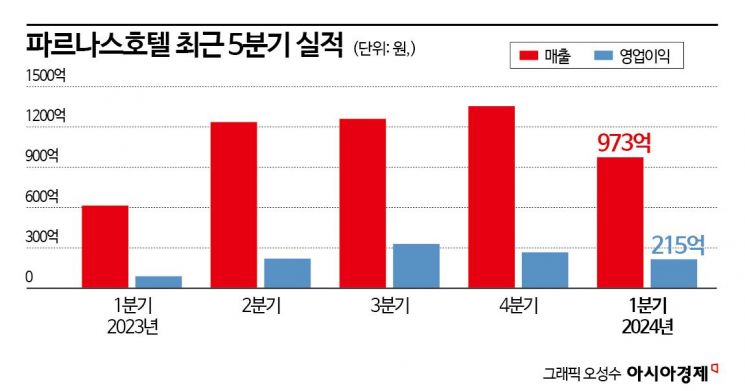

Performance has also improved. Hotel Lotte's hotel division recorded sales of 276.5 billion KRW, and Hotel Shilla's hotel & leisure division posted 150.1 billion KRW in sales in the first quarter of this year, up 4.6% and 5% respectively from the same period last year. Sales (130.8 billion KRW) and operating profit (5.4 billion KRW) of Chosun Hotel & Resort also increased by 9.6% and 35.0% year-on-year. Parnas Hotel recorded an operating profit of 24.4 billion KRW during this period, a 13.5% increase from the previous year, achieving its best first-quarter performance.

The industry believes that this improvement in business conditions influenced GS Retail's decision to spin off Parnas Hotel. The market environment is favorable enough to establish a holding company dedicated to the hotel business. GS Retail also stated, "Despite each business division, including hotels, showing good performance, the complex business structure has led to undervaluation compared to competitors, prompting the decision to split the company."

Earlier, GS Retail announced that it plans to pursue a spin-off of its subsidiary Parnas Hotel to enhance shareholder and corporate value. Accordingly, the company will be divided into the existing company GS Retail and a newly established company tentatively named Parnas Holdings. Under Parnas Holdings will be Parnas Hotel, currently a subsidiary of GS Retail, and the meat processing company Fresh Meat.

The spin-off date is set for December 26. The split ratio is 0.8105782 for GS Retail and 0.1894218 for Parnas Holdings. Upon completion of the split, GS Retail shareholders will hold shares in both GS Retail and Parnas Holdings according to the split ratio. The new corporation is scheduled to be listed on January 16 next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.