Record Quarterly Sales in Cosmetics Sector

Domestic Fashion Investment... Shinsegae Tomboy 10 Billion KRW Capital Increase

Shinsegae International recorded its highest-ever sales in the cosmetics sector in the first quarter. This is the first time since the first quarter of 2019. Although the fashion sector's performance was poor due to the economic downturn, the cosmetics sector compensated for this, helping to prevent a decline in overall performance.

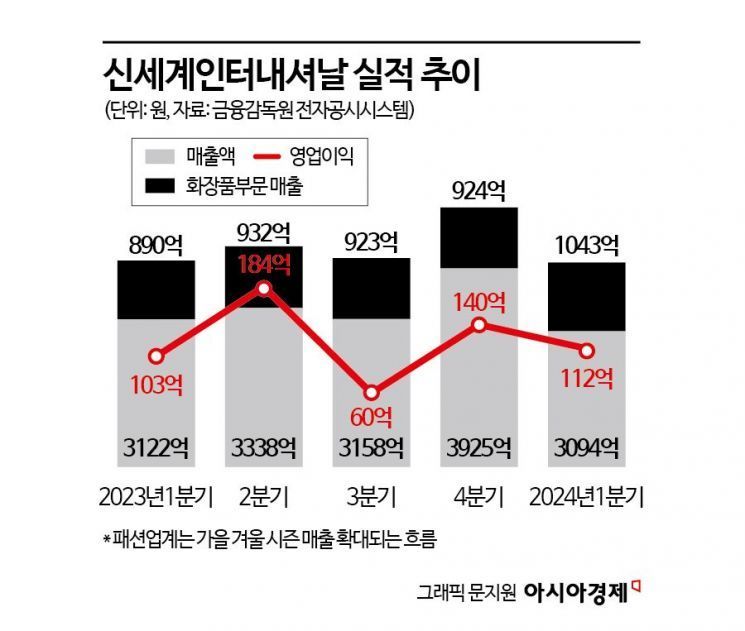

According to the Financial Supervisory Service disclosure system on the 8th, Shinsegae International posted sales of 309.4 billion KRW and an operating profit of 11.2 billion KRW in the first quarter. While sales decreased by nearly 1%, operating profit grew by about 9%. Considering that major fashion companies that announced their results early reported a decline in first-quarter performance, Shinsegae International's results are regarded as relatively favorable.

Shinsegae International's performance is largely divided into fashion and cosmetics sectors. The driving force behind the first-quarter results was the cosmetics sector. First-quarter sales in the cosmetics sector reached 104.3 billion KRW, with an operating profit of 6.5 billion KRW, representing growth of 13.5% and 16.7% respectively compared to the same period last year. The cosmetics sector's sales exceeded the securities market's expected level of 90 billion KRW by 15 billion KRW, showing rapid growth. This figure surpasses the record quarterly sales of 103 billion KRW in the first quarter of 2019.

Both in-house and imported cosmetics showed significant growth in the cosmetics sector. Among in-house cosmetics, luxury brands Poare (63%) and Yeonjak (32%) both posted double-digit growth rates. Poare gained popularity with its foundation 'Teint de Soie' and the elastic skincare lines 'Absolift Cr?me (cream)' and 'Serum.' Despite its price exceeding 100,000 KRW, Teint de Soie has been attracting customers since 2022, when it became known as the 'Jun Ji-hyun foundation.'

Yeonjak's main products, ‘Skin Perfecting Protective Base Prep’ and ‘Jeoncho Concentrate,’ have shown steady sales growth. Swiss Perfection saw its sales increase by about 64% as the facility investments made last year entered their final stages. Imported cosmetics brands such as Diptyque and Hourglass, including niche perfumes and hair care products, continued their growth momentum.

In the fashion sector, significant sales were generated mainly by major imported overseas brands UGG (23%), Rick Owens (23%), and Brunello Cucinelli (22%). 'The Row,' which made its domestic debut in March, also attracted considerable attention and is reportedly growing its sales. The Row is a new luxury brand representing the old money look and is known to be favored by celebrities such as Jennie, Ros?, and Han Ga-in.

Shinsegae International stated, "Recently launched fashion brands among imported brands have shown results beyond expectations," but added, "However, the overall business environment in the fashion industry was challenging." Domestically, the fashion sector saw Shinsegae Tomboy's sales increase from 30 billion KRW in the first quarter of last year to 58.1 billion KRW, but profits only rose by 900 million KRW to 3.7 billion KRW.

To enhance its domestic fashion capabilities, Shinsegae International plans to proceed with a paid-in capital increase of 10 billion KRW. The strategy is to improve financial structure through debt repayment and to increase investment capacity in Studio Tomboy, BOBB, and JIGOTT, which are operated by Shinsegae Tomboy.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.