Despite Low Birthrate and Dairy Product Slump... Clear Increase in Consumption

Last Year's Import Amount $862.6 Million... Up 55% in 4 Years

Home Drinking Trend Diversifies Processed Cheese to Natural Cheese Product Range

As milk prices rise and the low birthrate trend continues, consumption of milk and powdered milk is decreasing, while cheese consumption is showing a clear upward trend. Cheese has become a familiar food for Koreans, and demand is rapidly increasing not only as a snack but also as an ingredient in various dishes and as an accompaniment to drinks. Dairy companies, struggling with a decline in raw milk consumption, are expected to intensify efforts to expand their range of cheese products.

According to the Food Industry Statistics Information of the Korea Agro-Fisheries & Food Trade Corporation (aT) on the 1st, last year’s domestic retail cheese sales amounted to 406.4 billion KRW, a 5.3% increase compared to the previous year (386 billion KRW). Cheese sales, which were 382.6 billion KRW in 2021, grew at an average annual rate of 3.1% until last year. This contrasts with milk sales, which decreased by 0.7% from 2.1841 trillion KRW to 2.1532 trillion KRW, and powdered milk sales, which dropped by 13.1% from 68.9 billion KRW to 52 billion KRW during the same period.

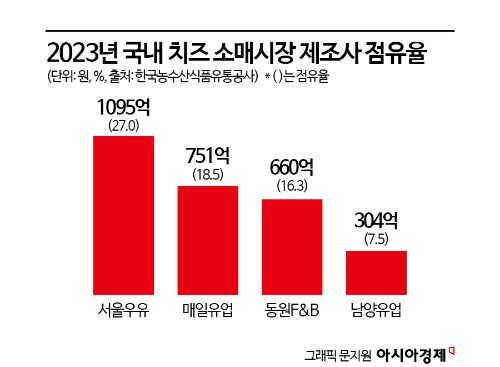

As domestic consumers’ cheese consumption increased, companies with sales exceeding 100 billion KRW have emerged. Seoul Milk Cooperative recorded cheese sales of 109.5 billion KRW last year, a 12.7% increase from the previous year, securing a market share of 27.0% and taking the industry lead. According to Seoul Milk, the growth rate of cheese product sales, which was within 5% during the COVID-19 pandemic period from 2019 to 2021, increased to around 15% between 2021 and 2023.

By manufacturer, Maeil Dairies ranked second with 75.1 billion KRW in sales and an 18.5% market share, followed by Dongwon F&B with 16.3% (66 billion KRW) and Namyang Dairy Products with 7.5% (30.4 billion KRW). By brand, Seoul Milk’s ‘Seoul Milk Cheese’ led the market, followed by Maeil Dairies’ ‘Sangha Cheese,’ Dongwon F&B’s ‘Denmark,’ Namyang Dairy’s ‘Da Vinci,’ and Dongwon F&B’s ‘Sowanamu’.

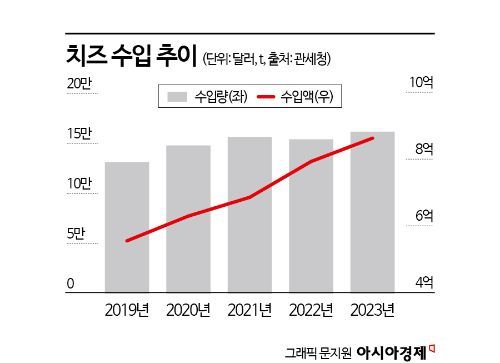

Although raw milk consumption is generally declining recently, consumption of dairy products made from raw milk continues to increase. In particular, cheese is recognized as a highly versatile ingredient, and demand has rapidly grown along with a sharp rise in import value. According to the Korea Customs Service, cheese import value increased by 55.4% over four years, from 555.08 million USD (approximately 740 billion KRW) to 862.6 million USD (approximately 1.15 trillion KRW) last year. During the same period, import volume also rose by 23.1%, from 131,354 tons to 161,753 tons.

Changes in domestic consumers’ eating habits are identified as the main cause of the increase in cheese consumption. As Westernized diets have become popularized, the practice of cooking with cheese added to various foods has increased, and the consumption of convenient foods such as salads has led to growing demand for various types of cheese. Slice cheese, which is preferred as a snack, still dominates the domestic cheese market. Last year, slice cheese accounted for 46.2% of the retail market share, nearly half, and Seoul Milk’s high market share was driven by the strength of slice cheese products such as ‘Cheddar Cheese,’ ‘Tasty Cheese High Calcium,’ and ‘High Protein Cheese.’

However, as cheese consumption patterns gradually change, the market’s center is shifting from processed cheese to natural cheese. One of the main drivers of this change is the home drinking and solo drinking culture established during the pandemic. As consumption of imported alcoholic beverages such as wine and whiskey increases, cheese is increasingly sought as a light accompaniment. Natural cheese can be enjoyed without special preparation, paired with various ingredients like basil and tomato, and consumers use cheese not only as a snack but also in salads, pasta, and other dishes.

With expanding consumer demand for various cheese product lines, cheese demand is expected to continue growing steadily. The dairy industry is also likely to accelerate market expansion by distributing a variety of premium cheeses such as burrata, fresh mozzarella, and ricotta cheese, in addition to the existing sliced processed cheese, in line with consumer awareness and trends. A Seoul Milk official explained, “We are preparing to expand our domestic cheese lineup with additional products such as string cheese and grillable cheese made from domestic raw milk to meet diverse consumer needs.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.