Last year, credit card consumers showed the strongest preference for benefits in the airline and hotel sectors.

Credit card platform Card Gorilla announced the 'Most Useful Card Benefits of 2023' on the 12th. This survey was conducted over two weeks from the 26th of last month to the 8th, targeting visitors to the Card Gorilla website, with 2,569 participants.

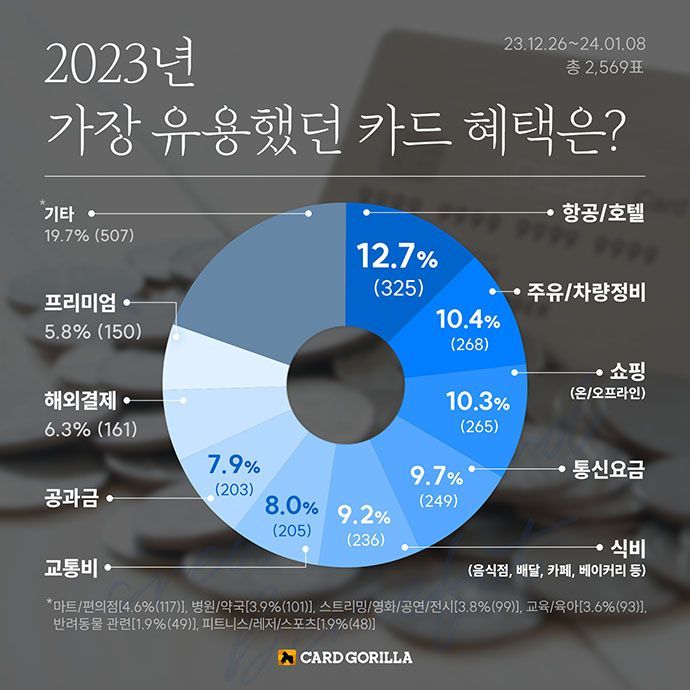

The most useful card benefit was 'Airline and Hotel,' accounting for 12.7%. This is attributed to the surge in overseas travel demand that had been suppressed due to COVID-19.

The second place was 'Fuel and Vehicle Maintenance,' accounting for 10.4%. It appears that benefits related to these expenses gained popularity due to unstable international oil prices and increased domestic travel.

The third place was 'Shopping,' accounting for 10.3%. Fourth to seventh places were essential spending categories. Fourth was 'Communication Fees' (9.7%), fifth was 'Food Expenses' (9.2%), sixth was 'Transportation Costs' (8%), and seventh was 'Utility Bills' (7.9%). The total proportion of essential spending categories was 34.8%, meaning one out of three respondents found these benefits useful.

Go Seung-hoon, CEO of Card Gorilla, said, “Many consumers took good advantage of card benefits in fixed living expenses that must be paid and in large one-time payments such as airline, hotel, and shopping. It is advisable to decide on the number of cards or premium cards to use by considering card usage amounts, fixed expense ranges, and travel frequency.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.