53.1% Surge Compared to Previous Year

Largest Scale Since 2014

Maximum Card Debt Rollover Too

The amount of overdue credit card debt has surpassed 2 trillion won. This is the largest scale since the establishment of the eight-card company system in South Korea in 2014. The scale of revolving credit, card loans, and refinancing loans used to cover debts has also soared to an all-time high, raising concerns that it could act as a trigger for the household economy.

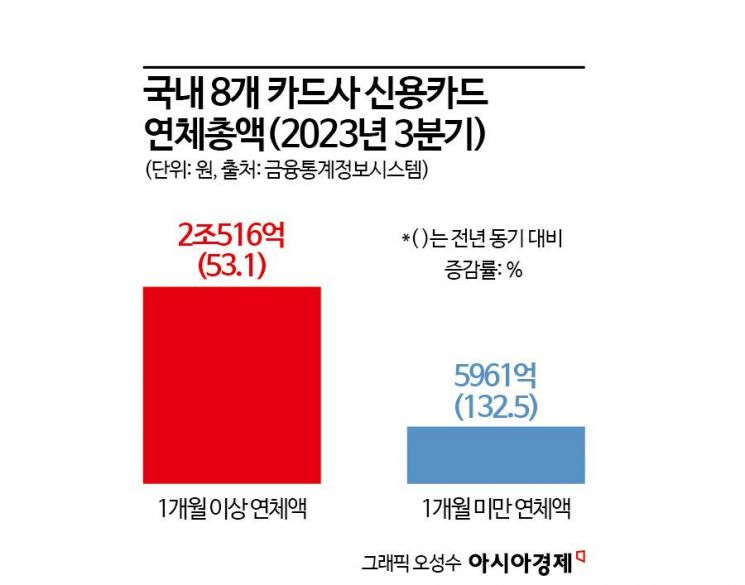

According to the Financial Statistics Information System on the 8th, the total amount of overdue credit card debt (overdue for more than one month) as of the end of the third quarter last year for the eight domestic card companies (Shinhan, Samsung, Hyundai, KB Kookmin, Lotte, Woori, Hana, and BC Card) was 2.0516 trillion won. This is a sharp increase of 53.1% (711.8 billion won) compared to the same period last year (1.3398 trillion won). This is the first time since 2014 that overdue debt has exceeded 2 trillion won. The amount of credit card debt overdue for less than one month, which has a relatively high recovery rate, also reached 596.1 billion won, the highest in five years since the third quarter of 2018 (724.4 billion won).

Among the card companies, Shinhan Card had the highest amount of overdue debt over one month at 537.8 billion won. It was followed by KB Kookmin Card (322 billion won), Lotte Card (305.6 billion won), and Samsung Card (281.6 billion won). The card company with the highest increase rate in overdue debt compared to the same period last year was BC Card, which increased by 171%. Hana Card (164%), Lotte Card (84%), and Woori Card (65%) also saw sharp increases in overdue debt.

Due to prolonged high interest rates, economic downturn, and rising prices, household financial conditions have worsened, making it more common for people to fail to repay their card bills on time. The problem is that there is an increasing number of cases of so-called "debt rollover," where people borrow money to repay other debts rather than temporarily being overdue. The balance of refinancing loans for card loans, a product where borrowers who have overdue card loans borrow again to repay the card loans, was 1.596 trillion won as of November last year, a 49.6% (529.6 billion won) increase compared to the same period last year (1.0664 trillion won). This is the largest increase from January to November compared to the same period last year.

The balance of revolving credit is also continuing its high-rise trend. As of the end of November last year, the revolving credit balance carried over by the eight domestic card companies was 7.5115 trillion won, an increase of 0.56% (41.8 billion won) from the previous month (7.4697 trillion won), marking an all-time high. Revolving credit is a service where only part of the credit card usage amount is paid, and the rest is carried over to be repaid later. While it can relieve sudden debt burdens, the interest rate exceeds 15% per annum, causing the debt to snowball. The revolving credit balance has steadily increased since it first surpassed 7 trillion won in September 2022 and has maintained the 7 trillion won level.

As the number of customers unable to repay card bills and loans increases, the delinquency rate of card companies has also risen. The delinquency rate of the eight card companies in the third quarter last year was 1.6%, up 0.3 percentage points from the previous quarter and 0.62 percentage points from the same period last year. During the same period, the amount of bad debt provisions set aside by card companies was 1.3795 trillion won, an increase of 81.2 billion won (6.3%) compared to the same period the previous year. As the delinquency rate rises, card companies are strengthening asset soundness by accumulating provisions to prepare for defaults.

Amid increasing demand for "quick cash," situations where even insurance policies taken out are used as collateral for loans are continuing. As of the third quarter last year, the scale of policy loans was 70 trillion won, an increase of 6.38% (4.2 trillion won) compared to the third quarter of the previous year. Policy loans allow borrowers to maintain insurance coverage while borrowing within 70-95% of the surrender value. However, if the loan principal and interest exceed the surrender value due to interest arrears, the insurance contract may be canceled. The interest rate is also relatively high at around 8%. A credit industry official said, "The burden of household debt is causing liquidity shortages for financial companies, which could lead to a vicious cycle of further debt-related instability in the financial market," adding, "Solutions to ease loan burdens, especially for vulnerable groups such as self-employed and small business owners, need to be implemented promptly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.