Non-life Insurers Lead Market with 13.7% Annual Growth

Rising Interest in Retirement Life and Increasing Single-Person Households... Demand Structure Expected to Change

Competition Intensifies to Target Niche Markets

It has been analyzed that the market for 'third insurance' products such as cancer insurance and indemnity medical insurance has maintained an average annual growth rate of 7.0% after 20 years of competition between life insurance companies and non-life insurance companies. As this is one of the few high-growth insurance sectors with intense competition, advice suggests the need for discovering various niche markets and differentiated attempts.

On the 30th, the Korea Insurance Research Institute released a report titled "Competitive Landscape and Evaluation of the Third Insurance Market." Third insurance products are those that both life insurers and non-life insurers can handle. They refer to contracts that promise to pay money or other benefits for the purpose of risk protection related to human diseases, injuries, or the resulting care, in exchange for premiums. Cancer insurance and indemnity medical insurance are representative products.

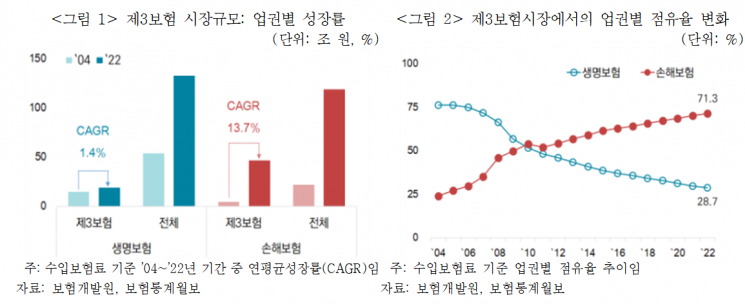

According to the Korea Insurance Development Institute, the average annual growth rate of the third insurance market from 2004 to 2022 was 7.0%. In particular, the average annual sales (earned premiums) growth rate of non-life insurers was 13.7%, significantly surpassing the overall non-life insurers' average annual sales growth rate of 9.8% during the same period. Initially, life insurers had a high market share in the third insurance market, but since 2010, the dominance of non-life insurers has increased.

Although life insurers and non-life insurers compete together, there are differences by sector when designing products. Third insurance corresponds to life insurance in that it insures the human body, but it has the characteristics of non-life insurance as it compensates for indemnity benefits such as cost loss and medical expenses.

Generally, insurance companies sell third insurance products that expand coverage with various riders on a main disease insurance contract. However, non-life insurers have maturity and benefit limits for disease death riders (age 80, 200 million KRW). Unlike life insurance, non-life insurance can also add liability coverage in addition to injury and disease coverage.

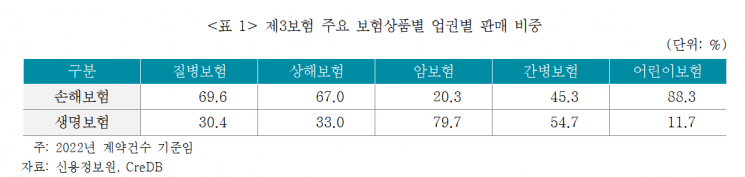

Beyond products, differences also appear by sector in terms of policyholder age and payment methods. Life insurance tends to have a relatively higher proportion of older policyholders, while non-life insurance has a higher proportion of younger policyholders. This is because life insurance has strengths in cancer insurance and nursing care insurance, whereas non-life insurance excels in children's insurance. Additionally, life insurance has a relatively higher proportion of annual payments due to the bancassurance channel influence.

Increased Interest in Retirement Life and Single-Person Households... Expected Changes in Demand Structure

It is expected that competition in the third insurance market will intensify further. As demand for death coverage decreases and demand for health coverage increases, the demand landscape is changing. Moreover, with the introduction of the new accounting standard 'IFRS17,' there is likely to be a strong movement to increase protection-type insurance, which is favorable for the profitability indicator Contractual Service Margin (CSM). Interest in retirement life is already growing, and changes in household structure are leading to increased demand for disease insurance and nursing care insurance.

Given these changes, it is analyzed that each insurance company will need to lead market structure changes by discovering niche markets and new coverage guarantees, innovating business models, and making efforts to secure customer touchpoints. Kim Dong-gyeom, a research fellow at the Korea Insurance Research Institute, explained, "Non-life insurers, who have already secured a significant number of customers, can establish customized marketing strategies for different life cycle stages by leveraging their competitiveness in the children's insurance market and securing many young customers. To lead the market, it is necessary to analyze disease occurrence trends, discover new risk factors, explore vulnerable groups to injury and disease risks, and prepare effective measures to secure customer touchpoints."

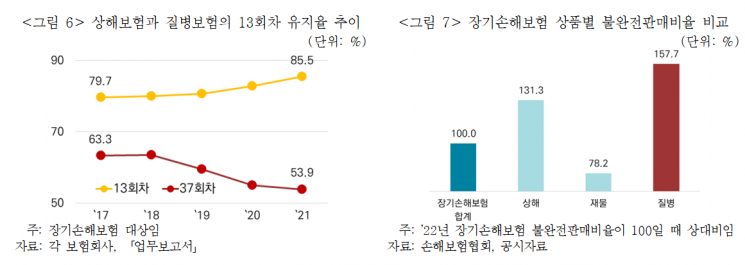

However, he emphasized the need to be cautious in product design and sales management, as excessive competition through expanding coverage or recruitment commissions could lead to incomplete sales or deterioration of insurers' profitability. Researcher Kim pointed out, "The ratio of 'new contract expenses to initial premium' for injury and disease insurance is on the rise, indicating intensified sales competition among companies in the third insurance market. The long-term retention rate (37th renewal) for injury and disease insurance is declining, and the incomplete sales rate is higher compared to other products, so appropriate management is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)