Impact of Largest Drop in Petroleum Prices Since January 1985 (25.4%)

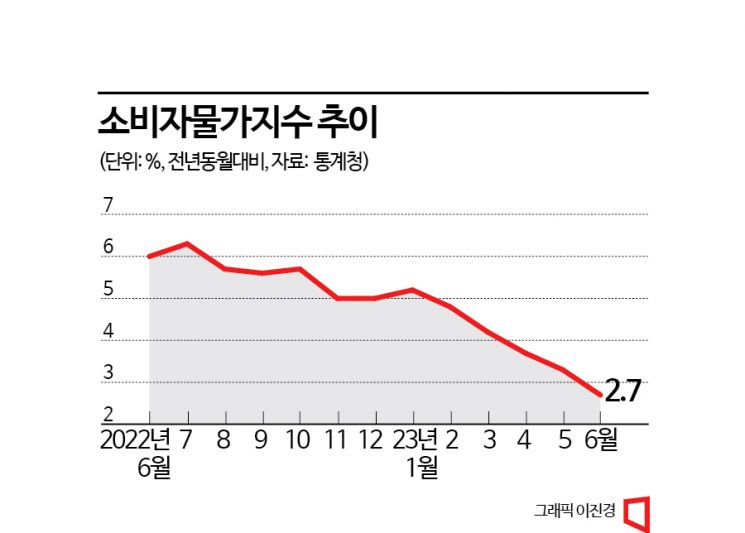

The consumer price inflation rate has fallen to the 2% range. In June this year, the consumer price inflation rate recorded 2.7%, entering the 2% range for the first time in 21 months. The main factor was the stabilization of petroleum product prices due to the decline in international oil prices.

According to the 'June 2023 Consumer Price Trends' released by Statistics Korea on the 4th, last month's consumer price inflation rate rose by 2.7% year-on-year, narrowing the increase by 0.6 percentage points compared to the previous month (3.3%). This is a significant slowdown from the inflation rate that surged to 6.3% in July last year. Since the beginning of this year, it has declined for five consecutive months from 5.2% in January. The increase rate hitting the 2% range is the first time in 21 months since September 2021 (2.4%).

The decline in international oil prices led to a drop in petroleum product prices and a slowdown in the service price inflation rate, causing the overall inflation rate to fall into the 2% range. Last month, petroleum product prices fell by 25.4% year-on-year, marking the largest decline since the related statistics began in January 1985. Service prices also rose by 3.3% compared to the same month last year, slowing down from 3.7% in the previous month. Kim Bo-kyung, the Economic Trend Statistics Commissioner at Statistics Korea, explained, "The main factors are the decline in petroleum product prices and the slowdown in the service price inflation rate."

On the other hand, prices for electricity, gas, and water rose by 25.9%, expanding the increase compared to the previous month (23.2%). City gas prices rose by 29.0%, and electricity rates, which were increased from the 16th of last month, rose by 28.8%.

The core inflation rate (excluding agricultural products and petroleum products), which reflects the underlying trend of prices, rose by only 4.1% year-on-year, marking the lowest level in 14 months. The food and energy exclusion index also rose by 3.5%, showing a relatively significant decrease in the rate of increase compared to May (3.9%), April (4.0%), and March (4.0%).

The living cost index also rose by 2.3% year-on-year, significantly narrowing the increase compared to last month (3.2%). Food prices rose by 4.7%, but prices excluding food increased by only 0.8%. The living cost index is compiled from 144 items out of a total of 458 items, focusing on those with high purchase frequency and expenditure share, which are sensitive to price changes. However, the fresh food index rose by 3.7% year-on-year, showing a continuous upward trend following April (3.1%) and May (3.5%).

Regarding future inflation, Commissioner Kim explained, "Since the inflation rate was high from January to July last year and slowed down from August to December, the base effect may cause the rate of inflation decline to slow in the second half of this year." He also pointed out that international raw material prices and public utility fee increases are potential risk factors that could stimulate inflation in the second half of the year.

The Bank of Korea held a 'Price Situation Review Meeting' chaired by Deputy Governor Kim Woong on the same day and forecasted, "The consumer price inflation rate in July is expected to continue the slowing trend seen in June, but it will rise again afterward, fluctuating around 3% until the end of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.