A Total of 230 Cases from January to June

Significant Increase After April's Relaxation of Resale Restrictions

Must Still Observe Actual Residence Requirement

The volume of apartment pre-sale rights and move-in rights transactions in Seoul during the first half of this year surged fivefold compared to last year. As the perception that housing prices have bottomed out spread and fears of soaring pre-sale prices grew, demand increased. In the case of Olympic Park Foret On, which is reconstructing Dunchon Jugong in Gangdong-gu, Seoul, the price has risen about 500 million KRW above the pre-sale price, reflecting a rising market value. A fresh breeze is blowing through Seoul's pre-sale and move-in rights market, which had been stagnant due to the real estate market downturn and various regulations.

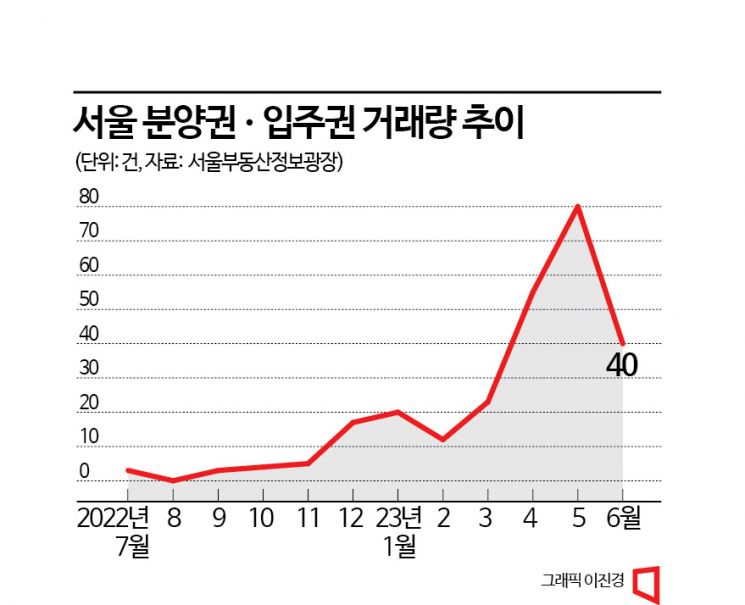

According to the Seoul Real Estate Information Plaza on the 4th, the total number of pre-sale and move-in rights transactions in Seoul from January to June this year was 230 cases. This is a 380% (182 cases) increase compared to 48 cases during the same period last year. It is also nearly three times the total transaction volume of 80 cases for the entire last year.

While the monthly transaction volume of pre-sale and move-in rights in Seoul remained in single digits last year, it sharply increased to 20 cases in January, 12 in February, 23 in March, 55 in April, and 80 in May this year. June currently has 40 cases, but since the registration deadline for actual transactions is about a month away, the number is expected to rise further.

The surge in pre-sale and move-in rights transactions is largely due to the government's significant reduction of the resale restriction period in the metropolitan area from a maximum of 10 years to a maximum of 3 years last April. In particular, the resale restriction period is 3 years in public housing sites and regulated areas such as Gangnam, Seocho, Songpa, and Yongsan districts, but only 1 year in other areas, even within Seoul. This has made it easier for successful applicants to sell their pre-sale rights.

Additionally, as the perception that "housing prices have hit bottom" has spread, demand to purchase new apartments has flooded the pre-sale and move-in rights market. Especially in Seoul, unlike Gyeonggi and Incheon where the 3rd New Towns are being supplied, there are few new housing sites, making the chances of winning a subscription low. Although reconstruction and redevelopment are actively underway, the general supply excluding union member quotas is insufficient, leading buyers to focus on pre-sale and move-in rights.

The recent sharp rise in pre-sale prices has also contributed to the increase in transaction volume, as buyers feel the urgency to purchase before prices rise further. According to the Housing & Urban Guarantee Corporation (HUG), as of the end of May, the average pre-sale price per 3.3㎡ for private apartments in Seoul was 31.05 million KRW, a 10% increase from a year ago. Kim Woongsik, a researcher at RealToday, said, "The most traded pre-sale right in Seoul during the first half of this year was 'Cheongnyangni Station Lotte Castle SKY-L65' in Jeonnong-dong, Dongdaemun-gu," adding, "As construction costs rise, the psychology that apartment pre-sale prices will increase further is spreading, leading to increased demand for pre-sale rights of already sold apartments."

As demand rises, prices are also noticeably increasing. The pre-sale right for an 84㎡ unit in Olympic Park Foret On recently changed hands for 1.8 billion KRW. The pre-sale price for the same size ranges from the low 1.2 billion KRW to the low 1.3 billion KRW range, about 500 million KRW higher. The nearby large complex Helio City in Songpa-gu saw the sale price for an 84㎡ unit recover to the 2 billion KRW range within the past year, raising expectations for capital gains. Additionally, a 59㎡ pre-sale right in Heukseok River Park Xi in Heukseok-dong, Dongjak-gu, was sold last month for 1.15 billion KRW, more than 400 million KRW higher than the pre-sale price, which was in the high 600 million to low 700 million KRW range.

However, it is important to note that the system is still incomplete for safely trading pre-sale rights. Initially, the government planned to abolish the residence obligation along with easing the resale restriction period. Even if resale becomes possible, it would be ineffective if the winner's residence obligation remains. However, the relevant bill has not been passed in the National Assembly and is still pending.

Buyers should also carefully consider the significant tax burden depending on the timing of the transaction. For pre-sale rights, if sold within one year from the subscription winning date, 77% of the capital gains (including local income tax) must be paid as capital gains tax; if sold after one year, 66% is required. A real estate industry official said, "Although the pre-sale and move-in rights market has recently revived, the residence obligation still limits market activation," advising, "Buyers should also consider that acquisition tax is based on acquisition, not move-in."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.