Fat Finger Error Caused by Simple Input Mistake

Losses Amplified by 'Algorithmic' Trading

'Flash Crash' Hits US and Europe

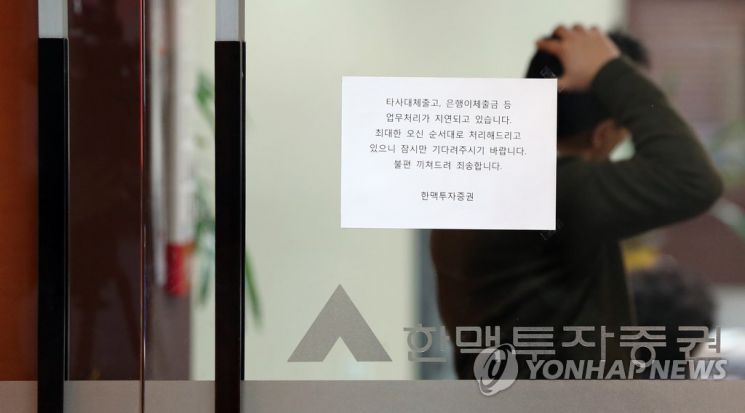

Hanmaek Investment & Securities, which went bankrupt after incurring losses worth hundreds of billions of won in 2013. The cause was a simple input error by a single employee. The incident not only led to Hanmaek's bankruptcy but also resulted in a nine-year legal battle between the bankruptcy trustee, the Korea Deposit Insurance Corporation (KDIC), and the Korea Exchange.

A mistaken trade caused by a securities firm employee's confusion or input error is called a 'Fat finger.' While a fat finger is just one of the 'human errors' that can happen anytime, its impact can be enormous, sometimes bringing down companies or wiping out hundreds of trillions of won in the stock market.

Hundreds of Billions Lost Due to Number Input Error... Securities Firm Bankruptcy

The Hanmaek incident occurred on December 12, 2013. After the market opened that day, a Hanmaek employee mistakenly sold shares at a price significantly lower than the market price.

In the futures market, interest rate calculations, which are variables in option pricing, are usually done as "remaining days/365." However, the employee made an error by entering "remaining days/0," which caused the upper limit of the purchase price and the lower limit of the selling price not to be set, allowing profit realization in all situations.

The program automatically executed a massive amount of algorithmic trading. It took only about two minutes for the employee to realize the mistake and unplug the computer. However, during that time, the trading volume reached approximately 37,900 transactions, and Hanmaek ultimately had to bear losses worth hundreds of billions of won. Hanmaek declared bankruptcy on February 16, 2015.

The Hanmaek incident did not end there. In 2014, the Korea Exchange filed a lawsuit against KDIC, demanding payment of approximately 41.1 billion won in unsettled settlement funds from Hanmaek. On the other hand, KDIC countersued, claiming that the Exchange was negligent in monitoring and supervising the derivatives market.

The legal battle lasted nearly nine years, but on the 14th, the Supreme Court confirmed the original ruling in favor of the plaintiff, resulting in a victory for the Korea Exchange. Accordingly, KDIC must pay the Exchange approximately 41.154 billion won through the bankruptcy estate.

'Human Errors' Threatening the Stock Market

Fat finger errors may seem like simple mishaps at first glance, but in the securities market where massive amounts of money move within minutes, they can be fatal mistakes. Moreover, since these errors are caused by 'humans,' it is impossible to predict when and how they will occur, which is the most dangerous aspect.

Another famous domestic fat finger case is the 2018 Samsung Securities phantom stock incident. In April of that year, Samsung Securities intended to pay a cash dividend of 1,000 won per share to employee stock ownership plans but mistakenly entered 1,000 shares per stock, resulting in an erroneous dividend.

The so-called 'phantom stocks' issued in this incident amounted to 2,812,950,000 shares (approximately 112 trillion won), which exceeded Samsung Securities' issuance limit by several tens of times. However, 21 employees, knowing that these shares were input erroneously, placed sell orders, causing Samsung Securities' stock price to plunge sharply during the trading session.

Eventually, they were prosecuted for selling phantom stocks, and last year, the Supreme Court upheld the second trial's ruling sentencing them to prison for violations of the Capital Markets Act and other charges.

'Flash Crashes' Causing Hundreds of Trillions to Disappear in US and European Stock Markets

Fat finger incidents also occur overseas. In May 2010, an employee at a US investment bank mistakenly pressed 'b' (billion) instead of 'm' (million), triggering a chain reaction of massive algorithmic trades that caused the Dow Jones Industrial Average to plunge 9.2% within a short time during the trading session. This event gave rise to the term 'flash crash.'

The flash crash was reproduced in Europe last May. An employee at the UK investment bank 'City Bank' entered a wrong number, triggering a sell algorithm that wiped out 300 billion euros (approximately 436 trillion won) from the entire European stock market during the trading session.

Currently, various safety measures and relief systems have been established to prevent fat finger incidents. After the first flash crash, securities exchanges in the US and Europe established a 'kill switch' system that checks and blocks erroneous trades.

In Korea, the kill switch and 'large-scale erroneous trade relief system' were introduced in 2016. The kill switch is a safety device that blocks trading and prevents loss expansion upon a securities firm's request when erroneous orders or trading errors occur.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.