TSMC Leads Widened by 10.7%P Over 4 Years

Experts Say "No Need to Be World No.1 Within 7 Years"

"Smooth Completion of Yongin Plant and Urgent M&A Are Priorities"

It has been four years since Samsung Electronics announced its 'System Semiconductor Vision 2030,' aiming to become the global leader in system (non-memory) semiconductors, but the gap with the number one Taiwanese company TSMC has actually widened. Experts have urged Samsung to increase corporate value through mergers and acquisitions (M&A) of fabless (design) companies with advanced technology and to complete five semiconductor factories in Yongin, worth 300 trillion won, on schedule by 2042.

At the System Semiconductor Vision Declaration Ceremony on April 30, 2019, Lee Jae-yong, Vice Chairman of Samsung Electronics, announced the 'System Semiconductor Vision 2030.'

At the System Semiconductor Vision Declaration Ceremony on April 30, 2019, Lee Jae-yong, Vice Chairman of Samsung Electronics, announced the 'System Semiconductor Vision 2030.' The person seated second from the left is Seung Hyun-joon, President of Samsung Research Global Research and Development (R&D) Cooperation.

[Photo by Samsung Electronics]

On April 30, 2019, Samsung Electronics announced Vision 2030. The plan was to invest 133 trillion won by 2030 to advance the supply chain of semiconductor manufacturers, fabless companies, and material, parts, and equipment suppliers, as well as support talent development, with the goal of becoming the world's number one system semiconductor company. An additional 38 trillion won was invested in May 2021.

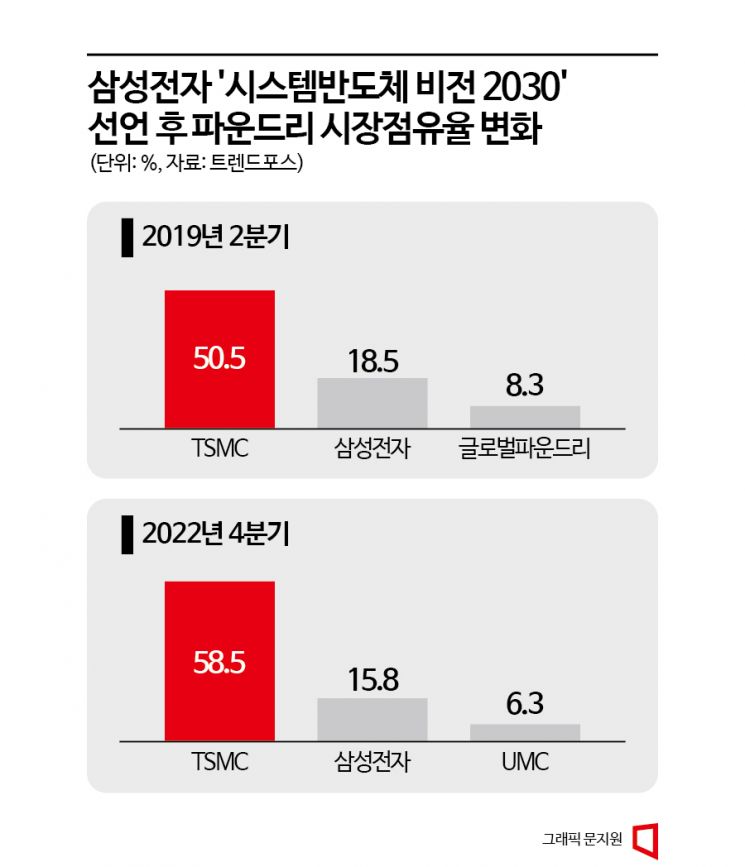

First, the results related to foundry (semiconductor contract manufacturing) market share were minimal. According to Taiwanese market research firm TrendForce, Samsung Electronics’ foundry market share in the second quarter of 2019 was 18.5%, ranking second in the world. At that time, it was 32 percentage points lower than the number one TSMC (50.5%) and 10.2 percentage points higher than the third-ranked U.S. company GlobalFoundries (8.3%).

Currently, the gap with the number one has widened further, and Samsung has allowed a chase from the third place. At the end of the fourth quarter last year, Samsung Electronics’ market share was 15.8%, trailing the number one TSMC (58.5%) by 42.7 percentage points, and leading the third-ranked Taiwanese UMC (6.3%) by 9.5 percentage points. Compared to four years ago, the gap with the number one widened by 10.7 percentage points, while the gap with the third place narrowed by 0.7 percentage points.

Samsung also struggled to secure premium customers. Big tech companies such as Apple, Nvidia, Qualcomm, AMD, and MediaTek place semiconductor contract manufacturing orders with TSMC. Regarding this, Samsung Electronics said at its first-quarter earnings conference call on the 27th, "Contrary to concerns, demand from major customers exceeds Samsung Electronics’ production capacity, and (rather) a supply shortage is expected to continue," adding, "We have long-term contracts with many major customers."

Kyung Kye-hyun, CEO of Samsung Electronics DS (Semiconductor) Division (from left), Lee Chang-yang, Minister of Trade, Industry and Energy, and Choi Si-young, Head of Samsung Electronics Foundry Business, are posing for a commemorative photo at the 'World's First GAA-based 3nm Mass Production Shipment Ceremony' held on the morning of July 25 last year at Samsung Electronics Hwaseong Campus in Hwaseong, Gyeonggi-do. Photo by Kim Hyun-min kimhyun81@

Kyung Kye-hyun, CEO of Samsung Electronics DS (Semiconductor) Division (from left), Lee Chang-yang, Minister of Trade, Industry and Energy, and Choi Si-young, Head of Samsung Electronics Foundry Business, are posing for a commemorative photo at the 'World's First GAA-based 3nm Mass Production Shipment Ceremony' held on the morning of July 25 last year at Samsung Electronics Hwaseong Campus in Hwaseong, Gyeonggi-do. Photo by Kim Hyun-min kimhyun81@

Samsung is evaluated to have succeeded in securing high technology. At the end of July last year, it began mass production of 3-nanometer (nm; one billionth of a meter) semiconductors five months earlier than TSMC. It is also reported that the yield of 4- and 5-nanometer processes was raised to a level similar to TSMC. Dongwon Kim, a researcher at KB Securities, said, "(Samsung Electronics’) 4- and 5-nanometer foundry yields have stabilized at 80-90%." Thanks to this, Samsung secured automotive semiconductor customers. In February, it signed a contract to produce 5-nanometer semiconductors for autonomous vehicles with Ambarella, a U.S. AI semiconductor specialist. Samsung also received orders from Mobileye, an Intel subsidiary considered one of the four major autonomous driving companies listed on Nasdaq, together with Ambarella.

In the '2-nanometer mass production competition' that will fully unfold after 2025, it will be important whether Samsung can achieve higher yields than TSMC and Intel. Samsung Electronics and TSMC plan to establish 2-nanometer mass production systems in 2025. Intel said it will mass-produce 1.8-nanometer semiconductors by the second half of next year. Samsung Electronics said at the conference call, "The 2-nanometer process is under development with the goal of mass production in 2025," adding, "Our goal is to lead the competition in 2025 (for 2-nanometer)."

A panoramic view of the candidate site for the national advanced industrial complex of the system semiconductor cluster, around Idong-eup and Namsa-eup, Cheoin-gu, Yongin Special City.

A panoramic view of the candidate site for the national advanced industrial complex of the system semiconductor cluster, around Idong-eup and Namsa-eup, Cheoin-gu, Yongin Special City. [Photo by Yongin Special City]

Experts say Samsung Electronics does not need to be overly obsessed with achieving the Vision 2030 goal of surpassing TSMC in seven years. It is more important to steadily address challenges such as business structure reorganization, execution of facility investments, and responses to trade risks. The challenges include reducing internal transactions dependence within the System LSI division, completing five semiconductor factories in Yongin worth 300 trillion won as planned by 2042, mitigating trade risks such as U.S. subsidies and Chinese equipment imports, and M&A transactions.

Yangpaeng Kim, a senior researcher at the Korea Institute for Industrial Economics & Trade, said, "There are voices in the industry that operating costs for U.S. factories are about 30% higher than domestic factories," adding, "It is most important to complete the Yongin factories without delay." He also said, "Acquiring high-level fabless companies could save Samsung Electronics development costs compared to pursuing technology development independently." Kyungjun Kim, former vice chairman of Deloitte Consulting, said, "M&A is the most effective management technique to shorten technology development time," adding, "Now is the time to calmly review why Samsung has not caught up with TSMC in the four years since the Vision 2030 announcement and to implement bold management strategies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.