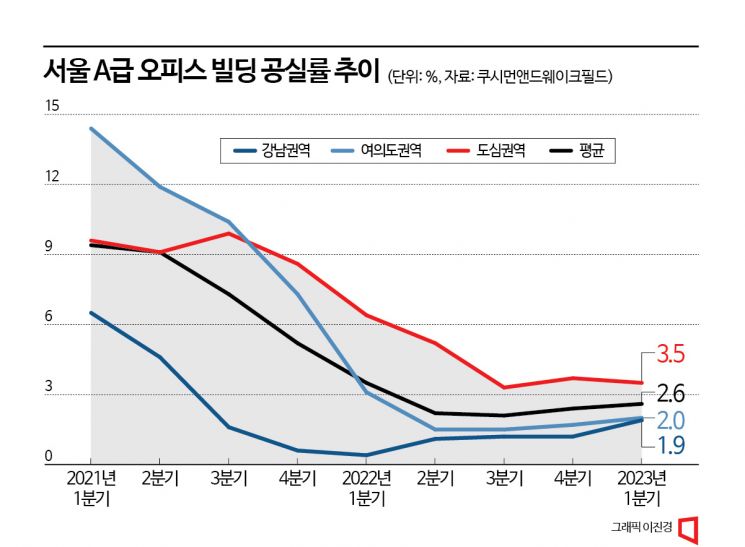

The vacancy rate of Seoul's Grade A office buildings, which had been declining last year, rose for the second consecutive quarter. This is attributed to the sharp increase in rental burdens due to steep interest rate hikes and the reduced leasing demand from the IT and startup sectors amid worsening economic outlooks.

According to the office market report published by Cushman & Wakefield (Cushman) on the 19th, the average vacancy rate of Seoul Grade A office buildings in the first quarter of this year was 2.6%, up 0.2 percentage points (p) from the previous quarter. This marks the second consecutive quarterly increase following the fourth quarter of last year and is the highest figure in a year since the first quarter of 2022 (3.5%).

The vacancy rate of Seoul Grade A office buildings had been steadily decreasing since the first quarter of 2021 (9.4%), two years ago. In the fourth quarter of the same year, it dropped by 4.2 p to 5.2%, and last year it continued to decline for three consecutive quarters from 3.5% to 3.0% to 2.2%, recording an unprecedentedly low vacancy rate.

Gangnam and Yeouido, which led the decline in vacancy rates... now driving the upward trend

The decline in vacancy rates was driven by the rising popularity of the Gangnam and Yeouido areas. The average vacancy rate of Grade A office buildings in the Gangnam area was somewhat high at 6.5% in the first quarter of 2021 but continued to decline, falling to 0.6% by the fourth quarter of the same year. It hit an all-time low of 0.4% in the first quarter of last year and then maintained just above 1%. Yeouido also had the highest vacancy rate among major Seoul areas at 14.4% in the first quarter of 2021 but dropped to 7.3% by the fourth quarter, about half the previous level. In the second and third quarters of last year, it also recorded an all-time low of 1.5%.

However, recently, the vacancy rate in the Gangnam area has been rising again. The average vacancy rate in Gangnam in the first quarter of this year surged by 0.7 p from the previous quarter to 1.9%, approaching the 2% mark. This is the highest figure in two years and nine months since the second quarter of 2021 (4.6%).

The increase in vacancies is interpreted as a result of the worsening economic outlook. According to a survey conducted by commercial real estate data specialist RSquare at the beginning of this year targeting 89 market experts and employees, 93.1% of experts who predicted an increase in vacancies due to a deteriorating office lease market cited "corporate performance deterioration due to economic slowdown" as the reason. They believe that companies lack the capacity to bear the rising office rents expected this year due to steep interest rate hikes.

By region, the 'Gangnam area (25.8%)' was identified as the most struggling office lease market. Given that many IT companies and startups are located there, it is expected that their performance deterioration will reduce leasing demand. Following Gangnam, 'Magok,' 'Central Business District (CBD),' 'Pangyo and Bundang,' and 'Yeouido area (YBD)' accounted for 23.6%, 16.9%, 14.6%, and 12.4%, respectively.

"Because it's too popular"... the paradox of the 탈(脫)Gangnam phenomenon

Companies choosing 탈(脫)Gangnam paradoxically reflects the continued high popularity of Gangnam offices. While Gangnam rents have risen sharply, vacancies have decreased, making it difficult to find office space of the desired size. According to Cushman statistics, the average office rent increase rate in Seoul last year was 7.3%, more than 4.5 times the 1.6% increase in the same period the previous year.

Recently, office demand from IT companies such as fintech firms has been concentrating in Yeouido. According to RSquare, fintech company RaonSecure recently leased two floors in Park One Tower 1 in Yeouido. Although it is unusual for a fintech company to move its headquarters from Teheran-ro to Yeouido, Yeouido is gaining popularity because it offers lower rental burdens than Gangnam, a wider selection of offices, and increased demand from financial institutions for the security industry.

In the past one to two years, fintech companies have been moving for similar reasons. In 2021, fintech company Lendit relocated to Post Tower in Yeouido, and 8 Percent and Honest Fund also moved their bases to Yeouido. Rainist, the developer of Bank Salad, has leased Park One Tower 1 in Yeouido, and IT security company Penta Security is located in the Sewoo Building in Yeouido.

Notably, Park One Tower 2 houses many large IT tenants with leased areas exceeding 1,000 pyeong (approximately 3,305㎡). Representative companies include KakaoBank, Kraft Technologies, and Nexus Community.

Meanwhile, there are also forecasts that the vacancy rate in the Gangnam area will stabilize in a short period. A Cushman official stated, "With the completion of the Tiger 318 Building (tentative name) near Gangnam Station, with a total floor area of 49,398㎡, it is expected that the vacancy rate will stabilize quickly as tenants requiring large spaces move in."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.