Secondary Battery ETFs Rise 60~78% This Year

Investment Heat Shifts to 'Lithium Theme' in Secondary Batteries

Market Experts Advise Caution in Chasing Soaring Stocks

As the value of companies related to secondary batteries continues to grow in the domestic stock market, the number of listed companies engaged in lithium-related businesses?one of the key minerals for secondary batteries?is gradually increasing. Not only large corporations such as POSCO Holdings and LG Chem but also companies like GN1 Energy and N2Tech have announced their entry into the lithium business, which is unrelated to their main operations. The Yeouido securities market expects the lithium business of POSCO Holdings and LG Chem to establish itself as a new growth engine. However, it pointed out that careful selection is necessary regarding the overheating phenomenon of lithium-themed stocks in the KOSDAQ market.

According to the Korea Exchange on the 6th, the TIGER Secondary Battery Theme Exchange-Traded Fund (ETF) rose 78.2% from the beginning of this year through the 4th. During the same period, the KODEX Secondary Battery Industry ETF increased by 60.2%. Although the rate of increase varied depending on the weight of the constituent stocks, both significantly outperformed the KOSPI's rise of 11.6% over the same period. Among the constituent stocks, Ecopro surged 400% compared to the end of last year, while Cosmo Advanced Materials and Ecopro BM also soared by 257.1% and 155.2%, respectively.

With the expansion of the electric vehicle market, expectations that demand for secondary batteries, a core component, would surge led to a sharp rise in related stock prices. As the stock prices of secondary material-related companies soared in a short period, the investment fever spread to raw material-related companies, including lithium?known as "white petroleum"?nickel, and cobalt.

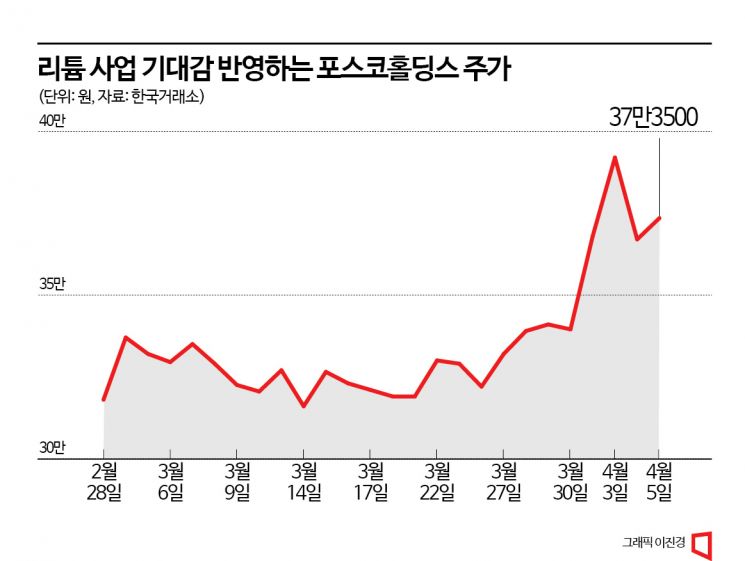

Lithium business is acting as a positive factor in evaluating the corporate value of POSCO Holdings. In the case of LG Chem, lithium mine investment is considered a factor that enhances business stability by diversifying the supply chain. The stock prices of POSCO Holdings and LG Chem have risen 35.1% and 22.0%, respectively, since the beginning of this year.

Major Corporations Enter Lithium Business as Demand Increases

POSCO Holdings secured a stable lithium raw material supply by acquiring stakes in lithium brine in Argentina and an ore lithium mine in Pilbara, Australia. It has established facilities capable of producing 93,000 tons in 2024 and plans to expand production capacity to 300,000 tons by 2030. Considering POSCO Group's cathode material production capacity and the corresponding lithium input, lithium self-sufficiency is expected to exceed 100% by 2030. Choi Moon-sun, a researcher at Korea Investment & Securities, explained, "POSCO HY Clean Metal, which produces recycled lithium, started production in the first quarter of this year," adding, "Production volume, future sales, and performance forecasts will be disclosed in the first-quarter earnings announcement." He further noted, "It is important to pay attention to the event of POSCO-produced lithium appearing in the world for the first time," adding, "This will be an opportunity to brighten the future of the lithium business, which extends from POSCO Pilbara Lithium Solutions to POSCO Argentina."

In February, LG Chem invested 95.9 billion KRW to acquire a 5.7% stake in the U.S. mining company Piedmont Lithium. Piedmont Lithium agreed to supply 200,000 tons of lithium concentrate to LG Chem over four years starting in the second half of this year. LG Chem is expected to reduce its dependence on lithium hydroxide supplied by Chinese companies. Jeon Yoo-jin, a researcher at Hi Investment & Securities, said, "LG Chem is developing a complete secondary battery material business DNA, including cathode materials, raw materials, separators, and carbon nanotubes," adding, "Considering its stable financial structure and scenarios utilizing part of LG Energy Solution's shares, further expansion of the value chain, including copper foil, is also possible."

POSCO Holdings and LG Chem, which are promoting secondary battery businesses through affiliates, are focusing on securing lithium because it is related to cathode materials, one of the four major secondary battery materials. Cathode materials are produced by combining lithium with metal components. The capacity, energy density, stability, lifespan, and price competitiveness depend on the ratio of nickel, which determines energy density; cobalt and manganese, which enhance stability; and aluminum, which improves output.

Small batteries used in smartphones contain about 30 grams of lithium, while medium to large batteries for electric vehicles contain approximately 30 to 60 kilograms of lithium. Lithium, a key raw material for cathode materials, is divided into lithium carbonate and lithium hydroxide. Lithium carbonate is the most basic lithium compound, and lithium hydroxide is produced through additional processing. Lithium hydroxide, which is easy to combine with nickel, has a high energy density and is mainly used in high-nickel secondary batteries for electric vehicles with a driving range of over 500 km. Lee Sang-heon, a researcher at Hi Investment & Securities, predicted, "Demand for lithium hydroxide will increase with the expansion of high-nickel secondary battery applications," adding, "By 2030, demand is expected to increase more than tenfold compared to 2020." He also forecasted, "Electric vehicle demand, which is about 10 million units in 2025, is expected to rise to 27 million units by 2030," and added, "After 2027, there is a possibility that lithium supply will not keep up with demand, leading to a recurrence of supply instability."

South Korea depends on China (64%) and Chile (31%) for 95% of its total lithium imports. The structure is such that lithium hydroxide is mainly imported from China, and lithium carbonate is imported from Chile. The dependence on China for lithium hydroxide, whose demand is rapidly increasing, reaches 84%. Due to the U.S. Inflation Reduction Act (IRA), domestic secondary battery companies must reduce their dependence on China and are hastening to diversify their lithium hydroxide supply chains.

Stock Price Surge Following News of New Lithium Business

The stock prices of KOSDAQ-listed companies newly entering the lithium-related business have been soaring day after day. EV Advanced Materials, GN1 Energy, and N2Tech are the three companies with the largest stock price increases in the domestic stock market this month. The announcement of their lithium business served as a catalyst for the stock price rise. EV Advanced Materials, a manufacturer of flexible printed circuit boards (FPCB), recently announced securing a lithium hydroxide supplier, recording consecutive daily price limits on the 3rd and 4th, with its stock price nearly doubling from 2,125 KRW to 4,080 KRW in just three days.

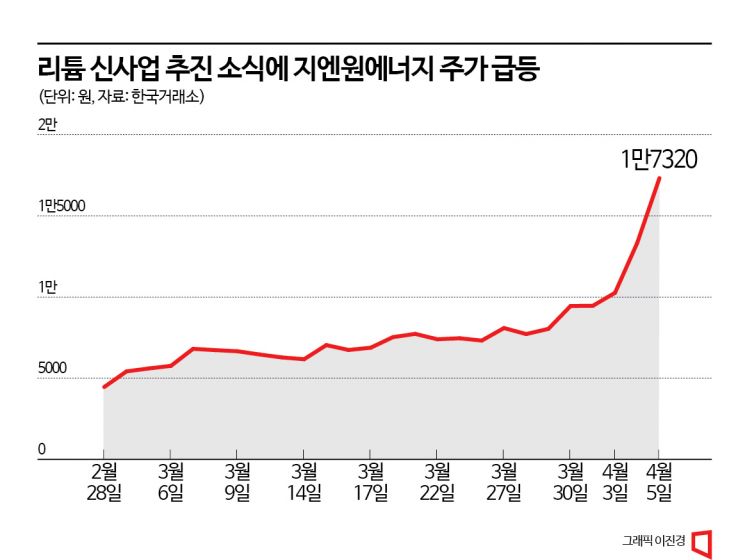

Geothermal heating and cooling system company GN1 Energy disclosed on the 3rd that it would invest 19.4 billion KRW in Israeli lithium company Extralith. From the 4th to the 5th, GN1 Energy's stock price continued its price limit surge. N2Tech, the largest shareholder holding 11.18% of GN1 Energy's shares, also saw its stock price hit the daily price limit for two consecutive days.

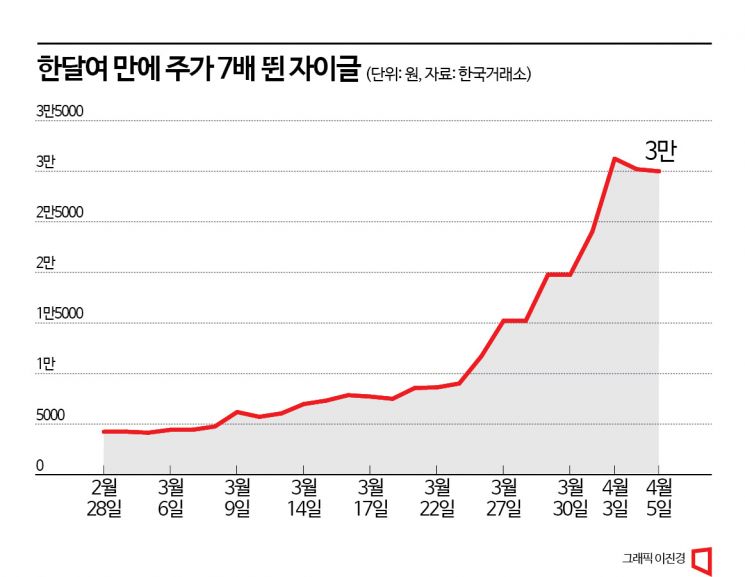

Kitchen appliance company Zaigle's stock price surged from 4,240 KRW on the 2nd of last month to 30,000 KRW by the 6th, in just over a month. Zaigle signed a contract at the end of last year to acquire the manufacturing plant and production facilities of CM Partner's battery business division. At that time, Zaigle explained that it acquired CM Partner's secondary battery business division, which has over ten years of research and manufacturing experience in the LFP (lithium iron phosphate) battery market, anticipating its full-scale growth. As a result of investing 7.4 billion KRW, the market capitalization jumped from 57 billion KRW to 400 billion KRW. On the 4th, Zaigle announced it would raise 30 billion KRW by issuing new shares to the XT ESS Fund. The payment date is May 15, and the new share issuance price is 17,040 KRW, about 40% lower than the current stock price.

As cases of stock price surges among companies announcing new lithium-related businesses increase, concerns are also growing. On the 5th, the Korea Exchange designated N2Tech, EV Advanced Materials, and GN1 Energy as investment warning stocks. When the stock price of a specific stock rises abnormally, it is designated as an investment warning stock to alert investors and prevent unfair trading in advance.

A financial investment industry official explained, "There are many cases where stock prices rise rapidly without verification of new lithium-related businesses," adding, "This seems to be a result of a learning effect as existing secondary battery-related stocks rise." However, he added, "As the stock market saying goes, 'the higher the mountain, the deeper the valley,' investment in stocks that have risen too quickly in a short period requires caution."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.