Naver is strengthening its competitiveness in the commerce business. It is expanding the D2C (direct-to-consumer) ecosystem by enabling sellers to build their own brand stores. Competition with e-commerce platforms such as Coupang and Musinsa is expected to intensify.

Helping Sellers Sell Products Without Going Through E-commerce Platforms

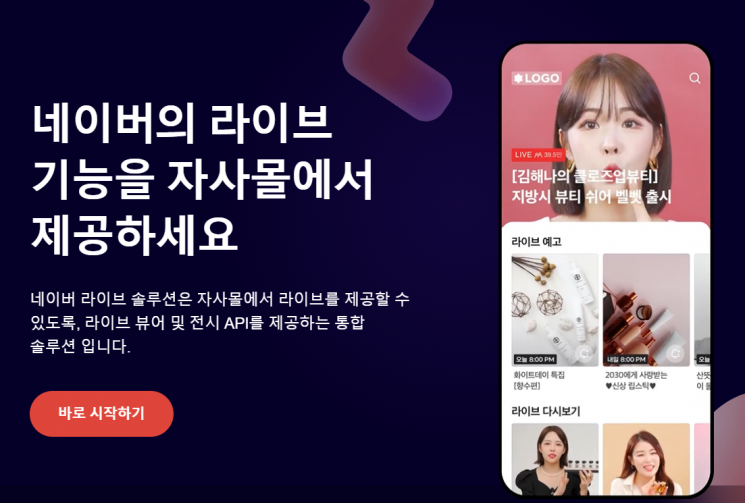

Naver recently announced that it will start a beta service of the ‘Shopping Live Solution’ which allows integration of Naver Shopping Live with brand stores. Previously, live streaming was only possible within the Naver platform. Going forward, live streaming on Naver Live can be simultaneously broadcasted on sellers’ own brand stores.

This solution provides APIs (application programming interfaces) for live streaming videos, viewer and like counts, preview pages, and broadcast lists. Features offered by Shopping Live, such as replay highlights, are fully supported. Sellers can also utilize notification functions to announce upcoming live streams in advance and access statistics to check marketing performance from live streams conducted on their brand stores.

Naver is expanding the D2C ecosystem. Recently, sellers have been leaving e-commerce platforms due to commission burdens and various restrictions. Instead, demand is growing for sellers to directly build their own brand stores and sell directly to consumers. Naver has capitalized on this trend by helping sellers build brand stores more cheaply and easily than building them independently, encouraging them to establish their brand stores within Naver’s ecosystem.

To strengthen delivery capabilities, Naver has partnered with logistics companies such as CJ Logistics to form a logistics alliance called NFA (Naver Fulfillment Alliance). Through this, it introduced the ‘Arrival Guarantee’ service, which promises fast delivery of purchased products within 1-2 days. Naver also provides sellers with data statistics accumulated during the logistics process to help them utilize it for marketing and other purposes.

Naver plans to launch a solution in April that will allow short-form videos to be easily uploaded on brand stores and linked to product sales, aiming to quickly lead the video commerce market following live commerce.

Direct Confrontation with Coupang and Musinsa

Naver’s expansion of the D2C ecosystem is a source of concern for existing e-commerce giants.

For example, CJ CheilJedang, which has been in conflict with Coupang over commissions since the end of last year, recently joined Naver. When Coupang stopped placing orders, CJ CheilJedang partnered with Naver, which launched the ‘Next Day Arrival’ service similar to Coupang’s ‘Rocket Delivery.’ LG Household & Health Care, which had a dispute with Coupang earlier than CJ CheilJedang, also operates its brand store on Naver.

The number of brands operating brand stores on Naver is rapidly increasing. The number of brand stores rose from about 1,300 in the fourth quarter of last year to 1,517 in April this year, just four months later. Among these, 441 are fashion-related brand stores, many of which are also listed on Musinsa.

Meanwhile, Naver’s commerce sector revenue is on the rise. It increased from 1.0897 trillion KRW in 2020 to 1.4885 trillion KRW in 2021. Last year, it grew to 1.8011 trillion KRW, and it is expected to surpass 2 trillion KRW this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.