Rising Treasury Bond Yields After Powell's Remarks

Possibility of Korean Interest Rate Hike... Tightening Nears End

Buying Timing When Bond Yields Rise

On the 7th (local time), Jerome Powell, Chairman of the U.S. Federal Reserve (Fed), hinted at the possibility of raising the benchmark interest rate, leading domestic bond yields to close higher for the second consecutive trading day. Experts analyzed that the market's perceived concerns about Fed tightening are somewhat excessive and viewed the rise in interest rates as an opportunity to increase bond allocations.

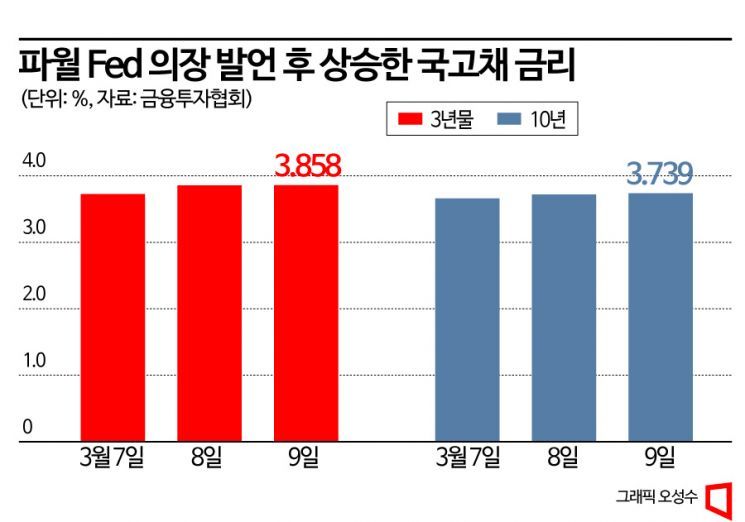

On the 9th, in the Seoul bond market, the 3-year Treasury bond yield closed at 3.858, up 3 basis points (bp, 1bp=0.01 percentage point) from the previous day. The 10-year bond yield ended at 3.739, rising 1.9 bp. The domestic bond market had shown a downward trend after both the 3-year and 10-year Treasury bonds hit their yearly highs on the 2nd. However, the trend reversed upward following Powell's series of hawkish remarks. At a U.S. Senate Banking Committee hearing, Powell stated, "The terminal rate is likely to be higher than previously expected," and added, "If the overall data show that faster tightening is justified, we are prepared to accelerate the pace of rate hikes."

Accordingly, the bond market is now placing more weight on the possibility of a 50 bp hike at the March Federal Open Market Committee (FOMC) meeting, instead of the previously expected 25 bp increase. After Powell's remarks, the U.S. 2-year Treasury yield surged intraday to 5.021% on the prospect of a larger-than-expected hike. This is the first time since 2007 that the 2-year yield has surpassed 5%. In contrast, the 10-year yield traded at 3.97%.

However, experts believe the likelihood of the U.S. terminal rate being raised to 6% is low. Jaegyun Lim, a researcher at KB Securities, said, "Given the solid economic indicators, rates will likely rise quickly above 5%, but once the benchmark rate reaches around 5.5%, the real policy rate (based on PCE) will turn positive," adding, "After the real policy rate turns positive, the Fed is expected to maintain a tightening environment by holding rates steady for an extended period."

In line with this trend, there is a possibility of interest rate hikes by the Bank of Korea, but the prevailing view is that the rate hike cycle is nearing its end. Seungwon Kang, a team leader at NH Investment & Securities, explained, "In July 2000, when the U.S.-Korea interest rate differential widened to 150 bp, Korea's credit rating was 'BBB,' but now it is 'AA-,' and the foreign investors holding won-denominated bonds are no longer asset managers," adding, "More than 60% have already shifted to foreign central banks and sovereign wealth funds." He analyzed that even if the U.S.-Korea interest rate differential expands to 200 bp, the possibility of systemic risk is limited.

Researcher Seungwon Kang argued that rising interest rates present a buying opportunity, based on the judgment that both the domestic economy and inflation have already entered a slowdown phase. He said, "The Fed's faster tightening pace in the short term will further stimulate the slowdown in Korea's economy and inflation," and added, "The inversion between 3-year and 10-year yields in Korea is expected to widen, so the rise in long-term rates can be seen as a buying opportunity."

Jiman Kim, a researcher at Samsung Securities, also raised the upper bound of the 3-year and 10-year Treasury yields by 10 bp from previous forecasts and viewed the rise in yields as a buying timing. Kim said, "Within three months, I expect the 3-year Treasury yield to be between 3.50% and 3.90%, and the 10-year yield between 3.50% and 3.85%," adding, "Although the outlook for the benchmark rate has increased, we must consider that we are now in the late phase of the rate hike cycle with only fine-tuning remaining." He further noted, "At the upper bound of the range, it is necessary to consider bond purchases as an opportunity in anticipation of a future rate cut."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.