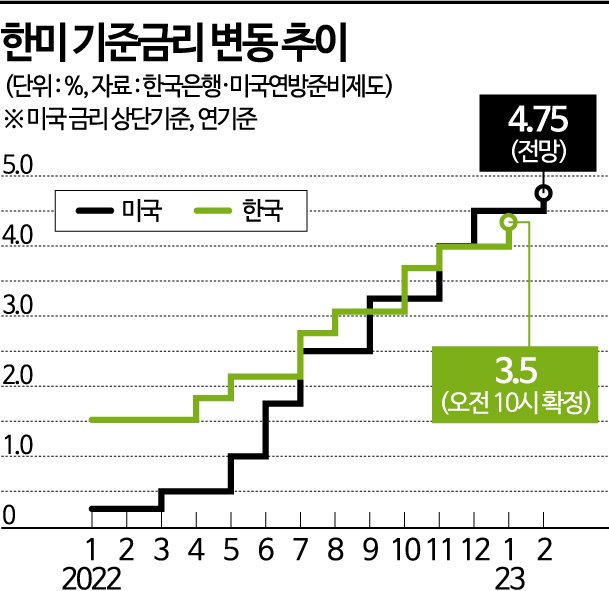

[Asia Economy Reporters Seo So-jeong and Moon Je-won] On the 13th, the Bank of Korea raised the base interest rate by 0.25 percentage points at the Monetary Policy Committee meeting, shifting market attention quickly to the final interest rate and the timing of rate cuts. As the rate hike trend enters its final stage, the key issue is whether the Bank will stop raising rates at 3.5% this month or proceed with one more hike to conclude the cycle at 3.75%.

At the meeting, the Bank of Korea’s Monetary Policy Committee decided to raise the base rate from 3.25% to 3.50% per annum. Last year, the base rate was raised by 0.25 percentage points in January, April, and May; by 0.50 percentage points in July; 0.25 percentage points in August; 0.50 percentage points in October; 0.25 percentage points in November; and with this month’s additional hike, it has returned to 3.5% for the first time in 14 years and 1 month since December 2008.

The Bank of Korea’s decision to raise rates for the seventh consecutive time for the first time ever at this year’s first Monetary Policy Committee meeting reflects persistent inflation expectations (price pressures). With consumer price inflation remaining in the 5% range and expectations that the U.S. Federal Reserve’s (Fed) tightening will continue, the Bank has raised rates further to narrow the interest rate gap with the U.S.

Shift from Inflation to Economic Slowdown and Financial Stability

Market attention is now focused on the final interest rate and the timing of rate cuts. Although high inflation in the 5% range remains a concern, recent stabilization of the won-dollar exchange rate and international oil prices, along with a slight decline in inflation expectations for the next year, have raised the possibility of shifting monetary policy’s focus toward economic slowdown and the real estate market.

Experts are divided between 3.5% and 3.75% as the final interest rate. While high inflation persisted until early this year, prompting the Bank of Korea to raise rates this month, some believe that from next month onward, it will be necessary to assess the effects of previous hikes and simultaneously monitor inflation stability and the domestic economic slowdown. Yoon Yeo-sam, a researcher at Meritz Securities, said, "I believe the January hike will be the last unless there is an unexpected upward shock to inflation," adding, "To manage market expectations, the possibility of additional hikes may remain open, so monetary policy uncertainty will persist until the second quarter."

Ahn Jae-kyun, an economist at Shinhan Investment Corp., said, "Considering the ongoing trend of additional public utility fee hikes, the contribution of administered prices to this year’s consumer price index (CPI) inflation is expected to remain high," adding, "This means future inflation will be largely cost-driven, and cost-push inflation reduces consumers’ spending power, which could weaken growth, making 3.5% likely to be the final rate."

On the other hand, there are many opinions that an additional hike next month is necessary considering the interest rate gap between Korea and the U.S. The gap between Korea and the U.S. base rates, which widened to 1.25 percentage points after the Fed’s big step (0.50 percentage point hike) in December last year, narrowed somewhat to 1 percentage point with this month’s hike, but the Fed’s continued tightening is pressuring the Bank of Korea to raise rates further.

Woo Hye-young, a researcher at Ebest Investment & Securities, said, "The Fed’s strong commitment to raising rates to achieve inflation stability is likely to continue through the first quarter," and judged, "If the Fed realizes the final rate level of 5.25% indicated in the December dot plot, the Bank of Korea will need to raise rates to 3.75%." From the perspective of the won, which is not a key currency (the basic currency for international settlement and financial transactions) like the dollar, if the base rate falls significantly below the U.S. rate, there is a greater risk of foreign capital outflows and depreciation of the won.

Rate Cut Timing: Q4 This Year vs. Next Year... Election Variables

Opinions differ on the timing of rate cuts, with some expecting it as early as the fourth quarter of this year and others seeing it pushed to next year. Professor Heo Jin-wook of Incheon National University’s Department of Economics said, "Since inflation is slowing gradually and the economy, especially manufacturing, is weak, discussions on rate cuts could begin as early as the second half of this year," adding, "The U.S. inflation rate and the timing of its monetary policy shift are important variables."

Professor Heo Jun-young of Sogang University’s Department of Economics said, "I think rate cuts could start at the last or second-to-last Monetary Policy Committee meeting this year," adding, "Although the Fed has said it will not start cutting rates this year, Korea’s economy is clearly weakening, and issues like household loans and funding markets persist, so the possibility of earlier rate cuts than the U.S. cannot be ruled out." Joo Won, head of economic research at Hyundai Research Institute, said, "As the real economy recession intensifies in the second half of this year in both the U.S. and Korea, discussions on rate cuts will begin," and forecasted, "With the U.S. presidential election and Korea’s general election next year, pressure for rate cuts could intensify."

Conversely, Heo Jeong-in, a researcher at Daol Investment & Securities, said, "Due to continued tightening not only in the U.S. but also in Europe and Japan, the Bank of Korea is unlikely to make a premature pivot (direction change)," adding, "If a pivot leads to renewed inflation instability or worsens domestic financial imbalances, the environment may require raising the base rate, making rate cuts this year difficult." Jo Young-moo, a research fellow at LG Economic Research Institute, also predicted, "For Korea, it would be burdensome to cut rates before the U.S.," and "If high inflation persists, the Bank of Korea may not start cutting rates this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.