[Asia Economy New York=Special Correspondent Joselgina] The inflation indicator preferred by the U.S. Federal Reserve (Fed) has shown a slight slowdown in its upward trend, but there is still a long way to go.

This is because the level far exceeds the Fed's 2% target, and variables such as China's COVID-19 lockdowns that could raise inflation at any time are scattered around. There is a flood of opinions that a high inflation trend is inevitable for the time being.

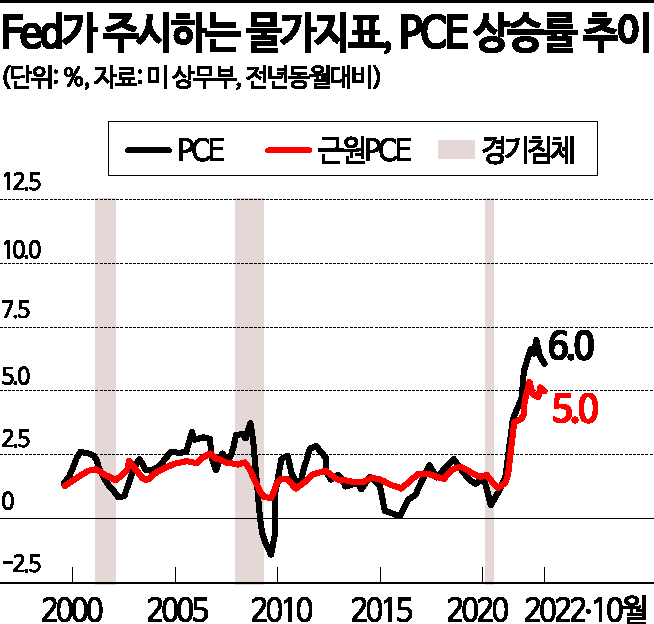

The U.S. Department of Commerce released the October U.S. Personal Consumption Expenditures (PCE) price index on the 1st (local time), showing a 6.0% increase compared to the same month last year. This is a slight slowdown from the 6.2% increase in September, bolstering market expectations of a price peak-out.

The core PCE, which excludes volatile food and energy prices, also rose by 5.0% year-over-year and 0.2% month-over-month. These figures are 0.2 percentage points and 0.3 percentage points lower than the September growth rates, respectively. The core PCE is an indicator that Fed Chair Jerome Powell has stated is effective for judging inflation trends.

Notably, the PCE data was released shortly after the U.S. Consumer Price Index (CPI) for October showed a slowdown to the 7% range, drawing attention. This provided another signal that U.S. inflation, which had been soaring as expected by the market, has peaked and is now declining.

However, concerns about entrenched high inflation remain high. Even though a downward trend has begun, the level is still high compared to the 2% target, and the slowdown is minimal. There have been past cases where CPI and PCE growth rates slowed down and then accelerated again. This is the background behind Fed Chair Powell’s statement the day before, when he said, "(Just because the indicator) fell once does not mean a permanent decline."

Experts particularly point to the recent rise in energy prices, which had been declining for the past three months, as a cause for concern. The Russian crude oil embargo and China’s economic recovery are factors that could spur commodity price increases at any time.

Additionally, high wage growth is also putting upward pressure on prices within the U.S. According to the ADP National Employment Report, wages in the private sector rose 7.6% year-over-year in November.

S&P Global, in its 2023 economic outlook report, analyzed that U.S. inflation peaked in the third quarter of this year but predicted that the high inflation trend would continue next year due to global supply chain disruptions.

James Gorman, CEO of Morgan Stanley, also attended a conference held recently in New York and said, "Inflation can be mitigated through central bank interest rate hikes and demand management," but added, "Due to various complex issues such as supply chains, it may be difficult for inflation to return to the 2% range as high inflation becomes entrenched." He argued that the 4% range would be a critical threshold due to supply-side limitations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.