As nationwide apartment prices experience their largest decline in a decade, newly built apartments are falling at a faster rate compared to older buildings. Given the significant price increases of new apartments in recent years, the subsequent decline is also appearing more severe.

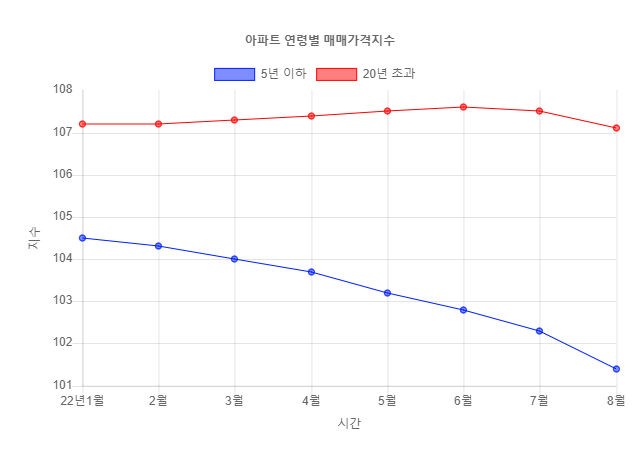

According to the Korea Real Estate Board's age-specific sales price index statistics on the 28th, the sales price index for newly built apartments aged '5 years or less' nationwide recorded 101.4 in August this year, down 0.91 points from the previous month. Since a decline of -0.12 points at the beginning of the year, the drop has widened over time with -0.31 points in March and -0.42 points in June.

In contrast, the sales price index for older apartments aged 'over 20 years' recorded 107.1 in August, down 0.35 points from the previous month. During the first half of the year, it even showed an upward trend with +0.17 points in January, +0.03 points in March, and +0.04 points in June.

This trend is consistent in Seoul, the metropolitan area, and other provinces.

In the metropolitan area, newly built apartments aged 5 years or less saw the largest drop in August, falling 1.11 points, while older apartments over 20 years declined by only 0.51 points. Similarly, in the provinces, the decline gap between new apartments (-0.75 points) and older apartments (-0.22 points) is significant.

Looking at individual complexes, the difference is even more pronounced. An 84㎡ unit in Apartment Complex A in Sangil-dong, Gangdong-gu, Seoul, which was completed in February 2020, was traded for 1.48 billion KRW in August. Compared to the peak price of 1.98 billion KRW recorded in April, this represents a drop of 500 million KRW (-25.3%).

Meanwhile, an 84㎡ unit in Apartment Complex B, an older building completed in 1986 nearby, was traded for 1.518 billion KRW in March this year. Compared to the peak price of 1.55 billion KRW recorded in March last year, this is a decline of only 32 million KRW (-2.1%).

The larger decline in new apartments is largely attributed to their rapid price increases. An industry insider said, "Due to supply shortages, new apartments have risen more sharply because of their scarcity premium," adding, "During downturns, the price drops are more significant and dramatic."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.