Atlanta Fed GDP Estimate -1.2%

5 of 8 Recession Indicators Remain Strong

Supply-Side Inflation Pressures More Important Than Q2 GDP

[Asia Economy Reporter Hwang Yoon-joo] There is a forecast that the United States' Gross Domestic Product (GDP) will record a negative growth in the second quarter. If the GDP records negative growth for the second consecutive quarter following the first quarter, it would be considered a technical recession; however, the Federal Reserve's (Fed) tightening stance is expected to continue. This is because the key variable for changes in the current policy stance is supply-side price pressure.

According to Samsung Securities on the 16th, the Atlanta Fed's GDP estimate (GDPNow) is expected to be -1.2% for the second quarter, significantly raising concerns about a U.S. economic recession due to two consecutive quarters of negative growth.

The National Bureau of Economic Research (NBER), which officially determines U.S. recessions, defines an official recession as "a significant decline in economic activity that is spread across the economy and that lasts more than a few months."

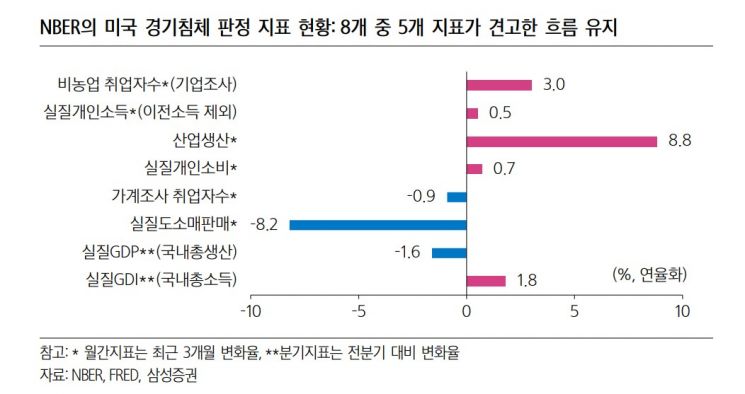

The economic indicators used by the NBER's Business Cycle Dating Committee to determine recessions include six monthly indicators and two quarterly indicators. Currently, three of the eight indicators (real retail sales, household survey employment, and real GDP) have recorded negative sequential growth over the past three months. However, the remaining five indicators still maintain positive growth rates.

Heo Jin-wook, a researcher at Samsung Securities, evaluated, "Among the reference indicators, the two with the largest known weights (nonfarm payroll employment and real personal income) are both maintaining solid growth."

Researcher Heo pointed out, "Generally, two consecutive quarters of negative real GDP growth are commonly used as the definition of a 'technical recession,' but the NBER applies equal weights to GDP and GDI when determining the business cycle."

In the first quarter of this year, real GDP decreased by 1.6% quarter-on-quarter. However, real GDI increased by 1.8% due to improved terms of trade from the strong dollar.

Researcher Heo forecasted, "Even if the U.S. records negative real GDP growth in the second quarter, it is unlikely that the NBER will officially determine that the U.S. has entered a recession."

Therefore, the Fed's monetary policy stance still places emphasis on inflation. Researcher Heo expects a 75 basis point increase in July and emphasized that the key variable for a change in policy stance is the stabilization of expected inflation due to easing supply-side price pressures.

He analyzed, "Since early June, concerns about a U.S. and global recession have rapidly spread, causing most commodity prices to plummet about 20-30% from their peaks (agricultural products -25%, metals -30%, international oil prices -20%). If commodity prices remain at current levels until the end of July, the U.S. headline Consumer Price Index (CPI) for July, scheduled to be announced on August 10, is expected to be flat month-on-month and slow to 8.5% year-on-year."

He also pointed out, "Considering the lag effect of monetary policy (about 2-3 months), the 50 basis point increase in May and the 75 basis point increase in June did not show an effect in reducing demand-side price pressures in the June CPI."

Researcher Heo diagnosed, "If the Fed expands the rate hike based on the June CPI results, which do not yet reflect the decline in supply-side price pressures after a significant drop in commodity prices over the past month, it could make the mistake of 'driving while looking in the rear-view mirror.'"

He explained that the fact that both Governor Waller and President Bullard, who have voting rights this year, still support a 75 basis point hike in July can be understood in this context.

Researcher Heo stated, "The June retail sales and July University of Michigan expected inflation results, to be announced on the 15th, are variables. I maintain the existing forecast that rate hikes will proceed with 75 basis points in July, 50 basis points in September, and 25 basis points each in November and December, concluding at 3.5% (upper bound) by the end of this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.