Report by Hankyungyeon on the 13th... Money Supply 1.8 Times GDP

"Rate Hikes Alone Are Insufficient... Fundamental Measures Needed to Control Money Supply"

The appearance of a traditional market in Seoul on the 28th of last month. Photo by Hyunmin Kim kimhyun81@

The appearance of a traditional market in Seoul on the 28th of last month. Photo by Hyunmin Kim kimhyun81@

[Asia Economy Reporter Moon Chaeseok] An analysis has emerged suggesting that it may be difficult to control inflation solely through interest rate hikes amid the rapid increase in the money supply caused by COVID-19. Experts advise that fundamental measures to curb the surge in the money supply are necessary to rein in soaring prices.

On the 13th, the Korea Economic Research Institute under the Federation of Korean Industries argued that the sharp rise in international raw material prices due to supply chain disruptions, along with an excessively increased money supply, are the main causes of the rapid inflation. This is attributed to the flood of money into the market caused by COVID-19.

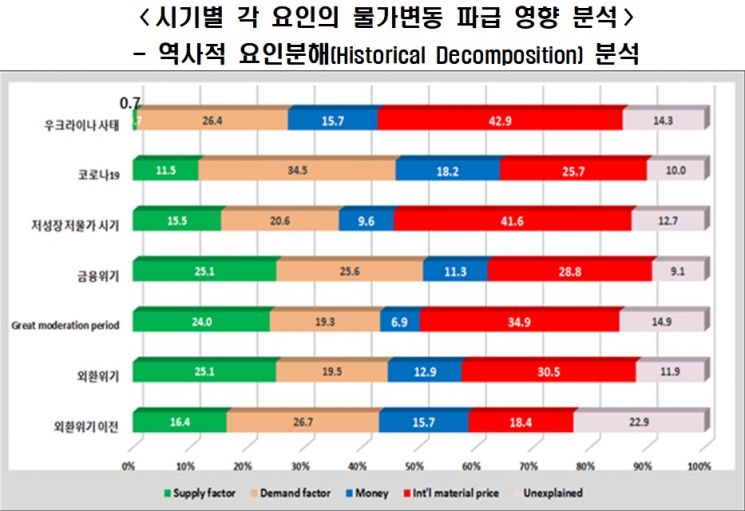

According to the report titled 'Analysis of Recent Inflation Causes and Implications' published by the Korea Economic Research Institute on the same day, the influence of the money supply on price fluctuations has significantly expanded from about 10% before COVID-19 to 15-18% afterward. Broad money (M2), which includes narrow money (M1) ? cash and demand deposits readily convertible to cash ? plus assets such as deposits and certificates of deposit (CDs) with maturities under two years, surged from 2,914 trillion won at the end of 2019 to 3,676 trillion won as of the end of April. This amount is approximately 1.8 times the gross domestic product (GDP) of 2,072 trillion won as of the end of last year.

The impact of international raw material prices on inflation also increased from the mid-30% range to 42.9% following Russia's invasion of Ukraine. In contrast, the influence of 'supply and demand' factors, which had exceeded 40%, has been declining since the second half of last year. Lee Seungseok, a senior researcher at the Korea Economic Research Institute, explained, "Before the outbreak of COVID-19, China served as the world's factory, maintaining a low inflation trend for nearly a decade. However, with the reorganization of global supply chains triggered by COVID-19 and the significant increase in the money supply, structural changes appear to have occurred in the transmission channels of inflation determinants."

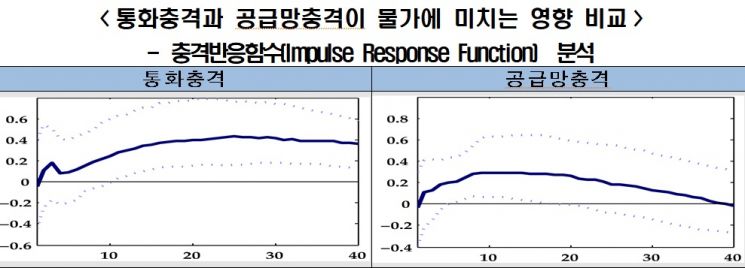

Notably, the effect of the money supply on inflation progresses gradually but tends to persist over a long period. Cost-push factors like international raw material prices push prices up in the short term, but their effects are short-lived. In other words, inflation caused by an excess money supply is difficult to control in the short term. Lee added, "Our research shows that the effects of monetary shocks last significantly longer than those of cost-push factors caused by supply chain disruptions. This means that even if current supply chain issues are resolved, high inflation may persist for a considerable time."

Ultimately, the Korea Economic Research Institute points out that raising the base interest rate alone is insufficient to control inflation, and fundamental inflation measures through money supply management are urgently needed. The current inflation surge is a 'complex equation' influenced by both monetary policy and external factors, and cannot be solved by temporary measures such as interest rate hikes or temporary tax reductions. Lee emphasized, "Interest rate hikes and the currently implemented temporary tax reductions and exemptions cannot serve as fundamental solutions for price stabilization. It is necessary to shift from a short-term interest rate adjustment approach centered on the base rate to an efficient and comprehensive money supply management strategy for monetary policy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.