[Asia Economy Reporter Lee Seon-ae] "Considering valuation and momentum, the investment environment in the Korean stock market can no longer be said to be unfavorable."

An investment strategy has emerged emphasizing the need to pay attention to the fact that the valuation of the Korean stock market is positioned in a meaningful range.

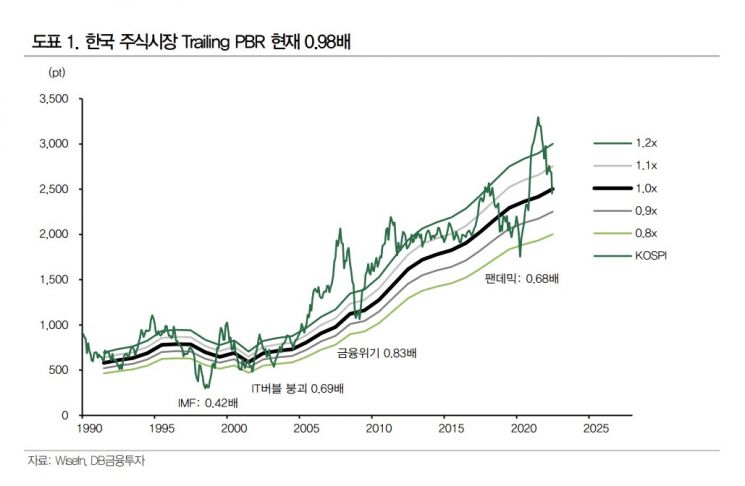

According to DB Financial Investment on the 20th, the current Trailing Price-to-Book Ratio (Trailing PBR) of the Korean stock market is 0.98 times. It is approaching 0.83 times, which was seen during the financial crisis. While there are mentions of the possibility of an economic recession, there is an interpretation that the stock price already reflects more than just the recession. Of course, there have been cases in major crisis situations where the Trailing PBR of the Korean stock market did not hold at 1 times. During major downturns in the Korean stock market, the Trailing PBR recorded 0.42 times during the 1998 IMF crisis, 0.69 times during the 2001 IT bubble burst, 0.83 times during the financial crisis, and 0.68 times during the pandemic. However, experts emphasize that even when the Trailing PBR falls below 1 times, it is important to note that recovery has always followed soon after.

Researcher Kang Hyun-ki of DB Financial Investment stated, "Considering that corporate book values have been enhanced due to recent inflation (and that this has not yet been immediately reflected in the current BPS), the actual PBR of the Korean stock market is likely lower than the currently recorded figure," adding, "When the valuation level is objectively assessed as one that could be considered the bottom range of the Korean stock market, the presence of momentum cannot be overlooked."

First, considering that the liquidity growth rate has been declining since early last year, there is a possibility that inflation issues will ease after mid-year. The decline in liquidity growth rate tends to reduce inflation rates after an average of 1 year and 8 months. There is also room for changes in supply and demand through the foreign exchange market. With the ECB’s announcement of interest rate hikes, the euro may strengthen, which could curb the unilateral strength of the dollar and cause a decline in the KRW/USD exchange rate. This would facilitate the inflow of foreign investors’ funds into the domestic stock market. The previously delayed Chinese infrastructure stimulus measures are also likely to be implemented intensively in the second half of the year. Due to China’s COVID-19 lockdowns, the initially planned infrastructure stimulus was postponed. Considering their current high unemployment rate and lowered economic growth rate, it seems unlikely that policy implementation will be delayed any further.

Researcher Kang advised, "There is a saying that if everything was difficult until just before, the next phase becomes easier, which is the logic of the stock market," adding, "Considering valuation and momentum, the investment environment in the Korean stock market from now on cannot be said to be bad, and although short-term volatility remains, the possibility of a market turnaround should be considered."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.