[Asia Economy Reporter Lee Jung-yoon] Bithumb Economic Research Institute, under the cryptocurrency exchange Bithumb, released an analysis on the 8th predicting that Bitcoin prices could rise up to $300,000 after the Bitcoin halving period from 2024 to 2028.

Established last month, the Bithumb Economic Research Institute published its first report titled "Checking Macro Variables That Cryptocurrency Investors Should Know" on the same day.

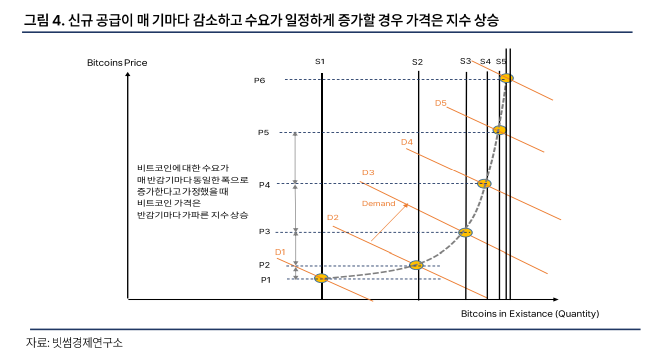

The report focused on the halving, one of the key variables determining Bitcoin's price. Bitcoin undergoes a halving every four years, where the block mining reward is cut in half. According to the report, the upper limit of the market capitalization during the previous halving formed the lower limit of the market capitalization for the next halving, causing Bitcoin prices to rise in a stepwise manner. Currently, about 900 Bitcoins are issued daily, but this is expected to decrease to around 450 after the 2024 halving. Considering this trend, Bitcoin prices are expected to rise around 2023, ahead of the halving. The report predicts that the expected market capitalization range for Bitcoin from 2024 to 2028 will be between $1 trillion and $6.2 trillion, with the price per Bitcoin ranging from $48,000 (approximately 60.28 million KRW) to $300,000 (approximately 376.77 million KRW).

Im Seon, Head of the Research Center at Bithumb Economic Research Institute, stated in the report, "Considering the past pattern where Bitcoin prices rose stepwise starting one year before the halving, the current price could be a good buying opportunity for mid- to long-term investors."

Additionally, the Bithumb Economic Research Institute diagnosed that the market is experiencing a "crypto winter" following the Luna Classic and TerraUSD (UST) crash incidents. It also analyzed that Bitcoin prices have plummeted more than 50% compared to November last year, and investment sentiment toward altcoins has significantly weakened, while regulations on cryptocurrencies by various countries are intensifying.

However, the institute explained that since mid-last month, the U.S. stock market has successfully rebounded, and Bitcoin prices have recovered to the $30,000 range since the end of last month, raising the bottom price. Although the 10-year U.S. Treasury yield recently rose back to the 3.0% range, global stock markets and Bitcoin prices have managed to absorb the higher interest rates and successfully rebounded.

The report forecasts that the terminal federal funds rate in this U.S. rate hike cycle will reach 2.75?3.00%, noting that the 2-year U.S. Treasury yield rose to 2.80% earlier last month, reflecting much of the market interest rates already pricing in the Federal Reserve's future rate hike path.

Furthermore, it analyzed that with the U.S. economic growth rate expected to slow from the 3% range this year to the low 2% range next year, the need for the Fed to take a hawkish stance has decreased compared to the past.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.