[Asia Economy Reporter Lee Seon-ae] The monthly trading volume of inflation-linked bonds in the government bond secondary market surpassed 1.4 trillion KRW, marking the highest level in about five years. As the consumer price inflation rate entered the 5% range and the high inflation trend continued, money movement toward inflation-linked government bonds (inflation bonds), whose yields are linked to inflation, has become active. With consumer prices rising sharply, these bonds are gaining attention as an 'inflation hedge' investment option.

According to the Korea Exchange on the 3rd, the trading value of inflation bonds in May was recorded at 1.4002 trillion KRW. This is the highest level in about five years since March 2017 (1.479 trillion KRW). Funds continued to flow in June as well. From May to the day before, the trading value of inflation bonds was recorded at 1.4218 trillion KRW.

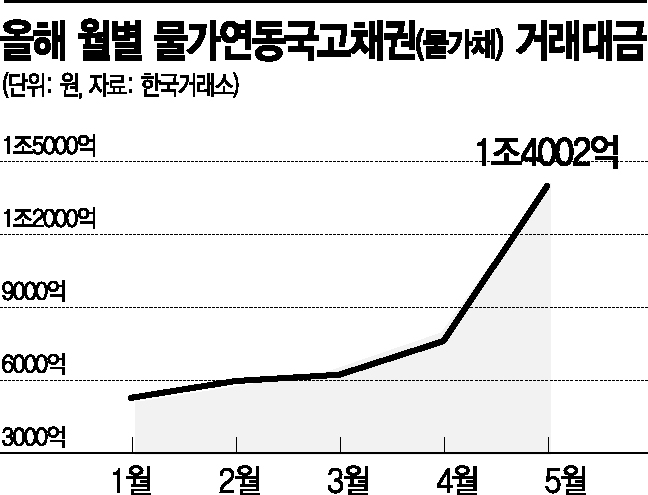

The monthly trading volume of inflation bonds exceeding 1 trillion KRW is the first time since March 2019 (1.082 trillion KRW). Since the beginning of this year, as inflation became a hot topic, funds have steadily flowed into inflation bonds. The trading values were 528 billion KRW in January, 597 billion KRW in February, 623 billion KRW in March, and 761 billion KRW in April, showing an increasing trend before surpassing 1 trillion KRW in May. The total trading value up to May this year was 3.923 trillion KRW, about 750 billion KRW more than 3.172 trillion KRW during the same period last year.

The reason funds are flowing into inflation bonds is that their yields are linked to inflation, making them attractive as an inflation hedge investment. Inflation bonds are structured so that when inflation rises, yields increase, and when inflation falls, yields decrease. They pay interest based on the principal adjusted for the inflation rate. Because capital gains occur when inflation rises, they are also used as a hedge against bond investment when bond yields rise (bond prices fall).

As inflation rises sharply, the BEI (Break-Even Inflation), an evaluation indicator for inflation bonds, has also maintained a high level compared to the beginning of the year, keeping the relative attractiveness of inflation bonds high. BEI is an indicator that reflects the market's expected inflation rate by subtracting the 10-year inflation-linked bond yield from the 10-year government bond yield. While BEI was around 140-150 basis points at the beginning of the year, it has maintained a high average level of about 190 basis points. With the increased attractiveness of inflation bond investments and the expectation that the inflation rate will remain in the 5% range next month, the trading value of inflation bonds is expected to remain above 1 trillion KRW in the second half of the year. Kim Ji-man, a researcher at Samsung Securities, predicted, "In the second half of the year, BEI is likely to rise further, and inflation bonds are expected to continue outperforming nominal bonds."

As the attractiveness of inflation bond investments increases, securities firms are also moving to launch related products. Kiwoom Asset Management newly listed the 'KOSEF Inflation Bond KIS' exchange-traded fund (ETF) on the 31st of last month, which primarily invests in inflation-linked government bonds. 'KOSEF Inflation Bond KIS' is the first domestic ETF to invest solely in inflation-linked government bonds. A representative from Kiwoom Asset Management explained, "This ETF will be an effective long-term inflation hedge product for individual investors who find direct bond trading difficult," adding, "As the first ETF investing in domestic inflation-linked bonds, it is expected to contribute to expanding the lineup of bond-type products."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.