In line with U.S. President Joe Biden's visit to South Korea, the domestic battery industry is planning massive investments, with the three major Korean battery companies already planning to invest over 17 trillion won in North America alone by 2025.

According to the three major domestic finished battery manufacturers?LG Energy Solution, SK On (a battery subsidiary of SK Innovation), and Samsung SDI?plans are underway to invest approximately 17.5 trillion won by 2025 to establish seven joint venture factories and four wholly owned factories in North America, including the United States and Canada. As alliances between automakers and battery companies are actively forming, there is a possibility of new investment plans being announced in conjunction with Biden's visit.

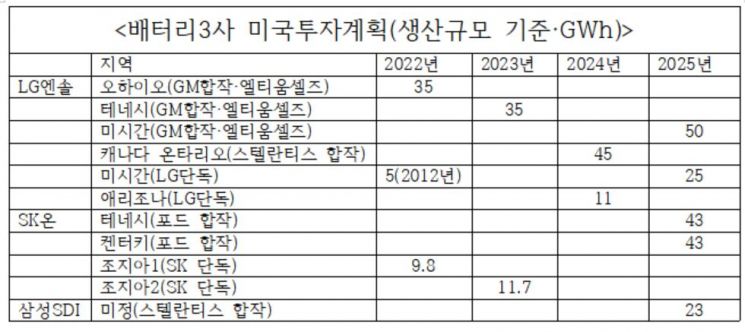

LG Energy Solution leads with the largest investment of 9.9 trillion won, followed by SK On with an estimated 6.45 trillion won, and Samsung SDI with an estimated 1.15 trillion won. Except for LG Energy Solution, the companies have not publicly disclosed their investment amounts, but the figures were estimated based on the production capacity expected to be established by 2025. The industry estimates that investments exceeding 100 billion won per annual gigawatt-hour (GWh) of production capacity are necessary. Joint investments through joint ventures are expected to be split 50-50. The production capacities are ranked as LG Energy Solution with 201 GWh, SK On with 107.5 GWh, and Samsung SDI with 23 GWh.

According to the U.S. Department of Energy (DOE), out of 13 large-scale battery production facilities scheduled for construction in the U.S. by 2025, 11 belong to the three Korean battery companies. If investments proceed as planned, the share of domestic companies' facilities within the total U.S. battery production capacity will expand from the current 10% level to about 70%. Currently, Panasonic, which collaborates with Tesla, holds an overwhelming 83% share in the U.S.

The reason 2025 is considered the inaugural year for the North American battery market's full-scale growth is the United States-Mexico-Canada Agreement (USMCA), a trade agreement announced in 2020. USMCA replaces the North American Free Trade Agreement (NAFTA) signed in 1994. The most significant feature of USMCA is the increase of the 'Regional Value Content (RVC)'?which qualifies for tariff exemptions?from the previous 62.5% to up to 75%, thereby strengthening the rules of origin for automobiles. In other words, automakers exporting cars to the U.S. must source at least 75% of parts locally by 2025 to avoid tariffs. Since batteries account for 40% of an electric vehicle's weight, failing to source batteries locally makes it difficult to avoid tariffs under USMCA. Local production of battery cells is thus an essential condition for U.S.-made electric vehicles. After 2025, producing batteries locally will likely become a prerequisite for automakers to secure orders.

The three Korean companies have established close cooperative relationships with the three major U.S. automakers?GM, Ford, and Stellantis. Additionally, with Toyota and Volkswagen, ranked first and second in global automobile market share, confirming plans to build battery factories in the U.S., the possibility of further cooperation with Korean battery companies has increased.

The largest battery factory investment in the U.S. is the joint venture between SK On and Ford, named BlueOvalSK. They plan to build a battery park with an annual capacity of 43 GWh in Glendale, Kentucky, and a battery factory of the same scale in Stanton, Tennessee. GM is also constructing a joint electric vehicle battery factory (35 GWh) in Tennessee with LG Energy Solution. Samsung SDI has exchanged a memorandum of understanding (MOU) with Stellantis to establish a joint venture and plans to build a 23 GWh battery factory capable of production starting in the first half of 2025.

The aggressive investments and new factory establishments by domestic companies are expected to provide jobs and significantly aid economic recovery in regions around the Great Lakes in the northeastern U.S., historically known as the 'Rust Belt.' This contributes to revitalizing underdeveloped areas while participating in the Biden administration's priority project of restructuring advanced industry supply chains. The Biden administration has also announced an astronomical investment of $170 billion (approximately 192 trillion won) for subsidies and infrastructure development to expand electric vehicle adoption. According to SNE Research, this will lead to high growth in the U.S. electric vehicle market, with sales increasing from 1.1 million units this year to 2.5 million units in 2023 and 4.2 million units in 2025, representing an average annual growth rate of 40%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.