Total Mortgage Loan Amount at Approximately 53% Level

[Asia Economy Reporter Buaeri] It has been revealed that nearly 3 million people in their 30s and 40s hold mortgage loans. This means that 1 in 5 people in their 30s and 40s have a mortgage loan.

The total amount of mortgage loans they have received reached 440 trillion won, accounting for more than half of the total amount across all age groups.

According to data on 'Mortgage Loan Status by Age' received on the 15th from the Financial Supervisory Service by Jin Sun-mi, a member of the National Assembly's Political Affairs Committee from the Democratic Party of Korea, as of the end of March this year, there were 6,358,000 mortgage loan holders, with a total amount reaching 823.5558 trillion won.

Mortgage loan holders in their 30s and 40s numbered 2,955,000, accounting for 52.6% (439.5318 trillion won) of the total amount. This corresponds to 1 in 5 people among the 14.83 million population in their 30s and 40s, and represents 46% of all mortgage loan holders.

In particular, the proportion of secondary financial institutions in the total mortgage loans is highest among those in their 20s and 30s, at 41.2% and 37.2%, respectively. This exceeds the average of 35% across all age groups.

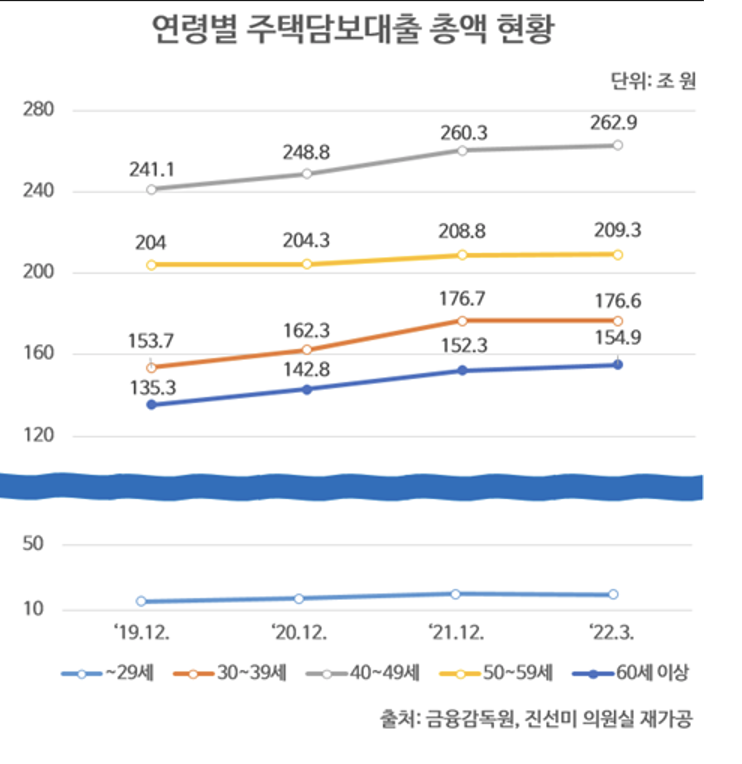

Looking at the total amount of mortgage loans over the past three years, the total mortgage loan amount increased sharply especially over the past two years. Among them, the total mortgage loan amount for the youth is rapidly increasing.

The trend of increase in the total mortgage loan amount is steepest among those in their 20s. Compared to the end of December 2019 (15.422 trillion won), it increased by 30% to 20.0424 trillion won at the end of December 2021. During the same period, while the total mortgage loan amount from banks increased by 18.7%, the total mortgage loan amount from secondary financial institutions rose by 52.5%, showing an overwhelming increase.

The total mortgage loan amount for those in their 30s and 40s increased by 10.7%, from 394.8734 trillion won at the end of December 2019 to 437.1017 trillion won at the end of December 2021. Similarly, while the total mortgage loan amount from banks for this age group increased by 3.6%, that from secondary financial institutions increased by 26.7%.

Meanwhile, the total mortgage loan amount across all age groups increased by 0.6% from 818.4 trillion won at the end of December last year to 823.5 trillion won at the end of March this year.

Assemblywoman Jin pointed out, "The scale of mortgage loans, which has grown due to rising house prices and COVID-19, may increase the possibility of defaults as it coincides with rising loan interest rates, high inflation, and low growth." She added, "We need to consider measures to manage risks until the economic recession caused by COVID-19 recovers and prepare for a soft landing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.