Netflix Stock Plummets 40% After Earnings Report

Subscriber Decline Expected to Continue in Q2

Focus on Content Investment Outside North America

[Asia Economy Reporter Minji Lee] Netflix has been on a sharp decline since its Q1 earnings announcement. Considering the intensified competition in the OTT (online video platform) market and the ongoing decrease in subscribers, the market expects it will be difficult for the stock price to rebound in the near term.

On the 25th (Korean time), Netflix's stock price stood at $215.52 as of the 22nd. Over the past five trading days, the stock price has dropped by about 40%, which is presumed to be due to a significant deterioration in investor sentiment following negative Q1 results caused by a decline in subscriber numbers.

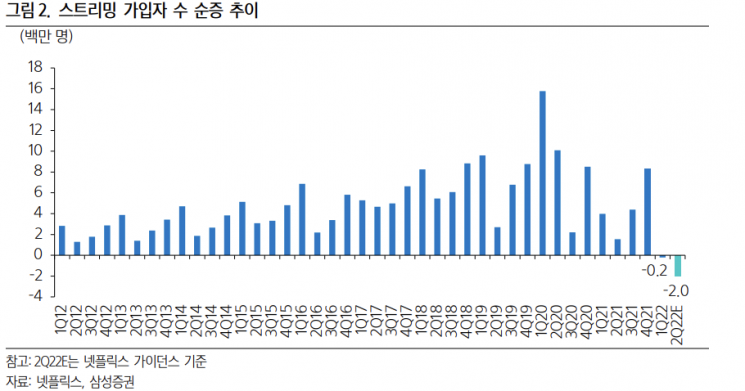

Netflix's Q1 revenue was $7.87 billion, and operating profit was $1.97 billion, marking growth of 99.8% and 0.6% respectively compared to the same period last year. Although there was growth compared to the previous year, the subscriber count, which directly affects the stock price, shrank for the first time since 2011, delivering a major shock to the market. The expected net subscriber increase for Q1 was 2.5 million, but the actual figure showed a net decrease of 200,000. Minha Choi, a researcher at Samsung Securities, said, “Due to Russia's invasion of Ukraine, services in Russia were suspended from March, resulting in a loss of about 700,000 subscribers. Additionally, in North America, where subscription fees were raised at the beginning of the year, subscriber numbers declined due to the impact of the price increase.”

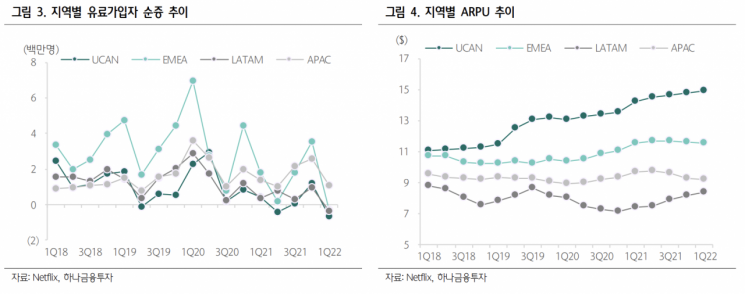

The only region where subscribers increased was Asia. By region, net subscriber changes were an increase of 1.09 million in Asia, while Europe, the Middle East, Africa, Latin America, and North America saw decreases of 300,000, 350,000, and 640,000 respectively. The average subscription fee rose by 2%, contributing to revenue growth.

Subscriber numbers are expected to decline further in Q2 compared to Q1. Net subscriber additions for Q2 are projected to decrease by 2 million from the previous quarter. Researcher Choi analyzed, “This appears to be due to the continued uncertain macro environment, competitive dynamics among operators, and seasonal effects. Coupled with disappointing guidance that could heighten concerns, it is highly likely that the stock price will continue to perform poorly for the time being.”

Intensified competition among OTT companies and account sharing among subscribers are major factors negatively impacting performance. The company estimates that in addition to 221.6 million paid subscriber households, 100 million households are sharing accounts.

Nayoung Jung, a researcher at Hyundai Motor Securities, explained, “The 100 million households sharing accounts for free have a low willingness to pay for the service, so it will be difficult to convert them into paid subscribers.” The company has been testing a pricing plan since last month in Chile, Peru, and Costa Rica that charges an additional fee when accounts are shared with non-cohabiting individuals.

Meanwhile, as the company is focusing on growth outside the U.S., it is expected to continue investing. Among the six most successful recent titles, three are ‘Squid Game’, ‘All of Us Are Dead’, and ‘Money Heist’. Kihoon Lee, a researcher at Hana Financial Investment, said, “Despite the decline in paid subscribers, Netflix expects double-digit revenue growth and even higher profit growth, with Korean dramas at the center of its growth strategy. Production costs are relatively low, and Korea holds the most dominant content in the only region showing net paid subscriber growth.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.