LG Energy Solution Nears 100 Trillion Won in Subscription Funds Inflow

[Asia Economy Reporter Seo So-jung] The amount of money circulating in the market increased by 33.8 trillion KRW in January this year. This was due to the influx of funds into public offerings such as LG Energy Solution, as well as a significant rise in time deposits and savings deposits under two years, driven by rising deposit interest rates and fund-raising to manage the loan-to-deposit ratio, marking the largest increase since the statistics were compiled.

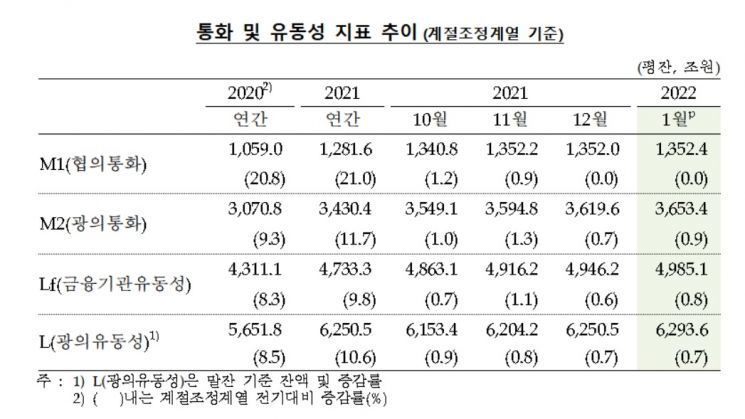

On the 17th, the Bank of Korea announced in its 'Monetary and Liquidity in January 2022' report that the broad money supply (M2, based on average balance) stood at 3,653.4 trillion KRW as of January, up 33.8 trillion KRW (0.9%) from the previous month. The year-on-year growth rate was 13.1%, slightly down from 13.2% in the previous month.

Broad money supply includes narrow money (M1), which consists of cash, demand deposits, and savings deposits with check-writing privileges, plus money market funds (MMF), time deposits under two years, financial bonds, money trusts, beneficiary certificates, negotiable certificates of deposit (CD), repurchase agreements (RP), and commercial paper.

By financial product, time deposits and savings deposits surged by 22.7 trillion KRW, while money trusts increased by 12.3 trillion KRW, and beneficiary certificates rose by 11.8 trillion KRW.

By economic agent, other financial institutions such as securities firms saw a sharp increase of 35.1 trillion KRW in money supply. Households and non-profit organizations increased by 4.6 trillion KRW, whereas corporations decreased by 6.6 trillion KRW.

A Bank of Korea official explained, "The inflow of nearly 100 trillion KRW in subscription funds into some large public offerings (LG Energy Solution) caused the largest increase in money supply among other financial institutions since the statistics began in January 2002. For corporations, despite an increase in loans, expenditures for payment of import bills and other funds led to a decrease of 6.6 trillion KRW."

The narrow money supply (M1), which includes only cash, demand deposits, and savings deposits with check-writing privileges, stood at 1,352.4 trillion KRW, up 0.5% from December last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.