Reduction of Capital Gains Tax Surcharge Rate in Pledges

Mitigation of Progressive Acquisition Tax Rates

Interest in Removal from Adjustment Target Areas

[Asia Economy Reporter Kim Min-young] As the next government is expected to significantly ease regulations related to multi-homeowners, attention is focused on whether these changes will revitalize the local real estate market. The Moon Jae-in administration's tightening of regulations on multi-homeowners ultimately led to a preference for a “smart single home,” which in turn cooled the enthusiasm for local real estate investment. In particular, interest is concentrated on whether adjustment target areas, cited as a factor in the contraction of real estate transactions, will be removed.

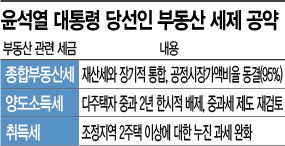

According to the People Power Party’s policy pledge book, President-elect Yoon Seok-yeol plans to temporarily exclude the application of the capital gains tax surcharge rate on multi-homeowners for up to two years and will also reconsider the multi-homeowner surcharge tax policy. The progressive acquisition tax rate (up to 12%) applied to owners of two or more homes in adjustment target areas is also expected to be eased.

Experts believe that if tax regulation easing for multi-homeowners and removal from adjustment target areas become a reality, the preference for a smart single home will weaken. In 2016, the capital gains tax rate was up to 40% regardless of the number of homes, but under the Moon Jae-in administration, it soared to as high as 75%. Also, inclusion in adjustment target areas limited the loan-to-value ratio (LTV) and debt-to-income ratio (DTI) to 50%. For homes exceeding 900 million KRW or in speculative overheated districts, this ratio was reduced to 30%. Multi-homeowners or those not residing in the home cannot obtain mortgage loans. However, if regulatory areas such as speculative overheated districts and adjustment target areas are reduced, the tax burden on multi-homeowners will decrease, and investors are expected to turn their attention to the local real estate market.

Kim Woong-sik, a researcher at Real Today, said on the 16th, “As the tax burden on multi-homeowners decreases, there is no longer a need to insist on owning only one home,” and “The real estate market, which has been concentrated in the Seoul metropolitan area including Seoul, is likely to expand its scope to local areas.”

As the tax burden decreases, there is great expectation that local real estate markets such as Daegu, Gyeongnam, and Sejong, which have been in decline for several months, will regain vitality. According to the weekly apartment trend by the Korea Real Estate Board, apartment prices in Daegu have been declining for three consecutive months since November last year. The apartment sale prices in Sejong, which surged due to the administrative capital relocation issue, have been falling for nine consecutive months since July last year.

Like Sejong and Daegu, local real estate markets are frozen due to the same loan regulations as the metropolitan area and designation as adjustment target areas, resulting in decreased transactions, price drops, and increased unsold units. According to the Ministry of Land, Infrastructure and Transport, as of January, there were 3,678 unsold housing units in Daegu. This is an 86% increase compared to December last year (1,977 units). This is the highest monthly unsold inventory since the end of 2011. This is why demands for removal from adjustment target areas are strong, especially in regions where the recent housing price decline is evident.

According to the Ministry of Land, Infrastructure and Transport, seven local governments including Daegu, Ulsan, and Dongducheon in Gyeonggi Province have requested removal from adjustment target areas this year. Whether to remove the designation will be reviewed and decided at the upcoming Residential Policy Deliberation Committee. Considering that the committee met only once last year per quarter, it is expected to convene around the end of this month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.