Decline in Market Share of Chinese Imports

[Asia Economy Reporter Park Sun-mi] South Korea's status, which ranked first in China's import market share for seven consecutive years from 2013 to 2019, is being shaken due to the increase in China's imports of Taiwanese semiconductors, the rise of ASEAN countries, and China's policy of self-sufficiency in parts and materials.

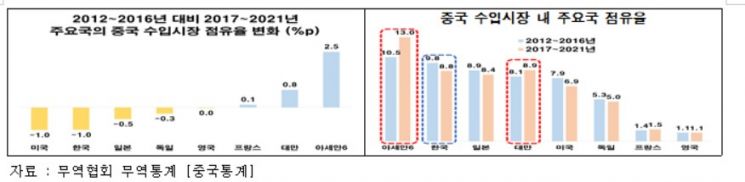

On the 16th, the Federation of Korean Industries (FKI) announced that an analysis of changes in China's import market share from 2012?2016 to 2017?2021 among China's top 20 import countries in 2015, including the G5 (United States, Japan, Germany, France, United Kingdom), South Korea, Taiwan, and ASEAN 6 (Malaysia, Thailand, Indonesia, Singapore, Vietnam, Philippines), showed that South Korea experienced the largest decline in market share among these countries.

South Korea's market share fell by 1.0 percentage point from 9.8% in 2012?2016 to 8.8% in 2017?2021. The United States, engaged in a hegemonic competition, also decreased by 1.0 percentage point. In contrast, the market shares of the six ASEAN countries and Taiwan, which are transforming into hubs of the global supply chain, increased by 2.5 percentage points and 0.8 percentage points, respectively. The increase in Taiwan's market share in China's import market during this period was due to the rise in China's imports of Taiwanese semiconductors after the United States restricted semiconductor technology and equipment exports to China, citing concerns that they could be used by the Chinese military.

Excluding memory semiconductors, South Korea's largest export item to China, its market share in China's import market decreased by 2.0 percentage points from 8.8% in 2012?2016 to 6.8% in 2017?2021, while the ASEAN 6 countries' share increased by 2.8 percentage points.

China's imports of parts and materials decreased by 6.6% in the recent five years compared to 2012?2016. This is due to China's industrial structure advancement policies such as self-sufficiency in parts and materials and the growth of Chinese domestic companies, which caused fundamental changes in China's parts and materials import structure. This negatively affected South Korea's exports of parts and materials to China, which are mainly general-purpose materials excluding memory semiconductors, resulting in South Korea's market share in China's parts and materials import market dropping by 5.0 percentage points from 16.9% in 2012?2016 to 11.9% in 2017?2021.

As of 2018, in China's top 10 imported consumer goods markets including passenger cars, pharmaceuticals, cosmetics, baby food, and plastic products, South Korea's market share decreased by 1.2 percentage points from 5.4% in 2012?2016 to 4.2% in 2017?2021. During this period, France was the only country among the G5 and ASEAN 6 whose market share increased by 2.3 percentage points, as China's imports of cosmetics from France increased about fourfold compared to 2012?2016.

Kim Bong-man, head of the FKI International Headquarters, said, “China's industrial upgrading and domestic demand-centered growth policies to reduce external dependence after the 2008 global financial crisis are the direct causes of South Korea's decline in China's import market share since 2016.” He added, “As China's import structure is being reorganized around high value-added intermediate and consumer goods, companies need to discover high value-added strategic export items to China such as steel products and fine chemical products beyond semiconductors, and the government should strengthen policy support including revising the Korea-China FTA product concessions that took effect in December 2015.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.