[Asia Economy Reporter Myunghwan Lee] The Korea Exchange announced on the 15th that it has designated the final settlement benchmark bonds for the government bond futures (September 2022 contracts) traded from the 16th.

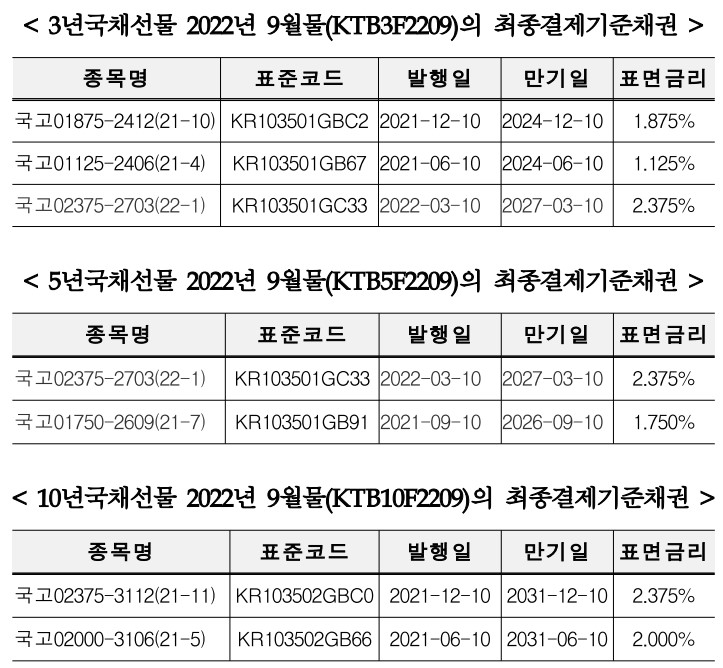

The Exchange designated the final settlement benchmark bonds for the three types of September 2022 government bond futures traded from the 16th. The final settlement benchmark bonds for the three government bond futures are as follows: ▲3-year government bond futures September 2022 (KTB3F2209) ▲5-year government bond futures September 2022 (KTB5F2209) ▲10-year government bond futures September 2022 (KTB10F2209).

The final settlement benchmark bonds for government bond futures are designated bonds among treasury bonds that pay interest semiannually, in accordance with Article 20-9, Paragraph 4 of the Korea Exchange's Derivatives Market Business Rules Enforcement Regulations.

Government bond futures are derivatives based on treasury bonds with a face value of 100 won and a coupon rate of 5%. Since such treasury bonds do not actually exist, the Exchange combines already issued treasury bonds that are similar to the underlying asset to designate the final settlement benchmark bonds.

The spot yields for each final settlement benchmark bond are calculated daily at 11:30 a.m. and 4:00 p.m. by the Korea Financial Investment Association and announced through the Korea Financial Investment Association website, KOSCOM CHECK terminals, and Yonhap Infomax.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.