Service Preparation in Full Swing... Focus on Convenient Features Targeting the MZ Generation

"Payment amount 0 won, pay later." The domestic postpaid payment market is heating up this year.

According to industry sources on the 11th, Toss is preparing to launch a postpaid payment service next month. A Toss representative said, "We plan to start the service with some merchants and gradually expand it." Postpaid payment literally means allowing people without credit cards to purchase goods on credit. Consumers receive the goods first and pay the cost later. Fintech companies assess repayment ability through their own data technology and screening. The main target group for postpaid payment services is the MZ generation (Millennials + Generation Z). It enables people in their 20s, who lack financial history and cannot get credit cards, to purchase goods even without cash.

NHN Payco is also launching its self-developed credit scoring model ‘P-Score’ next month and will enter the postpaid payment market within the year. An NHN official said, "Even among the 20s and 30s with limited financial history, we plan to enable the use of financial products such as small postpaid payments or loans by utilizing non-financial data like Payco payment history along with financial data."

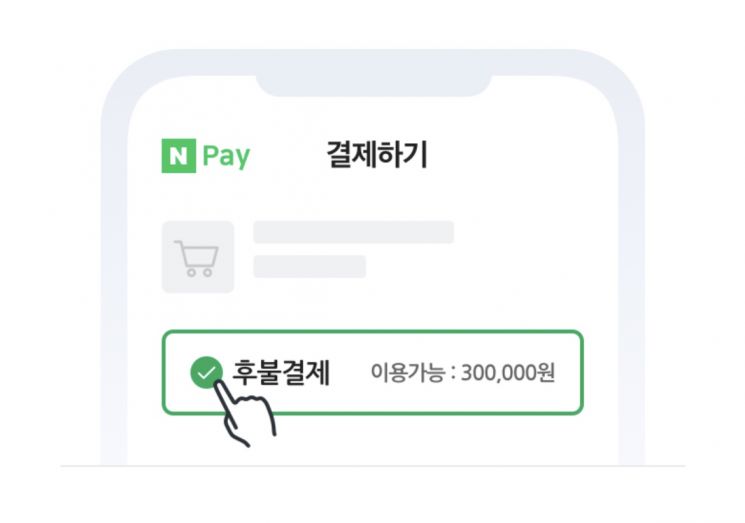

Naver was an early entrant into the market domestically. Naver Financial has been operating a pilot postpaid payment service with a monthly limit of 300,000 won since last year. Naver provides the postpaid payment service using an Alternative Credit Scoring System (ACSS) based on big data processing technology. Coupang also offers a ‘Pay Later’ service with a monthly limit of 500,000 won (differentiated by individual credit) to some members, and Kakao Pay started a postpaid transportation card service with a monthly limit of 150,000 won last month.

In Western countries, global companies such as Apple and PayPal have already entered the market, expanding the ‘Buy Now, Pay Later (BNPL)’ market. Bank of America forecasts this market to grow to as much as $1 trillion (1,199 trillion won) by 2025.

Compared to this, the domestic market is still small in scale and at an early stage of service. However, it is a market of high interest as major fintech companies are entering one after another. Unlike overseas companies aiming for profits through fees, domestic fintech companies focus on the ‘lock-in effect’ of keeping users tied to their platforms rather than profitability. They concentrate on securing future customers by providing convenience of small postpaid payment services to young adults and the MZ generation. Additionally, their consumption and credit data become another asset for domestic fintech companies. An industry insider said, "Domestic services focus more on convenient features than profitability," adding, "They aim to increase loyal customers through this."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)