[Asia Economy Reporter Donghyun Choi] 8.7 out of 10 small and medium-sized enterprises (SMEs) believe that loan maturity extensions and interest repayment deferral measures are necessary.

The Korea Federation of SMEs announced on the 26th that a survey on 'Opinions of SMEs regarding loan maturity extension and interest repayment deferral' was conducted from the 13th to the 18th, targeting 323 SMEs, and the results showed this trend.

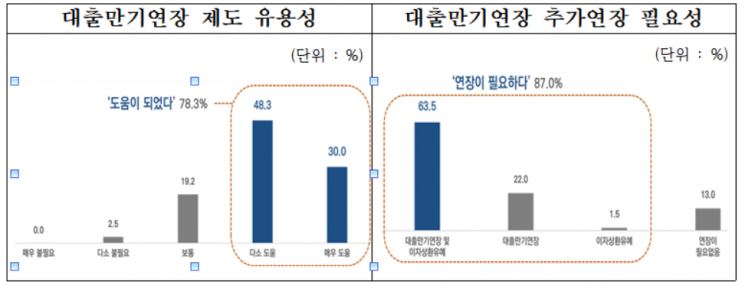

87% of the SMEs who responded to the survey hoped for an additional extension of the loan maturity extension and interest repayment deferral measures. This figure is higher than previous surveys on the same topic. In the July 2020 survey, it was 78.1%, in January 2021 it was 77.9%, and in August 2021 it was 78.5%.

The main reasons for needing an additional extension (multiple responses allowed) were 'decreased sales due to the resurgence of COVID-19 (64.1%)', followed by 'concerns about rising loan interest rates (55.2%)', and 'lack of financial capacity to repay loans and interest (43.8%)'.

Notably, the percentage of respondents who answered 'concerns about rising loan interest rates' increased by 15 percentage points compared to the August last year survey (40.2%). Among companies experiencing loan interest rate changes within six months, the average increase was 0.75 percentage points, indicating a growing burden of interest rates.

Expected problems if the additional extension ends included 'need for additional loans to repay existing loans (51.7%)' and 'difficulties in paying purchase costs, labor costs, and rent (30.7%)'. Desired support measures were 'support for low-interest refinancing loan programs (67.8%)', 'establishment of a long-term installment repayment system for loan maturity (50.8%)', and 'provision of special policy funds to resolve liquidity (25.4%)'.

Among SMEs that utilized the loan maturity extension and interest repayment deferral measures, 8 out of 10 (78.3%) responded that it was helpful, indicating that these measures are considered effective.

Jumungap Choo, Head of the Economic Policy Department at the Korea Federation of SMEs, said, “The recent resurgence of COVID-19 due to Omicron is serious, and the base interest rate has been raised three times in six months, returning to the pre-COVID level (1.25%). As the burden on small business owners and SMEs is expected to intensify, it is necessary to additionally extend the loan maturity extension measures scheduled to end in March, slow down the pace of interest rate hikes, and implement active financial support policies.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.