PI Film Laying 'Golden Eggs'... Global No.1 PI Advanced Materials

Sales Reached 4,436 Tons Last Year... About 121% Growth in 5 Years

Operating Profit Expected to Hit '100 Billion KRW' This Year... New Businesses Accelerate

New Factory Established in Gumi... Production Capacity Expanded to 5,200 Tons Within the Year

[Asia Economy Reporter Junhyung Lee] PI Advanced Materials, a KOSPI-listed company, has surpassed the annual sales milestone of 300 billion KRW. This is the highest sales figure since its establishment in 2001. There are also forecasts that this year's operating profit could exceed 100 billion KRW. This is due to the rapid increase in demand for the company's main product, polyimide (PI) film, alongside advancements in new technologies such as organic light-emitting diode (OLED) displays. The company is aggressively expanding its PI film production capacity to meet market demand.

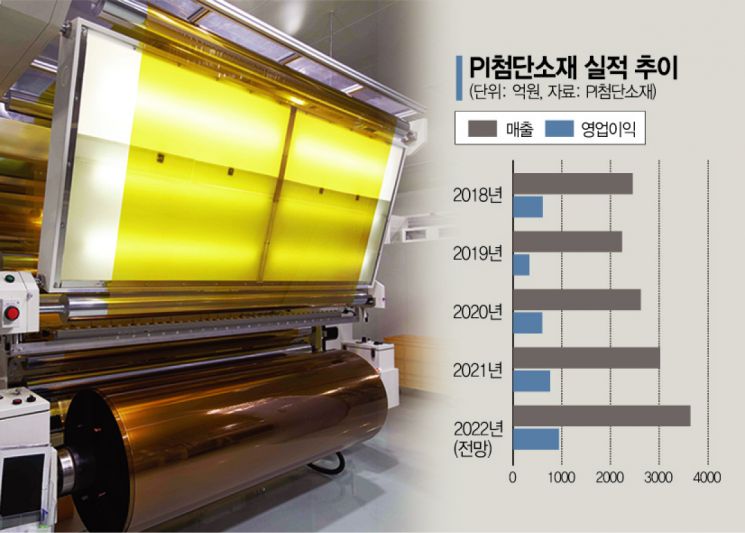

According to PI Advanced Materials on the 25th, the company's sales last year reached a record high of 301.9 billion KRW. Operating profit during the same period was 75.9 billion KRW, with an operating profit margin of about 25.1%. Although this is a slight decrease from the previous year's operating profit margin (about 26.7%), it remains a significant level considering that a 'dream operating profit margin' for manufacturers is in the 20% range. The average operating profit margin for domestic manufacturers is less than 5%. The outlook for this year is also bright. Hana Financial Investment expects the company's operating profit this year to reach 100.7 billion KRW.

PI Film ‘Global No.1’

PI Advanced Materials is a global leader in PI film, which is produced in thin film form from PI. PI is used in various industries such as aerospace and displays and is known as an 'engineering plastic.' According to the Japanese market research firm Yano Research, the company's global market share of PI film is in the low 30% range. This is more than twice the market share of Japan's Kaneka, the second largest at 14.3%. Compared to the U.S. DuPont, which was the first in the world to develop PI and holds an 11.3% market share, the company's share is nearly three times higher. The company overtook leading material companies to become the market leader in 2014 and has maintained its top position for over seven years. The company aims to increase its market share to 40% by next year.

The applications of PI film are steadily expanding. Originally, PI film was mainly used in mobile devices such as smartphones and tablet PCs. However, recently, its applications have expanded to displays, semiconductors, and even electric vehicles. This is because PI film is a core material for new technologies such as OLED and 5th generation mobile communication (5G). The COVID-19 pandemic has also fueled demand for IT devices. In the industry, there is even a saying that "PI film is a material that lays golden eggs."

In fact, PI Advanced Materials' sales volume has been soaring every year. The company's PI film sales volume increased by about 121.6% over five years, from 2,002 tons in 2016 to 4,436 tons last year. Last year's PI film sales volume exceeded production volume (4,261 tons) by 175 tons. CEO Kim stated, "We are even pulling from inventory to sell PI film."

New Factory Operation Starting This July

This is why the company is focusing all efforts on maximizing productivity. The company increased its annual production capacity from 3,900 tons to 4,300 tons last year through equipment upgrades. It is also building a new factory in Gumi, Gyeongbuk, with an investment of 143 billion KRW. Production capacity is expected to expand to 5,200 tons in the second half of this year. CEO Kim said, "The Gumi new factory will start full-scale operation from July this year," adding, "By the end of next year, we will secure a production capacity of 6,000 tons."

The company is also proactive in new businesses. It is using PI film as a cash cow and expanding its product portfolio to become a comprehensive materials company. 'Varnish,' which processes PI in liquid form, is a representative new business. The company began mass production of varnish in 2019 and supplies all of it for Hyundai Motor Company's electric vehicles. The company expects varnish sales this year to increase about 2.5 times compared to last year (approximately 3.4 billion KRW).

The company is also focusing on recycling its main raw material, dimethylformamide (DMF), as the price increase trend has not eased since February to March last year. The average price of DMF was in the 800 to 1,000 KRW per kilogram range but recently surged to around 3,200 KRW. Accordingly, the company raised the PI film delivery price twice last year. To increase the recycling rate of raw materials, the company also established its own refining facilities since the DMF price started rising. CEO Kim said, "We can raise the DMF recycling rate from the current 40% to 70% by April this year," adding, "If the recycling rate is increased to 100%, the annual cost-saving effect will reach 5 to 7 billion KRW based on operating profit."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.