Nearly 340 Unicorn Companies This Year, More Than Triple Last Year

75% of Companies Listed via SPAC Fall Below IPO Price, Sparking 'Bubble Debate'

[Asia Economy Reporter Byunghee Park] Despite bubble concerns, it has been confirmed that large-scale investments are still pouring into the Special Purpose Acquisition Company (SPAC) market. The bubble controversy surrounding newly listed companies using SPACs is also expected to grow further.

According to financial information firm Dealogic, SPACs raised approximately $12 billion each in October and November, the Wall Street Journal (WSJ) reported on the 27th. This is about twice the monthly fundraising amount in the third quarter. SPACs led the boom in the initial public offering (IPO) market in the first half of this year, but bubble concerns arose in the second half. Therefore, there were expectations that the SPAC market would slow down, but in reality, this was not the case.

With continued inflows of investment funds, it has been confirmed that an average of three SPACs are being created daily even in December. SPAC funds aiming for listing through mergers with companies within the next two years amount to about $160 billion.

Venture capital and private equity markets are also seeing a rapid increase in standby investment funds for startups. According to financial information firm Preqin, the amount of unallocated investment funds in the venture capital and private equity markets stands at $440 billion and $310 billion, respectively. Including SPACs, about $900 billion in funds are waiting to target startups expected to grow rapidly in the future. WSJ diagnosed that the scale of fundraising for SPACs and venture capital this year is at an all-time high, showing disregard for the startup bubble controversy.

Despite the IPO market boom centered on SPACs, the performance of newly listed companies this year has not been good. The exchange-traded fund (ETF) reflecting the stock prices of companies listed through SPACs posted a 25% loss this year. ETFs investing in public offerings through traditional IPO methods also recorded a 15% loss over the past three months.

Nevertheless, the reason investment funds are pouring into SPACs and venture capital is due to abundant liquidity. Although a base rate hike is expected next year, the U.S. base rate remains near zero, and the U.S. stock market rose significantly this year, increasing available investment funds.

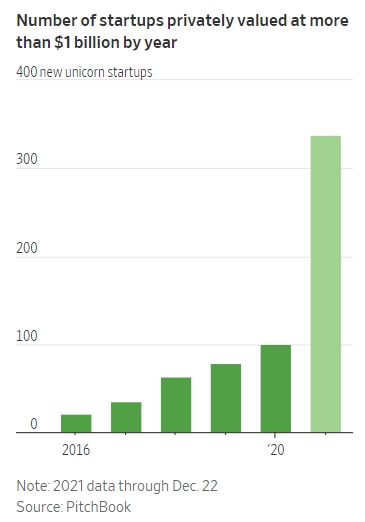

Food delivery startup GrubMarket initially aimed to raise $50 million, but as investment demand surged, it secured over $240 million by November. The company was also valued at over $1.2 billion. Mike Si, CEO of GrubMarket, said, "Funds were raised extremely quickly and in much larger amounts than expected." According to financial information firm PitchBook, nearly 340 unicorn companies valued at over $1 billion have been recognized this year, more than triple the number from last year.

As SPAC investments become more active, bubble concerns are also growing. According to SPAC Research, nearly 200 companies went public through SPACs this year, and 75% of these companies’ stock prices are below their offering prices. Experts point out that startups that are not fully prepared are going public through SPACs because of the advantage of quickly raising funds.

Mike Ryan, CEO of financial information firm Bullet Point Network, noted that while SPACs have increased the means for companies to raise funds, they can ultimately cause problems such as flawed IPOs and incorrect company valuations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.