Three Domestic Travel Startups Face Sharp Sales Drop Due to COVID-19

Targeting Personalized Travel Services with IT Technology

Increasing Staff and Launching New Services... Will Recovery Continue?

[Asia Economy Reporter Kim Bo-kyung] Can domestic travel startups, which suffered business setbacks due to the COVID-19 pandemic, continue their recovery phase in line with the With Corona (gradual return to normal life) policy? Travel startups equipped with advanced IT technologies are attracting large-scale investments and focusing on personalized, experience-centered travel services preferred by the MZ generation (people in their 20s and 30s).

According to a travel startup analysis report provided by the startup growth analysis platform 'Forest of Innovation' and analyzed by 'Underwatch' on the 27th, MyRealTrip's sales last year plummeted to 7.07 billion KRW, about one-fifth of the previous year.

Both MyRealTrip and Triple recorded average operating losses exceeding 10 billion KRW annually over the past three years since 2018. However, Triple posted an operating loss of 15.5 billion KRW last year, showing a 22% recovery in loss magnitude compared to 2019.

Personalized Travel is the Trend... Active Investment Attraction

Notably, investors anticipating the post-COVID era continued investing in travel startups even last year when the travel industry was shrinking.

MyRealTrip secured investments worth 43.2 billion KRW in July last year from Altos Ventures and others, while Triple also attracted a total of 20 billion KRW in investments from Yanolja and venture capital (VC) firms last year.

Accordingly, travel startups are expanding their market influence by increasing employment and expanding marketing and planning personnel even after COVID-19.

The key to successful investment attraction was 'personalized services.' With the advancement of the latest ICT technologies such as big data and artificial intelligence (AI), the travel paradigm has shifted from agency-centered group tours to personalized travel tailored to individuals.

Personalized travel, which recommends travel schedules and provides guides according to user preferences, is becoming a trend. With pent-up travel demand, the travel industry is recovering after With Corona, creating opportunities for startups.

New Travel Products Launched... Aggressive Talent Recruitment

New types of travel products are being launched using the latest ICT technologies.

MyRealTrip introduced 'Studio Live Online Tour' in June last year, an online service where travel guides introduce destinations through local videos and photos and communicate with users in real time. They also launched the 'Overseas Travel Scanner' service, which allows users to check currently available countries for travel and entry requirements. Recently, they participated in the 'Korea Accommodation Grand Sale,' issuing accommodation coupons usable for domestic lodging reservations.

Triple has partnered with Naver to provide flight reservation services. They plan to introduce a simple payment service for airline tickets via Naver Pay in the future. The company announced plans to hire about 50 developers by the end of this year to prepare for overseas travel demand.

Frip is strengthening activity-centered travel products targeting the MZ generation. They plan to prioritize 'experience' in travel and focus on products that meet consumer needs.

Traffic Leader is 'Triple', Google Search Leader is 'MyRealTrip'

According to this analysis, over the past six months, the traffic ranking of the three companies was Triple, MyRealTrip, and Frip in that order.

Monthly Google search volume showed MyRealTrip at 12,100 searches, about 3.4 times that of Triple (3,600) and about 2.7 times that of Frip (4,400).

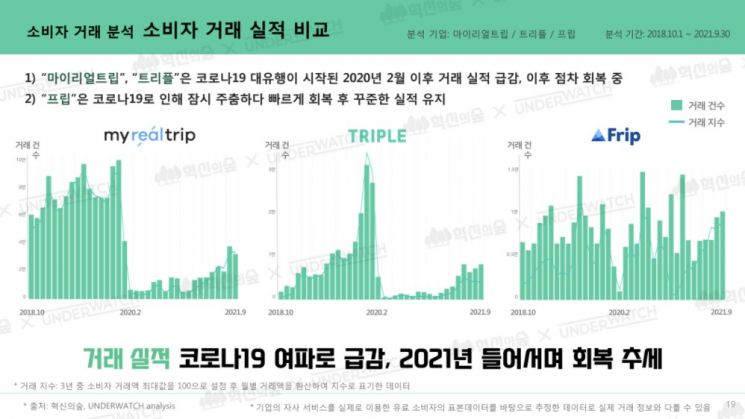

Comparing consumer transaction performance, MyRealTrip and Triple saw a sharp decline in transactions since February last year when the COVID-19 pandemic began but are gradually recovering. Frip briefly stalled due to COVID-19 but quickly recovered and has maintained steady performance.

MyRealTrip had the highest average spending per customer at 117,000 KRW, but Frip had the highest repurchase rate. The main user age group for all three companies was the MZ generation, accounting for over 70%, with Frip's MZ generation proportion reaching 92%.

The report stated, "With the advancement of IT technology, new services combining the travel industry and technology are being launched," adding, "Going forward, targeting the needs of the MZ generation through innovative technology will be the key to securing industrial competitiveness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.